Scene 1 (0s)

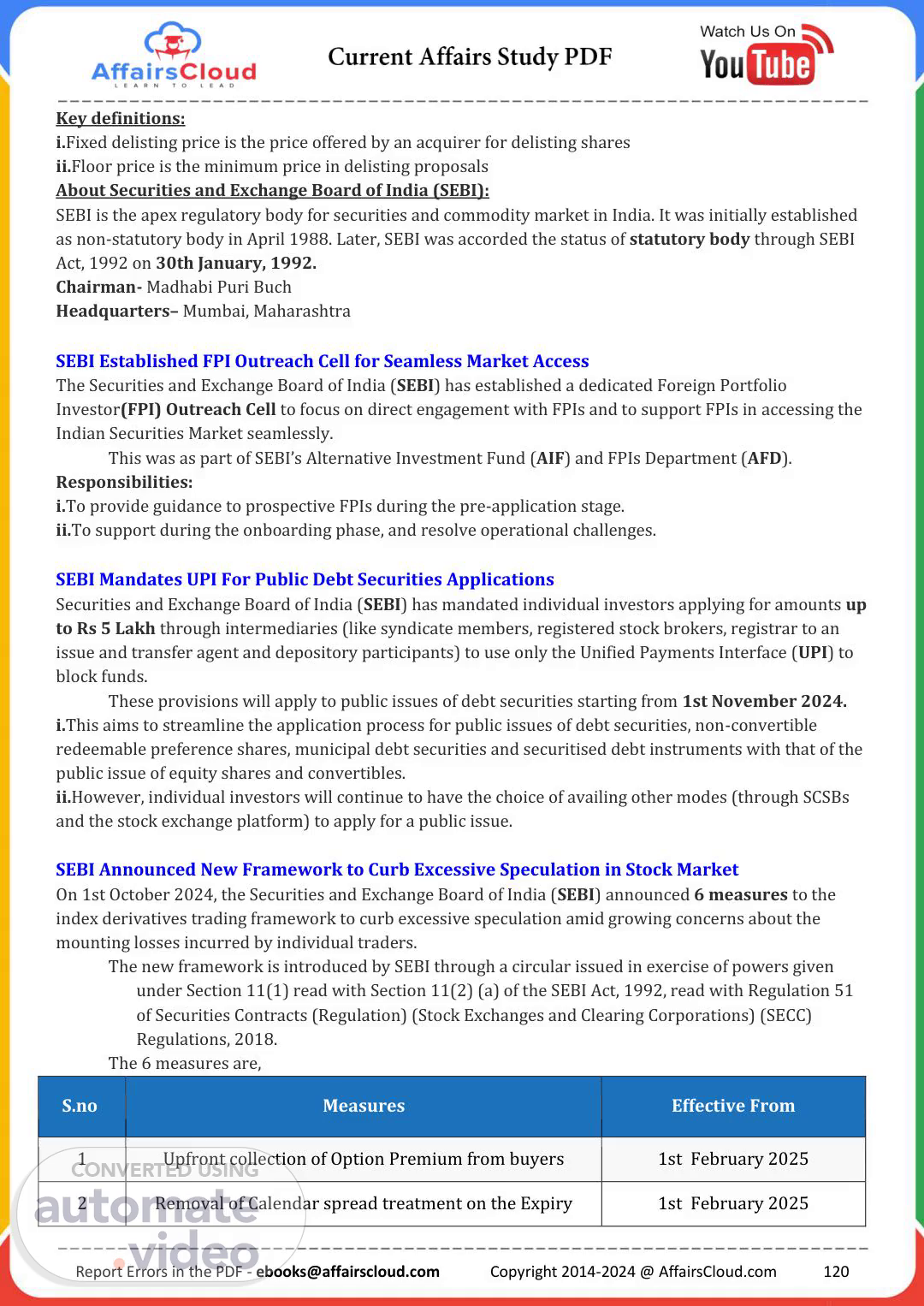

[Virtual Presenter] Key definitions: i.Fixed delisting price is the price offered by an acquirer for delisting shares ii.Floor price is the minimum price in delisting proposals About Securities and Exchange Board of India (S-E-B-I-): sebi is the apex regulatory body for securities and commodity market in India. It was initially established as non statutory body in April 1988. Later, sebi was accorded the status of statutory body through sebi Act, 1992 on 30th January, 1992. Chairman Madhabi Puri Buch Headquarters– Mumbai, Maharashtra sebi Established F-P-I Outreach Cell for Seamless Market Access The Securities and Exchange Board of India (S-E-B-I-) has established a dedicated Foreign Portfolio Investor(F-P-I--) Outreach Cell to focus on direct engagement with F-P-I's and to support F-P-I's in accessing the Indian Securities Market seamlessly. This was as part of sebi’s Alternative Investment Fund (A-I-F--) and F-P-I's Department (A-F-D--). Responsibilities: i.To provide guidance to prospective F-P-I's during the pre application stage. ii.To support during the onboarding phase, and resolve operational challenges. sebi Mandates U-P-I For Public Debt Securities Applications Securities and Exchange Board of India (S-E-B-I-) has mandated individual investors applying for amounts up to Rs 5 Lakh through intermediaries (like syndicate members, registered stock brokers, registrar to an issue and transfer agent and depository participants) to use only the Unified Payments Interface (U-P-I--) to block funds. These provisions will apply to public issues of debt securities starting from 1st November 2024. i.This aims to streamline the application process for public issues of debt securities, non convertible redeemable preference shares, municipal debt securities and securitised debt instruments with that of the public issue of equity shares and convertibles. ii.However, individual investors will continue to have the choice of availing other modes (through SCSBs and the stock exchange platform) to apply for a public issue.sebi Announced New Framework to Curb Excessive Speculation in Stock Market On 1st October 2024, the Securities and Exchange Board of India (S-E-B-I-) announced 6 measures to the index derivatives trading framework to curb excessive speculation amid growing concerns about the mounting losses incurred by individual traders. The new framework is introduced by sebi through a circular issued in exercise of powers given under Section 11(1) read with Section 11(2) (a) of the sebi Act, 1992, read with Regulation 51 of Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) (S-E-C-C-) Regulations, 2018. The 6 measures are, S.no Measures Effective From 1 Upfront collection of Option Premium from buyers 1st February 2025 2 Removal of Calendar spread treatment on the Expiry 1st February 2025 Report Errors in the P-D-F [email protected] Copyright 2014-2024 @ AffairsCloud.com 120.

Scene 2 (3m 58s)

[Audio] Day 3 Intradaymonitoring of position limits 1st April 2025 4 Contract size for index derivatives 20th November 2024 5 Rationalization of Weekly Index derivatives products 20th November 2024 6 Increase in tail risk coverage on the day of options expiry 20th November 2024 Note: These new measures will be implemented in a phased manner with effect from 20th November, 2024. Key Points: i.Earlier, the SEBI has constituted an Expert Working Group (EWG) to review the regulatory frameworks to protect investors and foster the growth of the equity derivatives market. ii.On 30th July 2024, the SEBI had released a consultation paper based on the recommendations of EWG and subsequent discussions held by SEBI's Secondary Market Advisory Committee (SMAC). About the 6 Measures: i.Upfront collection of Option Premium from options buyers: As per new framework, SEBI has mandated the collection of options premium upfront from option buyers by the Trading Member (TM) or Clearing Member (CM) and will come into effect from 1st February, 2025, in order to avoid any undue intraday leverage to the end-client, and to discourage any practice of permitting any positions beyond the collateral at end-client level. ii.Removal of Calendar Spread Treatment on Expiry Day: Considering substantial volumes observed on expiry days compared to other future expiry days and the increased basis risk associated with such volumes, SEBI has decided that the benefit of offsetting positions across different expiries called calendar spread will not be available on the day of expiry for contracts expiring on that day. iii.Intraday monitoring of position limits: SEBI has directed stock exchanges to monitor existing position limits for index derivatives as there is a risk of positions being created beyond permissible limits amid large volumes on expiry day. According to the SEBI's direction, stock exchanges will be required to consider at least 4 position snapshots during the day. This new measure will come into effect from 1st April, 2025. iv.Reduce the Minimum Contract Size for Index Derivatives: The new framework has increased the minimum contract size for index Futures & Options (F&O) derivatives, which is currently between Rs 5 lakh and Rs 10 lakh to Rs 15 lakh at the time of its introduction in the market. Also, the lot size will be fixed in such a manner that the contract value of the derivative on the day of review is between Rs 15 lakh and Rs 20 lakh. This marks the 1st revision of contract size by SEBI since 2015. v.Limiting Weekly Index Expiry to One Per Exchange: In order to prevent the problem of excessive trading in index derivatives on expiry day, SEBI has decided to rationalize index derivatives offered by exchanges which expire on a weekly basis. As per the new framework, weekly derivatives contracts will be only available on one benchmark index for each exchange, which means the National Stock Exchange (NSE) and Bombay Stock Exchange.

Scene 3 (7m 42s)

[Audio] vi.Increase in tail risk coverage on the day of options expiry: As per the new framework, SEBI has increased the tail risk coverage by levying an additional Extreme Loss Margin (ELM) of 2% for short option contracts. This new rule will be applicable for all open short options at the start of the day, as well on short options contracts started during the day that are due for expiry on that day. This new rule will help to prevent speculative activity around options positions and the attendant risks on the day of options contracts expiry. Important Terms: i.F&O derivatives: These are the financial derivatives that permit traders to speculate on asset price movements without owning the asset itself. It includes underlying assets such as: stocks, bonds, commodities, and currencies to indices, Exchange Traded Funds (ETFs), among others. ii.ELM: It is an additional margin levied by exchanges other than the normal margin requirements. It is designed to cover the risk of losses beyond the level predicted by Value at Risk (VAR) models. About Securities and Exchange Board of India (SEBI): SEBI is the apex regulatory body for securities and commodity market in India. It was originally established as non-statutory body in April 1988. Later, SEBI was accorded the status of statutory body through SEBI Act, 1992 on 30th January, 1992. Chairman- Madhabi Puri Buch Headquarter- Mumbai, Maharashtra SEBI Introduced New Regulations for InvITs and REITs to Boost Liquidity and Ease Business Compliance On 26th September 2024, the Securities and Exchange Board of India (SEBI) has introduced certain amendments in the " SEBI (Infrastructure Investment Trusts) Regulations, 2014, and in the " SEBI (Real Estate Investment Trusts) Regulations, 2014" in exercise of powers given under section 30 read with sections 11 and 12 of the SEBI Act, 1992 (15 of 1992). The most significant change introduced by the SEBI is that it has reduced the trading lot size of privately placed Infrastructure Investment Trusts (InvITs) to Rs 25 lakh. This move aims to boost investors' participation and increase liquidity of such investment vehicles. These new regulations are now known as the SEBI (Infrastructure Investment Trusts) (Third Amendment) Regulations, 2024 and SEBI (Real Estate Investment Trusts) (Third Amendment) Regulations, 2024. These regulations are came into effect from the day of its official notification by SEBI, while some of the provisions will come into force 60 days later. Note: Earlier, the trading lot for secondary market trading for privately placed InvITs was Rs 1 crore. If the InvIT invests minimum 80% of its asset value in completed and revenue generating assets, then the trading lot was Rs 2 crore. Key Changes for REITs and InvITs: i.SEBI has mandated that for publicly placed InvITs, the distributions declarations must be made at least semi-annually i.e. once every 6 months in every financial year and annually for privately placed InvITs. ii.As per new regulations, SEBI has fixed the timeline for undertaking distributions to unit holders by.

Scene 4 (11m 44s)

[Audio] In order to call an annual meeting, consent of minimum 95% of unit holders will be required and in case of any other meeting, consent by majority of the unit-holders will be required. iii.The new regulations has mandated for all unit holder meetings, the manager of REIT/ investment manager of InVITs are required to provide an option to unit holders to attend the meeting via video conferencing or other audio-visual means as the option of remote electronic voting. iv.As per new regulations, for any issue taken up in such meetings that require approval from the unit holders, it is mandatory that votes cast in favour of the resolution should be 50% of the total votes cast for the resolution unless otherwise specified. v.SEBI has specified that the manager and the trustee must ensure that adequate backup systems, data storage capacity as well as some other arrangements for alternative means of communication are maintained for the records maintained in electronic form. vi.Also, the manager and the trustee are required to ensure that a business continuity plan and disaster recovery site is in place for the records maintained electronically, to maintain data and transaction integrity. Important Terms: i.InvIT: It is similar to mutual fund, which allows direct investment of money from individual and institutional investors in infrastructure projects to earn a small portion of the income as return. ii.REIT: It is a company that owns and operates income-generating real estate or related assets. These may include office buildings, shopping malls, hotels, warehouses, among others. About Securities and Exchange Board of India (SEBI): SEBI is the apex regulatory body for securities and commodity market in India. It was initially established as non-statutory body in April 1988. Later, SEBI was accorded the status of statutory body through SEBI Act, 1992 on 30th January, 1992. Chairman- Madhabi Puri Buch Headquarters– Mumbai, Maharashtra JFSL & Black Rock Received In-Principle Approval from SEBI to Set up Mutual Fund Business On 3rd October 2024, Jio Financial Services Limited (JFSL), a Non-Banking Financial Company (NBFC) backed by Reliance Industries Limited (RIL) has received the in-principal approval from the Securities and Exchange Board of India (SEBI), to establish a Mutual Fund (MF) business, in partnership with New York (the United States of America (US))-based BlackRock Financial Management Inc., the world's largest asset manager. The final approval for registration will be granted by SEBI subject to the fulfillment of the requirements by JFSL and BlackRock laid out by SEBI in its official notification. Key Points: i.JFSL will invest an amount of Rs 3 crore towards initial subscription of 30 lakh equity shares of face value Rs 10 each. ii.Also, both the companies had announced an investment of USD 150 million each for the MF business in India. Points to note: i.In July 2023, Jio Financial Services announced the formation of a 50:50 joint.

Scene 5 (15m 29s)

[Audio] venture (JV) named "Jio BlackRock Investment Advisers Private Limited," focused on providing investment advisory services as its core business. ii.The Certificate of Incorporation was received from the Ministry of Corporate Affairs (MoCA) on 7th September 2024. Note: The MF Industry in India is one of the fastest growing as its Assets Under Management (AUM) has doubled from Rs 25.48 lakh (in 2019)to Rs 66.67 lakh crore (in 2024). About Jio Financial Services Limited(JFSL): It is an Indian financial service company and offers various financial services such as payment services, insurance broking, among others. Managing Director (MD) and Chief Executive Officer (CEO)– Hitesh Kumar Sethia Headquarters– Mumbai, Maharashtra Established– 2023 SEBI Changes Nomination Rules for Demat Account, Mutual Fund Investments The Securities and Exchange Board of India (SEBI) has changed the nomination rules between Mutual Funds (MF) and Demat Accounts allowing the holders of both instruments to include up to 10 nominees. The change was made during the SEBI board meeting held on 30th September 2024 in Mumbai, Maharashtra. i.The new rules will allow nominees to act on behalf of investors who are unable to do so, with some safeguards in place. The process for transferring assets to nominees will be streamlined, requiring less paperwork. ii.No rights will be granted to the legal heirs of the deceased nominee and creditors' claims will take precedence over the transmission of assets to nominees. The non-submission of 'choice of nomination' will not lead to freezing of demat accounts and mutual fund folios. iii.The nomination will be optional for joint demat accounts and for jointly held mutual fund folios. An investor can change the nominee multiple times as there will be no limit on the number of times a nominee can be changed. iv.The unique identifiers for nominees to be obtained will be either PAN (Permanent Account Number), Passport number or Aadhar. SEBI Extends Digital Relaxation for AGMs Until September 2025 On 4th October 2024, the Securities and Exchange Board of India (SEBI) extended the relaxation given to listed companies from sending physical copies of financial statements to shareholders for Annual General Meetings (AGMs) by one more year till 30th September 2025. The relaxation was valid till September 2024. The SEBI has decided to extend the relaxations granted earlier for compliance with Regulation 36(1)(b) and Regulation 44(4) of the SEBI, from LODR (Listing Obligations and Disclosure Requirements) Regulations until September 30, 2025. i.The Ministry of Corporate Affairs (MCA) issued a circular on September 19, 2024, announcing an extension of the relaxation on sending physical copies of financial statements, including the board's report and auditor's report, to shareholders for Annual General Meetings (AGMs) held until September 30, 2025. ii.Listed companies are required to adhere to the specific conditions detailed in.

Scene 6 (19m 27s)

[Audio] LOANS ISSUED BY BANKS ADB approves USD 162 mn loan for sustainable tourism development in Himachal Pradesh On 3rd October 2024, the Asian Development Bank (ADB) approved a USD 162 million loan to support sustainable and inclusive tourism development projects in Himachal Pradesh(HP). This project aims to improve district-level tourism management and to develop destination plans and tourist sites in HP. Key Points: i.The project will promote heritage and cultural centres, restoring the castle, beautification of public spaces, construction of convention centres and facilities in the districts of Mandi, Hamirpur, Kullu and Kangra. ii.By improving and maintaining heritage and cultural sites, building new infrastructure, and strengthening the tourism industry, this project will increase the state's potential for tourism. iii.These enhancements will incorporate environmentally friendly solutions, such as solar lighting and electric vehicles, ensuring accessibility for the elderly, women, children, and individuals with disabilities. iv.ADB will help strengthen the institutional capacity of the Himachal Pradesh Tourism Development Board to develop a tourism strategy and marketing plan. About Himachal Pradesh (HP): Chief Minister(CM)– Sukhvinder Singh Sukhu Governor– Shiv Pratap Shukla National Parks– Inderkilla National Park, Khirganga National Park Wildlife Sanctuaries– Dhauladhar Wildlife Sanctuary, Kanwar Wildlife Sanctuary PFC Secures largest-ever foreign currency term loan of USD 1.265 billion Power Finance Corporation Limited (PFC), a Maharatna public sector company and one of India's top nonbanking financial companies (NBFC), operating under the Ministry of Power(MoP), secured its largest ever foreign currency loan of USD 1.265 billion. This transaction was executed through a facility agreement with multiple banks based in the International Financial Services Centre (IFSC) in GIFT City, Gandhinagar, Gujarat. PFC plans to use this fund to finance projects not related to thermal power (coal based), promoting green and sustainable energy initiatives. This supports India's goals of reducing carbon emissions and increasing renewable energy capacity. Key Highlights : i.The USD 1.265 billion loan sets a record for Indian Public Sector Units (PSUs). It is structured as a floating-rate loan with an average interest rate of 4.21% per annum. ii.It is issued in three major Currencies-United States Dollar (USD), Euro (EUR), and Japanese Yen (JPY). The loan's interest rates are linked to global benchmarks- Secured Overnight Financing Rate (SOFR) for USD, the Euro Interbank Offered Rate (EURIBOR) for EUR, and the Tokyo Overnight Average Rate (TONA) for JPY. iii. The loan has a five-year term, offering PFC the flexibility needed to manage its investments and projects efficiently. iv.Several well-known banks helped organize the loan, including the State Bank of India (SBI), Industrial Development Bank of India (IDBI) Bank Limited,Axis Bank Limited, Mitsubishi UFJ Financial Group (MUFG Bank), Deutsche Bank, Sumitomo Mitsui Banking Corporation (SMBC). SBI was the main lender and.

Scene 7 (23m 47s)

[Audio] vi.This is a significant step towards supporting India's vision for sustainable economic development and energy transition. About Power Finance Corporation (PFC) Chairman & Managing Director (CMD)- Parminder Chopra Headquarters- New Delhi(Delhi) Founded-1986 About Ministry of Power(MoP): Union Minister- Manohar Lal Khattar (Constituency-Karnal, Haryana) Minister of State (MoS)- Shripad Yesso Naik (Constituency- North Goa) IFC Partners with Axis Bank to Provide USD 500 Million Loan to Fund Green Projects in India On 7th October 2024, the International Finance Corporation (IFC), private lending arm of the World Bank Group (WBG) has partnered with Axis Bank Limited, India's leading Private Sector Bank, to provide a loan worth USD 500 million (about Rs 4,200 crore) to help develop a blue finance market and scale up financing of green projects in India. This marks the first blue investment by the IFC in India and the 1st blue transaction by a financial institution in the country. This loan funding will enable Axis Bank to expand its climate finance portfolio. Significance: i.Due to India's rapid urbanisation and economic growth, there is major opportunity to enhance water and energy efficiency. As of 2022, the water and wastewater treatment market size was estimated at USD 1.6 billion and is expected to reach USD 3 billion by 2029. ii.Also, the green buildings sector offers an investment opportunity of USD 1.4 trillion by 2030, which will be mainly driven by a need of sustainable infrastructure. Major part of these investments need to come from the private sector in order to reduce the dependence on limited public funding. Points to Note: i.Axis Bank is among the 1st Indian banks to have board-approved Environmental, Social and Governance (ESG) policy for lending that complies with the IFC performance standards. ii.Axis Bank has also publicly committed to increase financing in Environmental, Social and Governance (ESG)-aligned sectors to Rs 60,000 crores (approximately USD 7.2 billion) by 2030 (from August 2021), of which Rs 30,000 crores (approximately USD 3.1 billion) of incremental financing was achieved by March 2024. iii.In 2016, the bank issued 1st green US dollar (USD) bond and also the 1st sustainable US dollar Additional Tier 1(AT1) bond from India in 2021. Important terms: i.Blue loan: It is an financial instrument which is used to raise and earmark funds for investments such as water and waste water management, reduction of marine plastic pollution, restoration of marine ecosystems, sustainable shipping, among others. ii.Green loan: It is a financial product which is used to fund projects that are sustainable and eco-friendly. iii.Brown loan: It is non-sustainable financing and investment product which supports the fossil fuel and carbon intensive activities. About International Finance Corporation (IFC): Managing Director (MD)– Makhtar Diop Headquarters- Washington DC, the United States of America (USA) Established-.

Scene 8 (27m 53s)

[Audio] About Axis Bank Limited: Managing Director (MD) and Chief Executive Officer (CEO)– Amitabh Chaudhary Headquarters– Mumbai, Maharashtra Tag line– Badhti ka Naam Zindagi Vivriti Capital Raises USD 25 Million ADB Loan for Climate Bond Vivriti Capital Limited (VCL), a non-banking finance company (NBFC), raised a USD 25 million senior secured debt facility from the Asian Development Bank (ADB) to lend towards its climate finance initiatives. This 4-year tenor bond is the 1st by an NBFC which will be used to expand its green finance portfolio. At least 30% of the funds will be earmarked for Electric Vehicle(EV) financing, including charging stations and battery swapping stations. The bond, certified by the Climate Bonds Initiative, aims to enhance access to climate finance for financially underserved enterprises, including micro, small, and medium-sized enterprises (MSMEs), mid-market corporates, and retail clients in India. Note: India has set ambitious targets in its updated nationally determined contributions, including reducing carbon emissions by one billion tons by 2030 and achieving Net-Zero emissions by 2070. World Bank Approves Rs 15,000 Crore Loan for Amaravati Development The World Bank (WB), in collaboration with the Asian Development Bank (ADB), has approved an inprinciple loan of Rs 15,000 crore to Andhra Pradesh (AP) for developing Amaravati as its capital city. A letter confirming the loan has been sent to India's Ministry of Finance(MoF), with final discussions scheduled for November 8, 2024 and the agreement expected to be signed by 15th November 2024. Key Points: i.The total project cost is estimated at Rs 49,000 crore, with Rs 15,000 crore being a soft loan from the WB. ii.The loan features a 15-year moratorium on repayment, shared by the Central and state governments in a 90:10 ratio. iii.Following the agreement, the Andhra Pradesh Capital Region Development Authority (APCRDA) will receive an initial tranche of Rs 3,750 crore in November 2024. iv.The funds will be used for infrastructure development, including residential and commercial layouts for land pooled from farmers, and construction of key government buildings, such as the state assembly and high court. Other Projects in Andhra Pradesh: i.The Central Government will release Rs 12,500 crore for the Polavaram Irrigation Project. ii.Bharat Petroleum Corporation Limited (BPCL) plans to invest Rs 85,000 crore in a new refinery in the state. iii.The "Swarna Andhra Pradesh 2047" vision document aims to transform the state into a USD 2.5 trillion economy with a per capita income of USD 40,000. About Asian Development Bank (ADB): President– Masatsugu Asakawa Headquarters– Mandaluyong, Philippines Establishment– 1966 Members– 69 (49 from region) Report Errors in the PDF - [email protected] Copyright 2014-2024 @ AffairsCloud.com.

Scene 9 (31m 52s)

[Audio] ADB approves USD 42mn loan for coastal protection ecosystem in Maharashtra The Asian Development Bank (ADB) has approved a loan of USD 42 million to enhance coastal and riverbank protection ecosystems in Maharashtra, boosting the resilience of local communities and their natural environments. i.The Maharashtra Sustainable Climate-Resilient Coastal Protection and Management Project will implement various solutions to combat coastal erosion and protect riverbanks, including offshore reefs, sheet piles, beach nourishment, and vegetation planting to restore and stabilize the coastline. The project builds on the ADB-financed Sustainable Coastal Protection and Management Investment Program. ii.The project aims to boost fisheries and tourism while promoting capacity building for stakeholders on gender equality and social inclusion. iii.ADB will support the Maharashtra Maritime Board in enhancing its capacity for shore management planning, including the creation of a coastal infrastructure management unit. AGREEMENTS & MoUs SIGNED NIPL & Trinidad and Tobago Partners to Develop UPI-like Payments System On 27th September 2024, NPCI International Payments Limited (NIPL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI), entered into a strategic partnership with the Ministry of Digital Transformation (MDT) of Trinidad and Tobago to build a real-time digital payments system modeled after the Unified Payments Interface (UPI) of India. With this, Trinidad and Tobago became the first Caribbean nation to adopt UPI. Key Points: i.This agreement will enable Trinidad and Tobago to establish a real-time payment platform for both person-to-person (P2P) and person-to-merchant (P2M) transactions expanding digital payments and fostering financial inclusion. ii.This will also support Trinidad and Tobago to modernise its financial ecosystem. iii.The accessibility, affordability, and connectivity with domestic and international payment networks will be enhanced Note: i.At present, Indians can pay selected merchants in Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka, and the United Arab Emirates (UAE). ii.In 2024, NIPL inked an agreement with the Central Bank of Peru and Bank of Namibia (BoN) to develop a UPI-like payment system. About NPCI International Payments Limited (NIPL): Chief Executive Officer(CEO)– Ritesh Shukla Headquarters– Mumbai, Maharashtra Incorporated– 2020 BOBCARD & RuPay partner to launch EMI feature on UPI payments BOBCARD Limited, a Non-Banking Financial Company (NBFC) and a wholly owned by Bank of Baroda (BoB), has partnered with RuPay to launch an Equated Monthly Installment (EMI) feature on Unified Payments Interface (UPI) payments, allowing users to convert their purchases into EMIs for a more convenient payment experience. i.Payments can be made via UPI at both online and offline merchants, with the option to convert transactions into EMIs at checkout. ii.Customers can apply for EMIs directly through their linked RuPay credit card on any UPI app, using their Report Errors in the PDF - [email protected] Copyright.

Scene 10 (35m 57s)

[Audio] UPI PIN for consent. iii.Users can select the EMI option and instalment period at the time of payment and track ongoing EMIs through the UPI app. iv.The feature targets the festive season and aims to boost digital credit adoption, especially in Tier 2 and Tier 3 cities. Note: Mumbai, Maharashtra based-BOBCARD Limited, formerly known as BOB Financial Solutions Limited, was established in 1994. AU SFB announces partnership with Kotak Life offering Life Insurance Solutions AU Small Finance Bank (AU SFB) has partnered with Kotak Mahindra Life Insurance Company Limited to offer life insurance solutions, expanding AU SFB's product offerings and enhancing financial security for its customers. i.The partnership provides AU SFB customers access to Kotak Life's comprehensive life insurance products, including term, retirement, savings, and investment plans. ii.The collaboration extends to both new and existing customers, including those from former Fincare SFB branches. iii.This partnership will strengthen AU SFB's presence in southern India by leveraging Kotak Life's portfolio. REC Limited Signed Rs 3 Lakh Crore Financing Agreement with Government of Rajasthan for Power Projects On 1st October 2024, REC Limited (formerly Rural Electrification Corporation Private Limited), a Maharatna Central Public Sector Unit (CPSU) under the administrative control of Ministry of Power (MoP) has signed a Memorandum of Understanding (MoU) with the Government of Rajasthan (GoR) to provide financial support of Rs 3 lakh crore to fund infrastructure projects in the state. The MoU was signed by Rahul Dwivedi, Executive Director,ED (PMD and I&L) REC Ltd. and Debasish Prusty, Secretary to GoR, in the presence of Bhajan Lal Sharma, Chief Minister (CM) of Rajasthan; Colonel Rajyavardhan Rathore, Minister for Industries and Commerce, GoR during the "Rising Rajasthan Investors meet" held in Rajasthan. About MoU: i.According to the MoU, REC Limited will provide financial support of Rs 50,000 crore per annum (increased from Rs 20,000 crore) to fund projects across power and non-power infrastructure for period of 6 years (up to 2030). On 10th March 2024, a MoU signed between GoR and REC Limited to finance Rs 20,000 crore annually till 2030. ii.The MoU is expected to cover various state's infrastructure sector projects such as: power, metros, roads, highways, airports, Information Technology (IT), steel, oil refinery, ports, and waterways, fibre optics, telecommunication, health, tourism, among others. iii.This partnership underscores REC's commitment to supporting the development of both power and non-power infrastructure in Rajasthan. About REC Limited: Chairman and Managing Director (CMD) – Vivek Kumar Dewangan Headquarter- New Delhi, Delhi Established- 1969 About Rajasthan: Chief Minister (CM) – Bajan Lal Sharma Report Errors in the PDF - [email protected] Copyright 2014-2024 @ AffairsCloud.com.

Scene 11 (40m 8s)

[Audio] Governor-Haribhau Bagde National Parks (NPs)- Ranthambore National Park, Keoladeo National Park ICICI Bank Partners with PhonePe to Offer Instant Credit on UPI On 8th October 2024, ICICI Bank Limited, India's leading Private Sector Bank, announced that it has partnered with PhonePe, India's largest digital platform, to offer instant credit on Unified Payments Interface (UPI) to its pre-approved customers through the PhonePe application (app). This strategic partnership enables the pre-approved customers of ICICI Bank to use this credit line facility for UPI transactions in a seamless and secure manner. This facility is announced ahead of the festive season to empower customers to purchase high ticket items like electronics, travel, and hotel bookings, bill payments, among others. Key Points: i.Under this instant credit offer, eligible customers can access up to Rs 2 lakh credit with a 45day repayment period. ii.This credit line facility is interoperable across different UP payment apps, offering flexibility and convenience. Points to Note: i.PhonePe leads the market share on UPI transactions, which is 49% of the total UPI transaction volumes in the country, followed by Google Pay (38%). Also, PhonePe platform registers transactions worth nearly Rs 200 crore per month. ii.In 2023, the National Payments Corporation of India (NPCI) launched the "credit line on UPI" service, which offers low-ticket, high-volume retail loans to individuals and businesses. iii.Other than ICICI Bank, some of the major lending banks such as: Axis Bank, HDFC Bank, Indian Bank, Punjab National Bank (PNB) and the State Bank of India (SBI) have also adopted this facility, making instant credit accessible on various platforms such as: Google Pay, Bharat Interface for Money (BHIM), Paytm, among others. About the ICICI Bank Limited: Managing Director (MD) and Chief Executive Officer (CEO)- Sandeep Bakshi Headquarters– Mumbai, Maharashtra Tag line- "Hum Hai Na, Khyal Apka" Established- 1994 About PhonePe: Chief Executive Officer (CEO)- Sameer Nigam Headquarters- Bengaluru, Karnataka Established- 2015 ICICI Bank and MakeMyTip Launched co-branded Premium Credit Card Mumbai( Maharashtra) based ICICI Bank Limited has partnered with MakeMyTrip (MMT), a leading Travel company, to launch a premium co-branded credit card named "MakeMyTrip ICICI Bank Credit Card" specially curated for the aspirational travellers of India. This card is issued as a dual offering which comes with the convenience of two cards, one each powered by Mastercard and RuPay. There is a joining fee of Rs 999 and there is an annual/renewal fee from the second year. The Cardholders earn unlimited reward points that never expire. The card offers a unique value with myCash (MakeMyTrip's reward currency), where 1 myCash is worth Rs 1 in spendable money. Report Errors in the PDF - [email protected] Copyright 2014-2024 @ AffairsCloud.com.

Scene 12 (44m 21s)

[Audio] The RuPay credit card can be linked to Unified Payments Interface (UPI), enabling safe and secure transactions through UPI enabled Applications( App). The co-branded credit card also offers complimentary MMTBLACK Gold membership, providing exclusive benefits across hotels, flights, and holiday packages. Google partners with Aditya Birla Finance & Muthoot Finance to offer personal & gold loans Google, an American search engine company, has partnered with Aditya Birla Finance Limited(ABFL) and Muthoot Finance Limited to enhance its financial services on Google Pay at the 10th edition of Google for India event held on 3rd October 2024 in New Delhi, Delhi. Google has partnered with Aditya Birla Finance to offer personal loans and with Muthoot Finance to provide gold-backed loans. Under this partnership, Indians can access the credit product, with affordable interest rates and flexible usage options – delivering flexibility to the borrower, and security to the lender. Note: The organised gold loan market is expected to surpass Rs 10 trillion in FY25 and may reach Rs 15 trillion by March 2027, according to ICRA Limited. Indian Navy & Bajaj Allianz Life Signed MoU for the Welfare of Naval Civilian Personnel The Indian Navy (IN) has signed a Memorandum of Understanding (MoU) with Pune(Maharashtra) based Bajaj Allianz Life Insurance Company Limited (BALIC), a private life insurance company, marking a significant initiative to enhance the welfare of its civilian personnel. This initiative aligns with the IN's declaration of the 2024 as 'Year of Naval Civilians,' aimed at enhancing the work environment and welfare measures for civilian staff This collaboration aims to provide tailored life insurance solutions specifically designed for the unique needs of naval civilians. Key Highlights of the MoU: i.Comprehensive Insurance Offerings: BALIC will offer a diverse range of life insurance products under this partnership, including term insurance and other plans tailored to meet the varied life goals of naval civilians. The primary objective is to provide these individuals with essential coverage at affordable premiums, ensuring that financial protection is within reach. The voluntary nature of the insurance allows naval civilians to select plans that best suit their individual circumstances and requirements. ii.Financial Relief for Families: A key aspect of the insurance offerings is the provision of immediate financial support for the families of civilian employees in the event of unexpected circumstances, such as untimely death. iii.Educational Initiatives: To maximize the benefits of this partnership, BALIC plans to conduct educational seminars and sessions for naval civilians. These initiatives will focus on raising awareness about the importance of term insurance and adequate life insurance coverage. iv.Customized Processes for Naval Civilians: Recognizing the unique needs of naval personnel, BALIC will implement specialized processes to cater specifically to this group. These tailored procedures aim to provide a smoother and more efficient experience when enrolling.

Scene 13 (48m 2s)

[Audio] About Bajaj Allianz Life Insurance Company Limited (BALIC): Managing Director and Chief Executive Officer (MD &CEO)– Tarun Chugh Headquarters– Pune, Maharashtra Founded – 2001 India Exim Finserve partnered with VoloFin to enhance receivables finance solutions for Indian SME exporters Gandhinagar(Gujarat) based India Exim Finserve IFSC Private Limited (Exim Finserve), a wholly owned subsidiary of Export-Import Bank of India (India Exim Bank) has collaborated with Singapore based VoloFin Services Private Limited to provide comprehensive receivables financing solutions to Indian exporters. This collaboration will assist underserved Small and Medium-sized Enterprise (SME) exporters who play an important role in the country's economic growth. It will also solve major trade finance gaps and enable open account trading between India and its trade partners. i.As as part of this initiative, New India Assurance Company Limited supported by global reinsurer Atradius, has introduced the first-of-its-kind trade finance insurance policy from GIFT City, Gujarat. ii.This strategic collaboration between VoloFin, India Exim Bank, and New India Assurance is poised to significantly enhance India's trade ecosystem, particularly for SMEs. Note: Netherland based Atradius is a global leader in credit insurance and risk management, with a presence in over 50 countries. SLCM partners with PNB & Bandhan Bank to Offer Management Solutions New Delhi(Delhi) based Sohan Lal Commodity Management Limited (SLCM) has partnered with New Delhi based Punjab National Bank (PNB) and Kolkata(West Bengal, WB) based Bandhan Bank Limited to provide 'Unified Collateral Management Solutions' aimed at enhancing the agricultural sector. This collaboration seeks to address critical issues related to post-harvest storage and financing, ultimately benefiting farmers and agri-businesses. i.It aims to facilitate access to post-harvest credit at competitive interest rates while offering scientific storage services and ensuring fair pricing for commodities in marketplaces (mandis). ii.SLCM utilizes its Artificial intelligence (AI) powered application(app) 'Agri Reach' to enhance the efficiency of post-harvest credit and storage services for both banks. Agri Reach app has been recognized for significantly reducing post-harvest losses from 10% to just 0.5%, regardless of the type of crop or location. MoRD Signs MoU with 10 Banks to Empower Rural Women Entrepreneurs through Financial Support The Ministry of Rural Development (MoRD) has signed a Memorandum of Understanding (MoU) with nine Public Sector Banks(PSBs)and one Private Sector Bank under the Deendayal Antyodaya Yojana-National Rural Livelihood Mission (DAY-NRLM) at the National Conclave on Women led Entrepreneurship held in New Delhi(Delhi). The PSBs involved in the agreement are: Bank of Baroda (BOB), Bank of India (BOI), Bank of Maharashtra (BOM), Canara Bank (CB), Central Bank of India (CBI), Indian Bank (IB), Indian Overseas Bank (IOB), Punjab National Bank (PNB).