Scene 1 (0s)

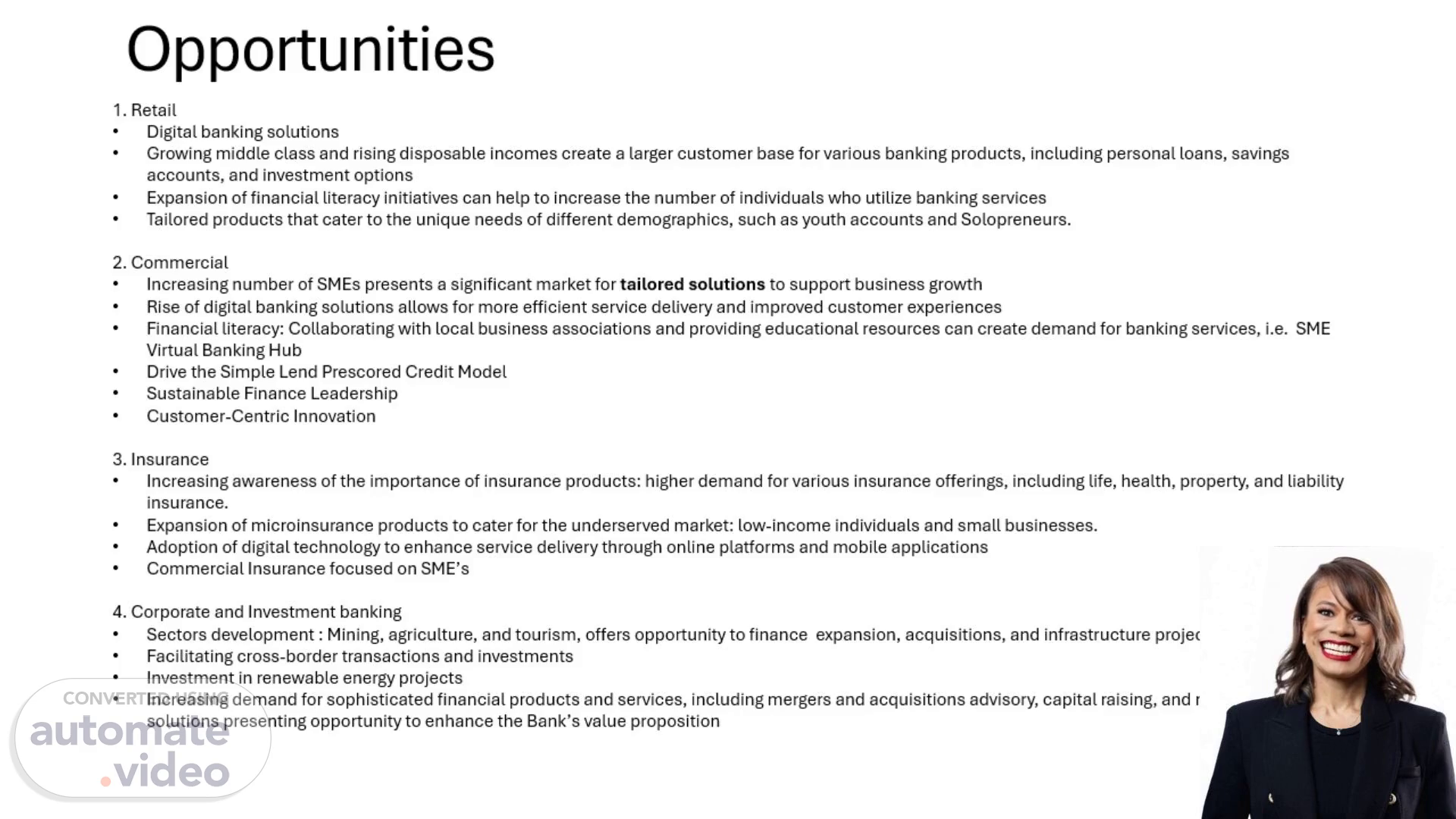

Opportunities. 1. Retail Digital banking solutions Growing middle class and rising disposable incomes create a larger customer base for various banking products, including personal loans, savings accounts, and investment options Expansion of financial literacy initiatives can help to increase the number of individuals who utilize banking services Tailored products that cater to the unique needs of different demographics, such as youth accounts and Solopreneurs. 2. Commercial Increasing number of SMEs presents a significant market for tailored solutions to support business growth Rise of digital banking solutions allows for more efficient service delivery and improved customer experiences Financial literacy: Collaborating with local business associations and providing educational resources can create demand for banking services, i.e. SME Virtual Banking Hub Drive the Simple Lend Prescored Credit Model Sustainable Finance Leadership Customer-Centric Innovation 3. Insurance Increasing awareness of the importance of insurance products: higher demand for various insurance offerings, including life, health, property, and liability insurance. Expansion of microinsurance products to cater for the underserved market: low-income individuals and small businesses. Adoption of digital technology to enhance service delivery through online platforms and mobile applications Commercial Insurance focused on SME’s 4. Corporate and Investment banking Sectors development : Mining, agriculture, and tourism, offers opportunity to finance expansion, acquisitions, and infrastructure projects. Facilitating cross-border transactions and investments Investment in renewable energy projects Increasing demand for sophisticated financial products and services, including mergers and acquisitions advisory, capital raising, and risk management solutions presenting opportunity to enhance the Bank’s value proposition.

Scene 2 (2m 35s)

[Audio] Today, we will be discussing the competitive differentiators for Retail banking in Namibia, specifically focusing on FNB's performance in comparison to other local competitors. The growing middle class and rising disposable incomes in Namibia have presented various opportunities in the retail, commercial, insurance, and corporate and investment banking sectors. FNB has positioned itself as a strong competitor in the market, with a diverse range of product offerings and a strong focus on customer service and community engagement. Their digital banking solutions, such as a user-friendly mobile app and online platform, have contributed to their success. Taking a look at FNB's local competitors, FNB stands out for its wide range of products, including lifestyle accounts with cash rewards. This not only attracts customers, but also shows their commitment to meeting and exceeding customer needs. FNB is known for its exceptional customer service and has received recognition for their efforts in this area. Their community engagement initiatives further showcase their dedication to both their customers and society as a whole. Some other local competitors include Standard Bank, known for its comprehensive suite of financial products and services, Nedbank, with a strong focus on sustainability and green banking initiatives, and Bank Windhoek, known for its local expertise and community involvement. In conclusion, FNB's key competitive differentiators are their diverse range of product offerings, exceptional customer service, and focus on digital banking solutions..

Scene 3 (4m 21s)

[Audio] Slide number 3 out of 5 in our presentation on the growing opportunities in the financial sector in Namibia will focus on the key competitive differentiators for business banking. These include tailored financial solutions, dedicated relationship management, access to credit and financing, digital banking capabilities, cash management services, networking opportunities, and support for startups and SMEs. FNB is known for its robust digital banking platform, offering a wide range of financing options and dedicated relationship managers. Standard Bank, on the other hand, is known for its extensive range of products..

Scene 4 (5m 6s)

[Audio] We have reached slide number 4 of our presentation on the growing opportunities in the retail, commercial, insurance, and corporate and investment banking sectors in Namibia. This slide will discuss the key competitive differentiators for Corporate and Investment banking in the country. Sector expertise is crucial in this sector, as it requires a deep understanding of the different sectors in Namibia and their specific financial needs. This allows for the creation of tailored and innovative solutions for clients. Comprehensive financial solutions are also essential, referring to the wide range of products and services offered by these banks, including corporate finance, structured finance, and investment solutions. Strong relationships with clients are important, providing personalized service and industry-specific expertise. Local market knowledge is another key factor, as banks with a strong understanding of the Namibian market can provide customized services to their corporate clients. Access to capital markets is a competitive advantage, enabling these banks to offer diverse financing options, including innovative solutions. Risk management services are also crucial, helping clients mitigate risk and protect their investments. In recent years, there has been a growing trend towards sustainability in the financial industry. Banks that prioritize sustainable finance and corporate responsibility are attractive to clients interested in environmental, social, and governance considerations. To illustrate further, the table on this slide compares how FNB, RMB, Standard Bank, Nedbank, and Bank Windhoek are faring amongst local competitors. FNB and RMB are known for their strong origination franchise and comprehensive product offerings, with a focus on innovation and tailored solutions. Standard Bank has a wide range of services and a vast network with expertise in various sectors. Nedbank is known for its sustainable finance and personalized service. Bank Windhoek takes pride in their strong emphasis on local knowledge and community involvement. In conclusion, the corporate and investment banking sector in Namibia presents abundant opportunities, and these key differentiators will help banks stay competitive and meet the evolving needs of their clients..

Scene 5 (7m 35s)

[Audio] Everyone, welcome back. Our presentation on the opportunities in the financial sector in Namibia is coming to an end. We will now discuss the key competitive differentiators for insurance in Namibia. These include product variety, tailored solutions, customer service, digital platforms, local expertise, community engagement, claims processing efficiency, and risk management services. Firstly, we must consider the product variety. With a growing middle class and rising disposable incomes, there is an increasing demand for diverse insurance products in Namibia. This presents a great opportunity for insurance companies to stand out by offering a wide range of options. Secondly, it is crucial for insurance companies to provide tailored solutions that address the specific needs and preferences of their customers, especially as the market becomes more competitive. Thirdly, efficient and prompt customer service is essential for retaining and attracting customers, given the rise of digital technology. Speaking of digital platforms, they have become a key differentiator in the insurance industry as they not only improve customer experience, but also expand the customer base. Local expertise is another differentiator, as it allows companies to understand the market and its needs and tailor their products and services accordingly. Active community engagement is also important in building trust and enhancing brand reputation. Claims processing efficiency is a major concern for customers, so insurance companies must prioritize timely and efficient processing to set themselves apart. Lastly, risk management services have gained importance and allow companies to offer value-added services and minimize potential risks for customers. Now, let's look at how FNB compares to its local competitors. As a relatively new player in the insurance market, FNB is well-known for its competitive offerings in these areas..