Scene 1 (0s)

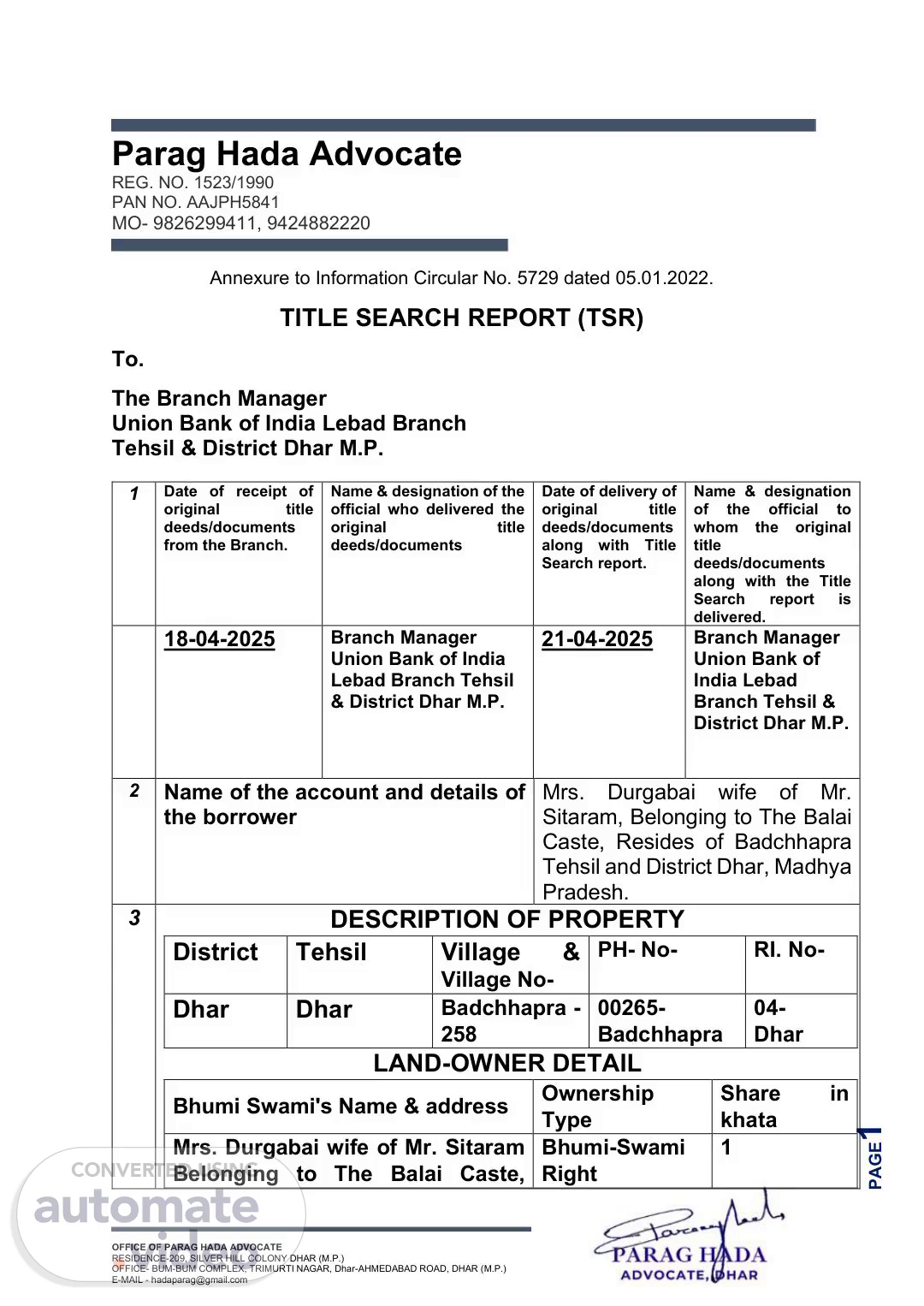

[Audio] Parag Hada Advocate REG. NO. 1523/1990 PAN NO. AAJPH5841 MO- 9826299411, 9424882220 Annexure to Information Circular No. 5729 dated 05.01.2022. TITLE SEARCH REPORT (TSR) To. The Branch Manager Union Bank of India Lebad Branch Tehsil & District Dhar M.P. 1 Date of receipt of original title Date of delivery of original title Name & designation of the official to Name & designation of the official who delivered the original title whom the original deeds/documents from the Branch. deeds/documents deeds/documents along with Title Search report. title deeds/documents along with the Title Search report is delivered. 18-04-2025 Branch Manager Union Bank of India Lebad Branch Tehsil & District Dhar M.P. 21-04-2025 Branch Manager Union Bank of India Lebad Branch Tehsil & District Dhar M.P. 2 Name of the account and details of the borrower Mrs. Durgabai wife of Mr. Sitaram, Belonging to The Balai Caste, Resides of Badchhapra Tehsil and District Dhar, Madhya Pradesh. 3 DESCRIPTION OF PROPERTY PH- No- RI. No- District Tehsil Village & Village No- Dhar Dhar Badchhapra 258 00265Badchhapra 04- Dhar LAND-OWNER DETAIL Share in Bhumi Swami's Name & address Ownership Type khata 1 Mrs. Durgabai wife of Mr. Sitaram Belonging to The Balai Caste, Bhumi-Swami Right PAGE1 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 2 (2m 38s)

[Audio] Resides of Badchhapra Tehsil and District Dhar, Madhya Pradesh. OTHERS- DETAIL Khata No Bhu-Adhikar - Pustika Detail 52 CRL No - 11164186654 LAND PARCEL DETAILS VILLAGE Area Land Parcel ID Survey /Block No (Ha/Sq.Mt.) Land Revenue 1576582571 272/1/2/2 (S) 0.0510 0.50 Total - 01 0.0510 0.50 in Madhya Pradesh, land regulations are governed by the "BhuSarvekshan Tatha Bhu-Abhilekh Niyam, 2020," stemming from the Land Revenue Code of 1959. Survey numbers identify land type: "S" for agricultural (farmland) and "P" for non-agricultural land. The Madhya Pradesh Land Record system is an online portal managed by the DLRS, offering access to land records, revenue payments, and land use details, streamlining land transactions and information retrieval for the state's citizens. ONLINE BHUADHIKAR PUSTIKA The Bhuadhikar Pustika is a crucial record that contains detailed information about land ownership, rights, and liabilities. It is prepared by Form-4 (rules 6) of the Bhu-Rajasva Sanhita (Bhu-Sarvekshan Tatha Bhu-Abhilekh) Niyam, 2020, which was published in the official Gazette on 06-07-2020. The rules and regulations governing the preparation of the Bhuadhikar Pustika are designed to ensure that the document is accurate and comprehensive and that it reflects the current state of affairs concerning land ownership and usage. "An online E-certified copy of the Bhu-adhikar Pustika related to the agricultural land is enclosed as Annexure - A of this search report." ONLINE KHATAWAR KHATONI OR JAMABANDI The Khatawar Khatoni or Jamabandi are records of rights (RoR) that provide essential information about land ownership, cultivators, and PAGE2 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 3 (5m 28s)

[Audio] other relevant details. These documents are prepared by Form-7 (rule 6) of the Bhu-Rajasva Sanhita (Bhu-Sarvekshan Tatha Bhu-Abhilekh) Niyam, 2020. The Khatauni is a document that specifically contains information about the landholdings of cultivators. These records serve as a vital source of information for landowners, cultivators, and other stakeholders, enabling them to make informed decisions about land usage and ownership. Online khatauni information can be collected from the respective state's land record or the. M.P. Bhu-Abhilekh web site "An online E-certified copy of the Khatawar Khatoni or Jamabandi for the year 2025-26 related to the agricultural land is enclosed as Annexure - B of this search report." ONLINE KHASRA The term "Online Khasra," also known as "Khasra," refers to the distinctive survey or plot number assigned to a particular land parcel. This identification number plays a crucial role in various land-related transactions, such as the transfer of ownership and tax payments. To ensure accuracy and reliability, Khasra records are prepared in accordance with Form-7 (rule 6) of the Bhu-Rajasva Sanhita (BhuSarvekshan Tatha Bhu-Abhilekh) Niyam, 2020. These regulations are designed to ensure that the records are comprehensive and provide trustworthy information regarding the unique survey or plot number assigned to each land parcel. "An online E-certified copy of the Khasra for the years 2025-26 is enclosed as Annexure - C and Khasra (the year 2021-22 to 2024-25) related to Above Mention agriculture Land enclosed As Annexure - D of this search report. BOUNDARIES OF PROPERTY AS PER FIELD MAP Following the stipulations of the Madhya Pradesh Land Revenue Code, 1959, a field map is a cartographic representation prepared under Section 107 of the act. Section 107 of the Madhya Pradesh Land Revenue Code, 1959 delineates the field map as a depiction that shows the demarcations of survey numbers or plot numbers, in addition to wastelands. The field map aims to give a precise and unambiguous PAGE3 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 4 (8m 25s)

[Audio] portrayal of the land, encompassing its boundaries, thereby easing proper documentation and management. The field map makes up a pivotal document in land administration, employed to resolve boundary disputes, speed up land transactions, and ensure judicious land utilization. Survey No Boundaries Show in Filed Trace Map / Not Show / Non -availability on Government Website or Partition /Division of Land or other reason? 272/1/2/2 (S) Boundaries show in Filed Trace Map "An online E-copy of the available filed trace map is enclosed as Annexure - E of this search report." VALUATION OF AGRICULTURE PROPERTY Area Property Valuation As par the SAMPADA 2.0 e-registry Portal Govt. of M.P. DISTRICT: DHAR Land Parcel Survey ID /Block No (Ha/Sq.Mt.) Land Revenue 1576582571 272/1/2/2 (S) 0.0510 0.50 Total Property Valuation Rs. 1,12,200/- "A copy of the Property Valuation As par the SAMPADA 2.0 for the relevant village is enclosed as Annexure - F of this search report." 3.1 NATURE OF THE Agriculture Land IMMOVABLE PROPERTY 3.2 1 Survey No. Detail Mention in Para no 3 of this report 2 Hissa No Full Detail Mention in Para no 3 of this report 4 Town Survey No. Not available 5 Khasra No. mentioned Detail Mention in Para no 2 of this report 6 Patta No Patta involved in said property 7 Khata No. Detail Mention in Para no 3 of this report PAGE4 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 5 (11m 2s)

[Audio] Local Name of the field as applicable including Subdivision Should be mentioned. The Said property is 3.3 Number/Identification details agricultural, for this reason, point no 3.3 is Not Related to Said Land. as per building map/plan (Mention here numbers like flat numbers etc. mentioned as per map/plan in the case of flats/condominiums/ apartments) The Said property is 3.4 The extent of Property (Please Mentioned and described to document title deed and show in Sqft. also) agricultural property for this reason point no 3.4 Not Related to Said Land. Mrs. Durgabai wife of Mr. 3.5 Name of owner (Full Description of the owner should be given) Sitaram, Belonging to The Balai Caste, Resides of Badchhapra Tehsil and District Dhar, Madhya Pradesh. 3.6 Nature of ownership 1 Free Hold- The applicant or borrower of Free Hold possesses the rightful authority to hold, utilize, and transfer the land by the guidelines outlined in the Madhya Pradesh Land Revenue Code, 1959. Such entitlements encompass the freedom to vend or hypothecate the land, albeit subject to specific stipulations and constraints imposed by the statute. 2 Lease Hold (mentioned residual lease terms); - It is important to note that the agricultural property mentioned above is not categorized as leasehold property. This type of property is usually leased or rented to the occupant for a specific duration, usually for a fixed number of years. However, in the case of the aforementioned agricultural property, the individual l holding the Bhumi Swami rights (the Free Hold applicant/Borrower) has complete ownership of the land and is not a tenant or lessee in any capacity. 3 License; - It is pertinent to state that the agricultural property in question is not classified as licensed property. A licensed property is typically a property where the occupant has gained permission or authorization to utilize the property for a specific purpose, usually temporarily. However, in the case of the mentioned agricultural PAGE5 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 6 (13m 46s)

[Audio] property, the individual possessing the Bhumi Swami rights (the Free Hold applicant/Borrower) has complete ownership of the land and is not a licensee. All Details mention in Para 3 4 Undivided interest (mention the share) of the search Report 5 Trust property (mentioned whether the borrower is a Trustee or beneficiary; - that the agricultural property mentioned above is not classified as trust property. Trust property is generally property that is owned and administered by a trustee for the benefit of the trust's beneficiaries. Nevertheless, in the case of the referred agricultural property, the person possessing the Bhumi Swami rights has complete ownership of the land and is not a trustee. Thus, it can be definitively stated that the agricultural property in question is not trust property. 6 Assignee/Grantee of Govt.; - that the above-mentioned agricultural property is not an assignee/grantee of government property. An assignee/grantee of government property is a person or entity who is granted the right to use or occupy government-owned land or property. However, in the case of the said agricultural property, the holder of Bhumi Swami rights has ownership of the land and is not an assignee/grantee of government property. Therefore, it can be confirmed that the said agricultural property is not an assignee/grantee of government property. 7 Cultivating tenant; - The above-mentioned agricultural property is not cultivating tenant property. A cultivating tenant is a person who cultivates land owned by someone else and pays rent or a share of the produce to the owner. However, in the case of the said agricultural property, the holder of Bhumi Swami rights has ownership of the land and is not a cultivating tenant. it can be confirmed that the said agricultural property is not a cultivating tenant property 8 Title only by possession The aforementioned property (mention whether adverse is under the ownership and exclusivity of the possession /or others) applicant/borrower, and no adverse possession has been discovered in this case. PAGE6 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 7 (16m 33s)

[Audio] The applicant/borrower is 9 As a member shareholder of society neither a member nor a shareholder of the society. 10 As a mortgage applicants /borrowers do not mortgage. 11 As a servant owner of easement right: - the applicants/borrowers have no existing easement rights or servant owner rights over the agricultural property in question. It is important to note that an easement refers to the right to use another person's property for a specific purpose, such as obtaining access to a road or water source. On the other hand, a servant owner is the property owner who grants the easement. The records do not indicate any mention of easement rights or servient owner rights being held by the applicants/borrowers on the agricultural property under consideration. Thus, it can be confirmed that the applicants/borrowers are not regarded as servant owners with easement rights on the said land. Bhumi Swami Right refers to 12 Any other (Please mentioned the nature of ownership) the right of ownership of land and is governed by the Madhya Pradesh Land Revenue Code (MPLRC) of 1959 4 Tracing of Title The Advocate submitting the opinion should give a flow chart for a 30-year title ordinarily. In the event it is not possible, it should be at least for a period of 13 years giving reasons why 30 years is not possible in terms of circular IC No: 6118 dated 15th November 2000. The flow chart ideally should be as follows: First Owner Second Owner…. Borrower It should be brought out how ownership came to be acquired by each of the owners both predecessor in interest and successor. While tracing the title deeds, the Advocate has to verify all original title deeds/link deeds and their genuineness. Title in Property Law: An Overview PAGE7 In the domain of property law, "title" constitutes the conceptual embodiment of a collection of rights associated with a property. These OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 8 (19m 2s)

[Audio] rights may include the ownership or interest in the property, which can be categorized as either legal or equitable. The components of this rights bundle can be allocated and held by various parties. Title essentially serves as proof or the foundational basis for asserting ownership rights. It can be established through deliberate actions by the parties involved or arise through the mechanisms of law. Acquisition of title can occur via transfer, either between parties or by legal prescription, and is regulated by the Transfer of Property Act concerning immovable property. Title Search Execution: Authoritative Platforms and Processes 1. Manual Search at the Registration and Stamps Department in Madhya Pradesh: I have physically inspected records to gather historical and current data on the property's title. 2. Online Search at the Registration and Stamps Department (Sampada) in Madhya Pradesh: I have executed a comprehensive online search to verify the property's registration and status. 3. Search on Land Records Portal (landrecords.mp.gov.in): By accessing this official portal, I have reviewed and cross-referenced land records for consistency and accuracy. 4. Search on Revenue Case Management System (RCMS): This system has been utilized to identify any revenue-related cases or disputes pertaining to the property. 5. Search on the Madhya Pradesh High Court Website: Legal proceedings and judgments that may impact the property's title have been examined through the court's digital records. In-Depth Property Records Review The meticulous inspection of property records encompassed the identification and verification of all pertinent transfer documents, which include: ⚫ Sale Deed: This document certifies the conveyance of property ownership from seller to buyer. PAGE8 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 9 (21m 26s)

[Audio] ⚫ Gift Deed: This document records the gratuitous transfer of property ownership without financial consideration. ⚫ Relinquishment Deed: This deed signifies the abandonment of rights by a co-owner in Favor of another party. ⚫ Co-owner Deed: This document specifies the shared ownership terms among multiple owners of the property. ⚫ Will: A legal testament outlining the distribution of the property owner's assets posthumously. ⚫ Partition: The division of property among co-owners, which can occur voluntarily or as mandated under the Madhya Pradesh Land Revenue Code 1959. ⚫ Encumbrance/Charge on Property: Any claims, liens, or charges against the property that may impede clear title transfer. ⚫ Pending Case on Property: Ongoing legal disputes or litigation involving the property that may influence ownership rights. ⚫ Pending Property Tax on the Property: Unsettled tax obligations that could potentially affect the property's transferability. Conclusion of the Title Search The results of the title search will be presented in the Next steps of this report, providing a detailed and authoritative assessment of the property's title status. This comprehensive analysis will aid in the determination of the property's marketability and the identification of any potential legal impediments to the transfer of ownership. INVESTIGATION REPORT: LAND TRANSFER RECORDS IN VILLAGE BADCHHAPRA, TEHSIL AND, DISTRICT DHAR, MADHYA PRADESH During my search on the official website of the Madhya Pradesh government land records, I found available land records for the relevant village, Badchhapra, covering the period from 1996-1997 to 2013-2014. I do not find any transfer documents, such as Partition deed, sale deeds, gift deeds, or mutation records, for the specific survey numbers in question. PAGE9 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 10 (23m 56s)

[Audio] The results of the search in Land Records Portal are provided as Annexure - G of this Search Report. Legal Analysis of Land Title Acquisition Under the Madhya Pradesh Land Revenue Code, 1959 Introduction This document provides a legal analysis of the acquisition of title to immovable property in Village Badchhapra, Tehsil and District Dhar (M.P.). The property in question includes: Survey Nos, 272/1/2 are owned by Mr. Babu son of Mr. Bondar the acquisition is governed by the Madhya Pradesh Land Revenue Code, 1959 (MPLRC). Legal Framework The acquisition of ownership rights over agricultural land in Madhya Pradesh is primarily governed by the Madhya Pradesh Land Revenue Code, 1959. This statute grants Bhumi swami rights, which represent full ownership privileges for individuals classified under certain categories of landholders. Additionally, the Indian Registration Act, 1908 and the Transfer of Property Act, 1882 play crucial roles in regulating the transfer of property through voluntary transactions such as sale, gift, or mortgage. Bhumi swami Rights under MPLRC, 1959 Under Section 158 of the MPLRC, a Bhumi swami is defined as an individual who holds full ownership rights over agricultural land. This classification applies to various categories of landholders depending on the region, including former tenants, concessionary landholders, and recognized occupants. The Bhumi swami enjoys the right to sell, lease, mortgage, or otherwise deal with the land, subject to compliance with agricultural laws and revenue obligations. Annexures: PAGE10 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 11 (26m 20s)

[Audio] To verify the above information, the Khasra of year 2006-07 is appended to this report as Annexure – H. Transaction of Agricultural Land Survey No. 272/1/2 Paki area Under the Transfer of Property Act, 1882 Mr. Babu@Babulal, officially transferred their rights, title, and interests in the agricultural land (known by Survey No. 272/1/2 paki area 0.051 hectares), located at Village Badchhapra, to Mrs. Durgabai wife of Mr. Sitaram, a resident of Village Badchhapra Tehsil Dhar. This transaction was made through a Registered Sale Deed, as per Section 54 of the Transfer of Property Act, 1882 Legal Framework: Section 54 of the Transfer of Property Act, 1882 Section 54 of the Transfer of Property Act, 1882 defines 'Sale' as the transfer of ownership in exchange for a price either paid or promised or part-paid, part-promised. This provision stipulates that for tangible immovable property worth one hundred rupees or more, or in the case of any intangible asset, a sale can only be validated through a registered instrument. The Sale Deed in question was duly executed with the proper stamp duty, in accordance with the Indian Stamp Act, 1899, and subsequently registered by the Sub-Registrar office located at Sub-Registrar Office Dhar under the Registration Act, 1908. Reporting Acquisition and Mutating Land Records Under the MP Land Revenue Code, 1959 Post-registration of the sale deed, Mrs. Durgabai wife of Mr. Sitaram reported the acquisition of rights in Survey No. 272/1/2 Paki area to the Patwari within the six months, as required by Section 109 of the MP Land Revenue Code, 1959. As per Section 110(1) of the same code, the Patwari recorded this acquisition in the mutation register and informed the Tehsildar within 30 days, in line with Section 110(2). The Tehsildar then published the mutation notice in the village and alerted any interested parties, as mandated in Section 110(3). Mutation of Land Records Reflecting Ownership Change After following the due process as outlined in the MP Land Revenue Code, the Tehsildar issued an order (Case No. 2437/A-6/2022-23 dated 19/03/2024) to mutate the land records. This mutation replaced the PAGE11 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 12 (29m 41s)

[Audio] names of the previous recorded owner, Babu@Babulal, with that of Mrs. Durgabai wife of Sitaram in the Land Record for Survey Number 272/1/2/2, designating him the new Bhumi swami of the land. The area associated with this mutation, as reflected in the records, is 0.051 hectares. Sale Deeds: Legal Framework and Significance A Sale Deed is a crucial legal document in property transactions, marking the point at which property ownership is transferred from the seller (Vendor) to the buyer (Vendee). This document contains detailed information about the property and outlines the rights and obligations of both parties involved in the transaction. Key Components of a Sale Deed A Sale Deed is executed on non-judicial stamp paper. It includes pertinent details about the property and the transaction, such as the description of the property, the total consideration involved, the mode of payment, and the exact date when the possession of the property will be transferred. Legal Governance The process and requirements for creating a Sale Deed are governed by the Registration Act of 1908. This Act mandates the registration of the Sale Deed to ensure the document's legal validity and enforceability. Vendor and Vendee In the context of a Sale Deed, the parties involved in the transaction are often referred to as the 'Vendor' (seller) and 'Vendee' (buyer). These terms are used to denote their respective roles in the transaction. Transfer of Ownership A Sale Deed signifies the transfer of property ownership from the seller to the buyer. In simpler terms, the Sale Deed marks the official change of ownership, moving the property title from the seller's name to the buyers. Legal Definition of Sale According to Section 54 of the Transfer of Property Act 1988, a sale is defined as the transfer of ownership in exchange for a price paid or promised, or part-paid and part-promised. This transfer is affected by the Sale Deed. Conclusion PAGE12 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 13 (32m 14s)

[Audio] In conclusion, a Sale Deed is a pivotal legal document in property transactions. It cements the transfer of ownership from the seller to the buyer, outlining the rights and obligations of all parties involved. Its contents and execution are regulated by the Registration Act 1908 and the Transfer of Property Act 1988 to ensure transparency, legality, and fairness in property transactions. For verification of the above information, the sale deed details from Sampada 2.0 and the mutation order in case no. 2437/A-6/2022-23 are appended to this report as Annexure – I and Annexure – J. Search in (SAMPADA) Registration and Stamps Department Official Website I have conducted a thorough search on the official website of the Registration and Stamps Department (SAMPADA) to verify the property's registration and status immediately prior to the date of this search report, 21-04-2025. The search did not yield any results indicating a transfer of the aforementioned land. Search in Madhya Pradesh High Court Official Website As an advocate, I have conducted a search for the property offered as mortgage in the Madhya Pradesh High Court Official Website and e-Courts Services. The search results will be mentioned in the next step. No Pending Litigation: For other survey numbers, no pending litigation was found, indicating no legal barriers to transferability. The search results from the Madhya Pradesh High Court website and e-Courts Services are annexed herewith as Annexure - K of this report. Possession The current applicant/borrower made an affidavit before a notary public, affirming that they possess the aforementioned agricultural land, which isn't subject to any injunction, attachment order, or ongoing litigation from any civil, criminal, or revenue court. The applicant/borrower stated that other statements mentioned therein were based on their knowledge and were true. PAGE13 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 14 (34m 48s)

[Audio] In a recent decision by the Supreme Court of India, New Okhla Industrial Development Authority v. Ravindra Kumar Singhvi (1502-2022), the Court highlighted the importance of affidavits as solemn declarations made before a qualified officer. If any facts in the applicant/borrower's affidavit are discovered to be false or incorrect, the bank will have the authority to commence appropriate legal proceedings against them. A copy of the affidavit is enclosed with this search report. Conclusion about the chain of title After examining the available revenue records and other documents related to the chain of title, I have formed an opinion that the current applicant/borrower has an unbroken and continuous history of Bhumi Swami Rights, resulting in complete ownership of the relevant agricultural land. The applicant has consistently demonstrated their possession as a Bhumi Swami Right holder, concluded by examining the pertinent documents. Title deeds documents details under which ownership is acquired. First Owner, Name/Nature of the deed, Details like Regn. etc. All Details Mention in para 3 Tracing of Title of this report 6 List of encumbrances. 1 Nature of Encumbrance Encumbrance found on said agriculture Land 2 Charge under contract No charges found on said agricultural land. 3 MORTGAGE / ENCUMBRANCE During an offline search at the office of the Sub-Registrar (Registration and Stamps Department, Commercial Tax, Madhya Pradesh, Dhar), I discovered encumbrances, charges, or liens on the said land. Loan 1: This entry, dated 18-Nov-03 with Document No. 1000 and Book No. 423, records a transaction for the party BABULAL SO BONDAR from the village BADCHHAPRA. The transaction took PAGE14 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 15 (37m 8s)

[Audio] place at the JHABUA DHAR BANK BRANCH GHATABILLOD (at present Madhya Pradesh Gramin bank). The amount involved was ₹30000, and the relevant Survey Nos. are 90/3, 194/3/1, 256/2, 272/1/2, and 117. Loan 2: On 17-Nov-06, Document No. 2680 and Book No. 578 detail an entry for BABULAL SO BONDAR from the village BADCHHAPRA. This transaction was with the JHABUA DHAR BANK BRANCH GHATABILLOD (at present Madhya Pradesh Gramin bank) for an amount of ₹30000. The associated Survey Nos. are 90/3, 194/2/1, 256/2, and 272/1/2. Loan 3: The third entry, dated 5-Aug-17, is recorded under Document No. 1442 and Book No. 1397 for the party BABU SO BONDAR. This transaction, related to the village BADCHHAPAR, occurred at the NARMADA JHABUA GRAMIN BANK BRANCH GHATABILLOD (at present Madhya Pradesh Gramin bank). The amount for this entry is ₹96000, and the Survey Nos. are 90/3, 194/2/1, 256/2, and 272/1/2. Significantly, in the year 2024, the outstanding loan amount associated with these specific entries was fully settled and cleared, resulting in the bank formally releasing the mortgage and declaring the said land parcel completely mortgage-free, thereby confirming its clear and unencumbered legal status as of that date. Legal Opinion on Priority of Charges on Agricultural Land in Madhya Pradesh Introduction This legal opinion concerns the priority of charges created on agricultural lands situated in Madhya Pradesh, as per the provisions of the M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972, vis-à-vis charges created by cooperative societies under the Madhya Pradesh Cooperative Societies Act, 1960. PAGE15 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 16 (40m 11s)

[Audio] Priority of Charges: Legal Framework M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972 Section 6: Financial Aid and Creation of Charges The Act allows farmers to seek financial assistance from banks by creating a charge or mortgage on their lands or interests therein, even when prior charges or mortgages exist in favor of cooperative societies. Section 7: Priority of Bank Charges Any charge or mortgage on an agriculturist's land created after the commencement of the Act in favor of a bank for financial assistance shall have priority over any charge or mortgage created in favor of cooperative societies or other individuals, with the exception of charges created by the State Government. Precedence of Banking Charges Based on the above legal provisions, charges created by banks for financial assistance post-1972 are to be accorded priority over charges created by cooperative societies or other individuals, irrespective of the chronological order of their creation. Professional Legal Opinion As a legal practitioner, my assessment is that when an agriculturist secures financial aid from a bank, and consequently a charge or mortgage is established on their agricultural land for this purpose, such charge or mortgage will supersede any pre-existing or subsequent charges created in favor of cooperative societies or other individuals. This prioritization is mandated by the M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972, and is applicable notwithstanding any conflicting provisions in the Madhya Pradesh Cooperative Societies Act, 1960. Payment of Government Taxes As per the law, Bhumi Swamis are obligated to pay land revenue to the government for their land ownership. The Madhya Pradesh PAGE16 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 17 (42m 39s)

[Audio] Land Revenue Code (MPLRC) outlines the procedures for assessing and collecting land revenue, and failure to make payments may result in property seizure by the government. Nonpayment of land revenue can lead to legal consequences and the potential seizure of property. As an advocate, I have acquired certified copies of the revenue records and conducted a thorough examination. I can confirm that there are no lingering dues to be paid by the present applicants or borrowers. 4 Negative lien There is no negative line on the said agricultural land. A negative line refers to a restriction or claims on a property that could affect its ownership or transferability. In this case, there are no such restrictions or claims associated with the agricultural land in question. 5 Lease/Tenancy There are no leases or tenancies in respect of the said farmland and there are no current agreements or arrangements permitting other parties to use or occupy the property for any specified period of time, 6 Right of The said agricultural land is not subject to any right of Maintenance/reversion maintenance or reversion. There are no claims or interests that would allow any other party to inherit or regain possession of the property. 7 Charge by operation of law The detail of charge mentioned in para 6 of this report 8 Preemption rights There are no rights of first refusal on the said farmland. Pre-emption rights refer to the right of a person or entity to PAGE17 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 18 (44m 31s)

[Audio] purchase a property before it is offered to others. In this case, there are no such rights associated with the subject farmland. There are no outstanding 9 Right specific performance under an agreement to sell obligations or claims under any prior agreement to sell the property, and the property is free and clear of any such contractual obligations. 10 Lincs/First charge under Laws Detail mentioned in para 6 of this report 11 Right of Reversion to Government There is no reversionary interest in said agricultural land to the government. This means that the property is not subject to any conditions or circumstances under which it may revert to government ownership, and the land remains free from such potential claims. 12 Name of person in whose favor encumbrances Detail of encumbrance Mention In para 6.3 of this search report subsisting 13 The date on which Detail of encumbrance Mention In para 6.3 of this search report encumbrance has come into existence 7 View on Encumbrance 1 In the case of encumbrance, the advocate should clearly opinion as to 2 How such an encumbrance would affect the value of the property. An encumbrance can affect the value of a property in different ways, depending on the type of encumbrance. For example, a mortgage or lien on the property can decrease its value because it reduces the owner's equity and limits the owner's ability to sell or PAGE18 refinance the property. Similarly, a restriction or easement on the OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 19 (46m 29s)

[Audio] property can limit its use or development potential, which can also reduce its value. On the other hand, some types of encumbrances can increase the value of a property. For example, an easement that provides access to a desirable amenity, such as a lake or beach, can make the property more attractive to buyers and potentially increase its value. 3 Any permission/approval is required for the Bank to create security. For creating security on an agricultural loan under the Kisan Credit Card (KCC) scheme in India, the bank doesn't necessarily need external permission from any other authority. However, the decision to require security and the type of security taken are governed by regulations set by the Reserve Bank of India (RBI). Here's a summary of the RBI guidelines on security for KCC loans: Loans up to ₹1 lakh: Banks are not allowed to ask for any security or margin for KCC loans with a limit of up to ₹1 lakh. Loans between ₹1 lakh and ₹3 lakh (with tie-up for recovery): Banks can consider sanctioning loans without collateral security, but it's at their discretion. Loans above ₹1 lakh (without tie-up) or ₹3 lakh (with tiePAGE19 up): Banks have the discretion to ask for collateral security. In states with online land record charge creation facilities, the bank should utilize them. Therefore, depending on the loan amount and tie-up details, the bank might require your permission to create security on assets. However, the decision to ask for security and the type of security lie with the bank within the framework set by the RBI. OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 20 (48m 36s)

[Audio] 4 The extent to which the Bank's security would be jeopardized because of Encumbrances on mortgaged property can jeopardize the bank's security by reducing property value, complicating encumbrance. foreclosure, exposing the bank to competing claims or legal risks, and potentially damaging the collateral. The extent of the impact would depend on the specific encumbrance and circumstances. Detail of mention in para 7.3 5 Manner of cost of removal of encumbrance. of this report 8 Regulatory Issues The property is not affected 1 Whether the property is affected by land ceiling law. by land ceiling laws. The said property is not affected 2 Whether the property is by land fragment law. affected by land fragment law. The property is not affected by 3 Whether the property is affected by forest law. forest law. The property is not affected by 4 Whether the property is affected by planning law. planning law. 5 Whether the property is affected by Urban Land Ceiling law. The Urban Land Ceiling Act (ULCA) was enacted by the Indian government in 1976 to prevent the concentration of urban land in the hands of a few individuals or groups. The act was repealed in 1999 by the Central government, but some states continue to enforce their versions of the law. In the case of Madhya Pradesh, the ULCA was applicable until it was repealed by the state government in 2001. Therefore, as of now, the Urban Land Ceiling Act is not applicable in Madhya Pradesh. The property is not affected by 6 Whether the property is affected by rent rent restriction/control law. restriction/control law. The property is not affected by 7 Whether the property is affected by Environment law. Environment law. PAGE20 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 21 (51m 0s)

[Audio] 8 Whether the property is affected by user restrictions under Municipal/Revenue law. As per the legal provisions of Section 165 of the Land Revenue Code 1959, there are restrictions on the mortgage/charge or transfer of agricultural land. However, Section 165(9-b) of the Land Revenue Code 1959 states that these restrictions do not prevent a Bhumi Swami (landowner) from transferring any right in their land to secure payment of an advance made by a Commercial Bank for agricultural purposes or improvements. This section also allows such banks to sell the rights to recover the advance. Additionally, Section 3 of The M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972 states that, notwithstanding any law or custom to the contrary, an agriculturist is allowed to alienate their land or interest in the land, including creating a charge or mortgage, in favor of a bank to obtain financial assistance. Considering the legal provisions, I, Parag Hada, advocate, opine that the Bank can mortgage/create a charge on the specified agricultural land under Section 165(9-b) of the Land Revenue Code 1959 and Section 3 of The M.P. Krishi Udhar Pravartan Tatha Prakirn Up bandha (Bank) Adhiniyam, 1972. 9 It is essential to report that the property is not subject to any regulatory issues, and none of the aforementioned concerns are applicable. 9 View of regulatory hurdle If the property is affected by regulatory issues, the advocate has to give a clear view, as to 1 How would such an encumbrance affect the value of the property? ;- An encumbrance can potentially decrease the value of a property by limiting the owner's equity, use or development potential, while certain encumbrances, such as easements, can increase the value of the property. Detail mentioned in para 7.3 2 Any permission/approvals of this search Report are required for the Bank to create security. PAGE21 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 22 (53m 52s)

[Audio] 3 The extent to which the Bank's security would be jeopardized because of encumbrances.: - The presence of an encumbrance could negatively impact the value of a property, as it may represent potential liabilities or restrictions on the property's usage or transfer, making it less attractive to potential buyers or investors. 4 Manner and cost of removal of encumbrance.: - Encumbrances are found on the property, the bank's security could be jeopardized to the extent of the outstanding claims or liabilities, which may affect the property's value and the bank's ability to recover the loan amount in case of default. 10 List of documents/deeds provided to the advocates perused by him the advocate has to give a full description of the documents received and perused by him one by one. Description of Document Original Bhuadhikar & Rin Pustika and Online Electronic Certified Copy of Bhuadhikar Pustika Online Electronic E -Certified Copy of Khatawar Khatoni & Jamabandi of the Year 2025-26 Online Electronic E -Certified Copy of Khasra of the Year 202526 & Online E - Copy of Khasra of the Year 2021-22 To 2024-25 According to the information 11 List of documents found while examining the deeds as above and in the search in the office of Registrar/ revenue authorities affecting the property and provided in the search report, all relevant documents affecting the property have already been mentioned and examined. examined. Therefore, there is no additional list of documents to be provided. "No additional documents have 12 A list of further documents called for examination and perused been requested or examined in this case." No further documents are 13 In case further documents are not deemed necessary in this case necessary the advocate should make a statement here that further documents are not necessary. PAGE22 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 23 (56m 20s)

[Audio] that all documents related to the 14 Whether documents examined are duly stamped as per the stamp act. agricultural property in question are exempt from stamp duty, as per the applicable laws. Therefore, the documents examined do not need to be stamped as per the stamp act. That documents of said Whether the registration agricultural property are not required for registration endorsement is in order endorsement 15 Certificate Examination This is to certify that I have examined all documents pertaining to the abovereferenced agricultural property and have found no evidence to indicate that these documents are forged or fictitious. All documents appear to be genuine and legal. 16 Certificate of title "This is to certify that the title to the property owned by the borrower is clear and marketable without further action by the borrower. The property is freely transferable and has no legal impediments affecting its marketability. 17 Documents required for creating a mortgage/charge include: Form-V: Declaration by the mortgager/borrower for the creation of a charge or mortgage deed, executed in favor of the bank. the M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972 (32 OF 1973), Section 5, an agriculturist can create a charge on their land or immovable property for securing financial assistance from a bank. PAGE23 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL - [email protected].

Scene 24 (58m 18s)

[Audio] For simple mortgages, as defined by Clause (b) of Section 58 of the Transfer of Property Act 1885, the mortgagor binds themselves personally to pay the mortgage money without delivering possession of the property. Registration of charge and mortgage in favor of banks is governed by Section 8 of the M.P. Krishi Udhar Pravartan Tatha Prakirn Upabandha (Bank) Adhiniyam, 1972 (32 OF 1973). Despite anything stated in the Indian Registration Act, of 1908, charges and mortgages created in favor of banks are deemed duly registered if the bank sends a certified true copy of the document creating such charge or mortgage to the Sub-Registrar within the prescribed time. Essential Document Required for Bank record. All Essential Document Required for Bank records are Enclosed as Annexure - A To Annexure - K of This Search Report Affidavit as per RBI Guideline dated 28-01-15 Online Agriculture Property Tax Deposit Receipt from Revenue Department Must Be Opiated from Borrower. Dated - 21-04-2025 Receipt of Search attached with This Report Seal and Signature Parag Hada Advocate Dhar. M.P. PAGE24 OFFICE OF PARAG HADA ADVOCATE RESIDENCE-209, SILVER HILL COLONY DHAR (M.P.) OFFICE- BUM-BUM COMPLEX, TRIMURTI NAGAR, Dhar-AHMEDABAD ROAD, DHAR (M.P.) E-MAIL – [email protected].