Scene 1 (0s)

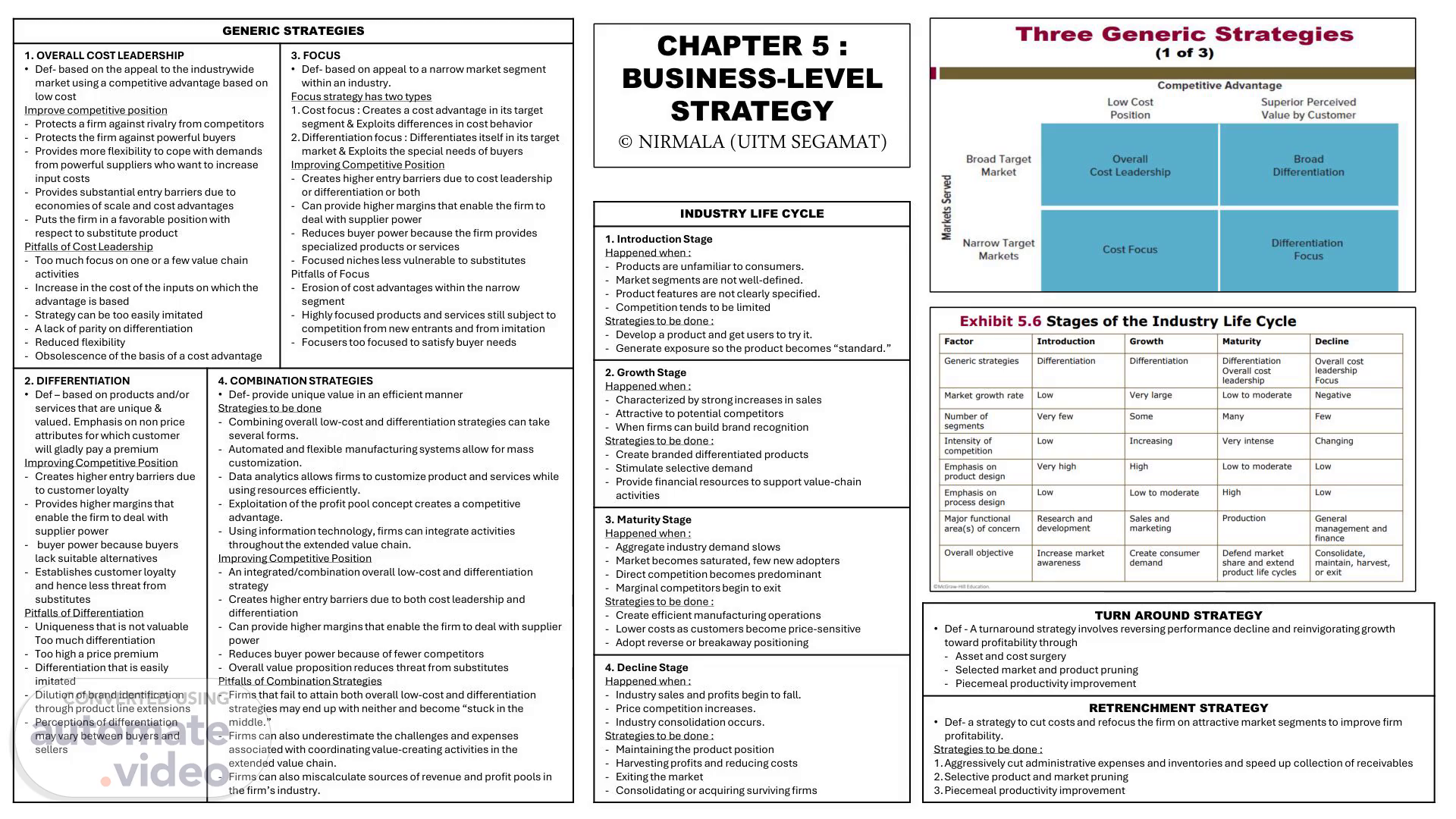

GENERIC STRATEGIES 1. OVERALL COST LEADERSHIP • Def- based on the appeal to the industrywide market using a competitive advantage based on low cost Improve competitive position - Protects a firm against rivalry from competitors - Protects the firm against powerful buyers - Provides more flexibility to cope with demands from powerful suppliers who want to increase input costs - Provides substantial entry barriers due to economies of scale and cost advantages - Puts the firm in a favorable position with respect to substitute product Pitfalls of Cost Leadership - Too much focus on one or a few value chain activities - Increase in the cost of the inputs on which the advantage is based - Strategy can be too easily imitated - A lack of parity on differentiation - Reduced flexibility - Obsolescence of the basis of a cost advantage 3. FOCUS • Def- based on appeal to a narrow market segment within an industry. Focus strategy has two types 1.Cost focus : Creates a cost advantage in its target segment & Exploits differences in cost behavior 2.Differentiation focus : Differentiates itself in its target market & Exploits the special needs of buyers Improving Competitive Position - Creates higher entry barriers due to cost leadership or differentiation or both - Can provide higher margins that enable the firm to deal with supplier power - Reduces buyer power because the firm provides specialized products or services - Focused niches less vulnerable to substitutes Pitfalls of Focus - Erosion of cost advantages within the narrow segment - Highly focused products and services still subject to competition from new entrants and from imitation - Focusers too focused to satisfy buyer needs 2. DIFFERENTIATION • Def – based on products and/or services that are unique & valued. Emphasis on non price attributes for which customer will gladly pay a premium Improving Competitive Position - Creates higher entry barriers due to customer loyalty - Provides higher margins that enable the firm to deal with supplier power - buyer power because buyers lack suitable alternatives - Establishes customer loyalty and hence less threat from substitutes Pitfalls of Differentiation - Uniqueness that is not valuable Too much differentiation - Too high a price premium - Differentiation that is easily imitated - Dilution of brand identification through product line extensions - Perceptions of differentiation may vary between buyers and sellers 4. COMBINATION STRATEGIES • Def- provide unique value in an efficient manner Strategies to be done - Combining overall low-cost and differentiation strategies can take several forms. - Automated and flexible manufacturing systems allow for mass customization. - Data analytics allows firms to customize product and services while using resources efficiently. - Exploitation of the profit pool concept creates a competitive advantage. - Using information technology, firms can integrate activities throughout the extended value chain. Improving Competitive Position - An integrated/combination overall low-cost and differentiation strategy - Creates higher entry barriers due to both cost leadership and differentiation - Can provide higher margins that enable the firm to deal with supplier power - Reduces buyer power because of fewer competitors - Overall value proposition reduces threat from substitutes Pitfalls of Combination Strategies - Firms that fail to attain both overall low-cost and differentiation strategies may end up with neither and become “stuck in the middle.” - Firms can also underestimate the challenges and expenses associated with coordinating value-creating activities in the extended value chain. - Firms can also miscalculate sources of revenue and profit pools in the firm’s industry. INDUSTRY LIFE CYCLE 1. Introduction Stage Happened when : - Products are unfamiliar to consumers. - Market segments are not well-defined. - Product features are not clearly specified. - Competition tends to be limited Strategies to be done : - Develop a product and get users to try it. - Generate exposure so the product becomes “standard.” 2. Growth Stage Happened when : - Characterized by strong increases in sales - Attractive to potential competitors - When firms can build brand recognition Strategies to be done : - Create branded differentiated products - Stimulate selective demand - Provide financial resources to support value-chain activities 3. Maturity Stage Happened when : - Aggregate industry demand slows - Market becomes saturated, few new adopters - Direct competition becomes predominant - Marginal competitors begin to exit Strategies to be done : - Create efficient manufacturing operations - Lower costs as customers become price-sensitive - Adopt reverse or breakaway positioning 4. Decline Stage Happened when : - Industry sales and profits begin to fall. - Price competition increases. - Industry consolidation occurs. Strategies to be done : - Maintaining the product position - Harvesting profits and reducing costs - Exiting the market - Consolidating or acquiring surviving firms TURN AROUND STRATEGY • Def - A turnaround strategy involves reversing performance decline and reinvigorating growth toward profitability through - Asset and cost surgery - Selected market and product pruning - Piecemeal productivity improvement RETRENCHMENT STRATEGY • Def- a strategy to cut costs and refocus the firm on attractive market segments to improve firm profitability. Strategies to be done : 1.Aggressively cut administrative expenses and inventories and speed up collection of receivables 2.Selective product and market pruning 3.Piecemeal productivity improvement CHAPTER 5 : BUSINESS-LEVEL STRATEGY © NIRMALA (UITM SEGAMAT).

Scene 2 (1m 5s)

Majority acquisition of public corporation result in value of destruction rather than value of creation CHAPTER 6 CORPORATE- LEVEL STRATEGY © NIRMALA (UITM SEGAMAT) REASONS FOR THE FAILURE OF MANY DIVERSIFICATION EFFORTS. Failed to effectively integrate their acquisition Paid too high a premium for the target common’s stock Unable to understand how to acquire firm’s asset would fit with their own lines of business Top executive may not have acted in the best interest of shareholder The motive for the acquisition may have been to enhance the executive power and prestige rather than to improve shareholder returns RELATED DIVERSIFICATION UNRELATED DIVERSIFICATION Def : a firm entering a different business that has little horizontal interaction with other businesses of a firm. It enables a firm to benefit from vertical or hierarchical relationships between the corporate office & individual business units How value can be created within business unit The corporate parenting advantage • Def : Parenting allows the corporate office to create value through management expertise & competent central functions. • Many firm have successfully diversifies their holding without strong evidence of the more traditional sources of synergy • These parent company can create value through management expertise • How? They improve plans and budgets and provide especially competent central functions • They also help subsidiaries make wise choices in their own Restructuring • the intervention of the corporate office in a new business that substantially changes the assets, capital structure, and/or management with new technologies, processes, and reward systems. • The corporate management must have the insight to detect undervalued companies competing in industries with a high potential for transformation • Restructuring can involve changes in : a. Asset restructuring involves the sale of unproductive assets. b. Capital restructuring involves changing the debt– equity mix, adding debt or equity. c. Management restructuring involves changes in the top management team, organizational structure, & reporting relationships. Portfolio Management • Def : a method of (a) assessing the competitive position of a portfolio of businesses within a corporation, (b) suggesting strategic alternatives for each business, and (c) identifying priorities for the allocation of resources across the businesses. • Using Boston Consulting Group’s (BCG) growth/share matrix o Each circle represents one of the firm’s business units. The size of the circle represents the relative size of the business unit in terms of revenue. o Stars : high industry high market. firm have long term growth potential and should continue o Question mark : high industry weak market. Resources should be invested to enhance competitive position o Cash cows : low industry high market. Limited long run potential o Dogs : low industry low weak market. Limited potential and be divested. Economies of scope allow businesses to Def : cost savings from leveraging core competencies and sharing related activities. Sharing activites • Def : having activities of two or more businesses’ value chains done by one of the businesses. • Primary Payoff : 1. Cost savings through elimination of jobs, facilities & related expenses, or economies of scale. This is the most common type of synergy and the easiest to estimate 2. Revenue enhancements through increased differentiation & sales growth Enables a firm to benefit from horizontal relationships across different businesses by leveraging core competencies and sharing activities Leveraging Core Competencies • Def : a firm’s strategic resources that reflect the collective learning in the organization. • Criteria to creating value and synergy 1. They create superior customer value. 2. The value-chain elements in separate businesses require similar skills. 3. They are difficult for competitors to imitate or find substitutes for. Related business gain market power by Pooled Negotiating Power • Def : the improvement in bargaining position relative to suppliers and customers. market power = firms’ abilities to profit through restricting or controlling supply to a market or coordinating with other firms to reduce investment. Principal by which firm achieve synergy through market power : PNP and VI Vertical Integration • Def : an expansion or extension of the firm by integrating preceding or successive production processes. • Benefit of VI a. A secure source of raw material or distribution channels b. Protection of and control over valuable assets c. Proprietary access to new technologies developed by the unit d. Simplifies procurement and administrative procedures • Risks of VI a. Costs and expenses associated with increased overhead and capital expenditure b. Loss of flexibility resulting from large investment c. Problem associated with unbalanced capacities along the value chain. d. Additional admin cost associated with managing a more complex set of activities • In making VI decision, issues that should be considered: a. Is the company satisfied with the quality of the value that its present suppliers & distributors are providing? b. Are there activities in the industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? c. Is there a high level of stability in the demand for the organization’s products? d. Does the company have the necessary competencies to execute the vertical integration strategies? e. Will the vertical integration initiatives have potential negative impacts on the firm’s stakeholders? • Transaction cost perspective ▪ Def : Every market transaction involves some transaction costs. ▪ Search cost : a decision to purchase an input from an outside source ▪ Negotiating cost : the process of reaching an agreement between two or more parties ▪ Contract cost : written spelling out future possible contingencies ▪ Monitor cost : parties of a contract have to monitor each other ▪ Enforcement cost : if party does not comply with terms of contract. MANAGERIAL MOTIVES Def: managers acting in their own self-interest rather than to maximize long-term shareholder value. Growth for growth’s sake • Def : managers’ actions to grow the size of their firms not to increase long-term profitability but to serve managerial self-interest. • Top managers gain more prestige, higher rankings, greater incomes, more job security. • How ? When stock is used to finance an acquisition, the shareholder of the acquiring and target firm share both the gains that will occur if the acquisition generates value over time and losses if the acquisition destroys value Excessive egotism • Def: managers’ actions to shape their firms’ strategies to serve their selfish interests rather than to maximize long- term shareholder value. • A healthy ego helps make a leader confident, clearheaded and able to cope with change • Egos can get in the way of a synergistic corporate marriage Use of antitakeover tactics • Def: managers’ actions to avoid losing wealth or power as a result of a hostile takeover. • Greenmail : a payment by a firm to a hostile party for the firm’s stock at a premium, made when the firm’s management feels that the hostile party is about to make a tender offer. • Golden parachute : a prearranged contract with managers specifying that, in the event of a hostile takeover, the target firm’s managers will be paid a significant severance package. • Poison pill : used by a company to give shareholders certain rights in the event of takeover by another firm. Diversification initiative Diversification : the process of firms expanding their operations by entering new businesses. Diversification initiatives must create value for shareholders through Mergers and Acquisition • Mergers : the combining of two or more firms into one new legal entity. • Acquisitions : the incorporation of one firm into another through purchase. • Motives : 1. Obtain valuable resources that help it expand its product offerings & services 2. Helps a firm develop synergy : Leveraging core competencies, Sharing activities, Building market power 3. Lead to consolidation within an industry, forcing other players to merge. 4. Enter new market segments by way of acquisitions • Limitations 1. Takeover premiums for acquisitions are typically very high. 2. Competing firms can imitate advantages and copy synergies. 3. Managers’ egos get in the way of sound business decisions 4. Cultural issues may doom the intended benefits • Divestment o Def : the exit of a business from a firm’s portfolio. o Help a firm reverse an earlier acquisition that didn’t work out as plan o Help cut their losses • Divestment objectives include: o Cutting the financial losses of a failed acquisition o Redirecting focus on the firm’s core businesses o Freeing up resources to spend on more attractive alternatives o Raising cash to help fund existing businesses • Divestment Success involves: o Removing emotion from the decision o Knowing the value of the business you’re selling o Timing the deal right o Maintaining a sizable pool of potential buyers o Telling a story about the deal o Running divestitures systematically through a project office o Communicating clearly and frequently Strategic Alliances & Joint Ventures • Strategic alliance : a cooperative relationship between two or more firms. • Joint ventures : new entities formed within a strategic alliance in which two or more firms, the parents, contribute equity to form the new legal entity. • Motive : o Enter new markets through greater financial resources and greater marketing expertise o Reduce manufacturing or other costs in the value chain o Develop & diffuse new technologies • Limitations : o Partners should have complementary strengths. o Partner’s strengths should be unique where uniqueness should create synergies and synergies should be easily sustained & defended. o Partners must be compatible & willing to trust each others Internal Development • Def : internal development entering a new business through investment in new facilities, often called corporate enterpreneurship and new venture development. • Motives : o No need to share the wealth with alliance partners. o No need to face difficulties associated with combining activities across the value chains. o No need to merge diverse corporate cultures. o No need for external funding for new development • Limitations : o Time-consuming o Need to continually develop new capabilities.

Scene 3 (2m 10s)

OPPORTUNITY ANALYSIS 1. OPPORTUNITY • The process of discovering and evaluating changes in the business environment, such as a new technology, sociocultural trends, or shifts in consumer demand, that can be exploited. Two phases of activity 1.Discovery : Becoming aware of a new business concept 2.Evaluation : Analyzing the opportunity to determine whether it is viable or feasible to develop further Four qualities for opportunity to be viable 1.Attractive . The opportunity must be attractive in the marketplace as there must be market demand for the new product or service 2.Achievable. The opportunity must be practical and physically possible 3.Durable. The opportunity must be attractive long enough for the development and deployment to be successful as the window of opportunity must be open long enough for it to be worthwhile 4.Value creating. The opportunity must be potentially profitable as the benefits must surpass the cost of development by a significant margin 3. ENTREPRENEURIAL LEADERSHIP • Leadership appropriate for new ventures that requires courage, belief in one’s convictions, and the energy to work hard even in difficult circumstances; and that embodies vision, dedication and drive, and commitment to excellence. Personality trait for leader a.Vision - Entrepreneurs envision realties that do not yet exists - Requires transformational leadership - Ability to share this vision with others b.Dedication and drive - Involves internal motivation - Calls for intellectual commitment - Requires patience - Stamina, willingness to work long hours - Enthusiasm that attracts others c.Commitment to excellence - Commit to knowing the customer. - Provide quality goods and services. - Pay attention to details. - Continuously learn. - Connect the dots. - Hire people smarter than themselves What difference characteristic between leader and manager - Higher core self evaluation - Higher conscientiousness - Higher openness to experience - Higher emotional stability - Lower agreeableness 2. RESOURCES • Resources are essential for entrepreneurial success. a.Financial Resources - depend on the stage of venture development & venture scale. - Initial, startup financing = Personal savings, family, and friends . Crowdfunding - Early-stage financing = Bank financing, angel investors - Later-stage financing = Commercial banks, venture capitalists equity financing b.Human capital = Strong, skilled management c.Social capital = Extensive social contacts & strategic alliances d.Federal, state, & local government resources = Government contracting, Loan guarantee programs, Training, counseling, & support services ENTRY STRATEGIES 1. Pioneering new entry : a firm’s entry into an industry with a radical new product or highly innovative service that changes the way business is conducted. - Create new ways to solve old problems. - Meet customers’ needs in a unique new way. - Disadvantages = strong risk that the product or services will not be accepted by consumer 2. Imitative new entry : a firm’s entry into an industry with products or services that capitalize on proven market successes and that usually have a strong marketing orientation. - Imitators have a strong marketing orientation. - Capitalize on proven market successes. - Introduce the same basic product or service in another segment of the market. - Can we do it better than an existing competitor? - Will someone then imitate us? 3. Adaptive new entry : a firm’s entry into an industry by offering a product or service that is somewhat new and sufficiently different to create value for customers by capitalizing on current market trends. - Capitalizes on current market trends. - Offers a product or service that is somewhat new and sufficiently different. - Creates new value for customers. - Captures market share. - Disadvantages = nothing to prevent a close competitor & keeping the idea fresh COMPETITIVE DYNAMICS • Def : intense rivalry, involving actions and responses, among similar competitors vying for the same customers in a marketplace. • New entry threatens existing competitors. How to respond to competitive dynamics - Need to identify new competitive action. - Engage in threat analysis. - Have the motivation and capability to respond. - Understand the types of competitive action. - Evaluate the likelihood of competitive reaction. Why Launch Actions? - To improve market position - To capitalize on growing demand - To expand production capacity - To provide an innovative new solution Hardball strategies for incumbent rivals - Devastating rivals’ profit sanctuaries - Plagiarizing with pride - Deceiving the competition - Unleashing massive & overwhelming force - Raising competitors’ costs Threat Analysis - Market commonality : the extent to which competitors are vying for the same customers in the same markets. - Resource similarity : the extent to which rivals draw from the same types of strategic resources. Types Competitive actions - Strategic actions : major commitments of distinctive and specific resources to strategic initiatives. - Entering new markets - Creating new product introductions - Changing production capacity - Pursuing mergers or alliances - Tactical actions : refinements or extensions of strategies usually involving minor resource commitments. - Doing price cutting (or offering increases) - Making product/service enhancements - Increasing marketing efforts - Developing new distribution channels Reaction to competitive dynamics 1.Likelihood of competitive reaction • Market dependence : degree of concentration of a firm’s business in a particular industry. • Competitor’s resources : • The reputation of the firm that initiates the action – the actor’s reputation 2.Choosing not to respond is a choice • Forbearance – holding back on an attack • Co-opetition – both cooperating & competing GENERIC STRATEGIES 1. Overall cost leadership : low pricing - Simpler organizational structure & smaller size - Quicker decision making to upgrade technology & integrate marketplace feedback controls costs 2. Differentiation : offer unique value of product or services - Offering a unique value proposition through innovation & superior use of new technology - Deploying resources in a radical new way 3. Focus : narrow or focused market - Use niche strategies that fit the small business model 4. Combination : Pursuing combination strategies can combine the best features of low-cost, differentiation, and focused strategies. - Holding down expenses by having a simple structure - Creating high-value products & services by being flexible & innovative - Offering highly specialized products or superior customer service to a niche market CHAPTER 8 ENTREPRE NEURIAL STRATEGY © NIRMALA (UITM SEGAMAT).

Scene 4 (3m 15s)

STRATEGIC CONTROL MECHANISMS • Strategic control involves monitoring performance toward strategic goals and taking corrective action when needed via effective systems. TRADITIONAL APPROACH MODEL 1. Strategies are formulated, goals are set. 2. Strategies are implemented. 3. Performance is measured against predetermined goals. Characteristic • Involves lengthy time lags & tied to firm annual planning cycle. • Most approriate when : Environment is stable & simple • Goals and objective can be measured with certainty • Little need for complex performance measure CONTEMPORARY APPROACH MODEL Contemporary control systems using informational control are effective when: • Focus is on constantly changing information that has potential strategic importance. • Information is important enough to demand frequent & regular attention from all levels. • Data & information are interpreted & discussed in face-to-face meetings. • Control system is a catalyst for ongoing debate about underlying data, assumptions & plans Characteristic - The focus is on constantly changing information that has potential strategic importance - The information is important enough to demand frequent and regular attention from all levels of the organization - The data and information generated are best interpreted and discussed in face-to-face meetings - The controls system is a key catalyst for an ongoing debate about underlying data, assumption and action plans BEHAVIORAL CONTROL • a method of organizational control in which a firm influences the actions of employees through culture, rewards, and boundaries. • focused on implementation – “doing things right” INFLUENCES THE ACTIONS OF EMPLOYEES VIA: 1. CULTURE • Organizational culture is a system of ; Shared values (what is important) Beliefs (how things work) • Organizational culture shapes a firm's people, organizational structures and control systems • Organizational culture produces behavioral norm (the way we do things around here) • Organizational culture sets implicit boundaries regarding: Dress, Ethical matters, The way an organization conducts its business • A strong culture : Leads to greater employee engagement, Provides a common purpose and identity & Reduces monitoring costs • Effective organizational cultures must be: Cultivated , Encouraged & Fertilized • Organizational cultures can be maintained by: Storytelling, Rallies or pep talks by top executives 2. REWARDS • Powerful means of influencing an organization’s • Focusing efforts on high - priority tasks • Motivating individual & collective task performance • Can be an effective motivator & control mechanism • Characteristic - Objectives are clear, well understood, and broadly accepted - Rewards are clearly linked to performance and desired behaviors - Performance measures are clear and highly visible - Feedback is prompt, clear, and unambiguous - The compensation “system” is perceived as fair and equitable - The structure is flexible; it can adapt to changing circumstances • Disadvantages - Individual actions are not related to compensation; employees are rewarded for the wrong things - Different business units have differing rewards systems - Behavior reinforced within subcultures may reflect value differences in opposition to the dominant culture - Reward systems may lead to information hoarding, working at cross purposes 3. BOUNDARIES • Focusing individual efforts on strategic priorities • Providing short-term objectives and action plans to channel employee efforts • Ways to channel employee effort : 1. Setting specific, measurable objectives, including a specific time horizon for attainment 2. Making them achievable, yet challenging enough to motivate 3. Holding individual managers accountable for implementation • Boundaries and constraints can also: o Improve efficiency and effectiveness through rule-based controls, appropriate when: o Environments stable and predictable o Employees are largely unskilled and interchangeable o Consistency in product and services is critical o The risk of malfeasance is extremely high INFORMATIONAL CONTROL • a method of organizational control in which a firm gathers and analyzes information from the internal and external environment in order to obtain the best fit between the organization’s goals and strategies and the strategic environment. • Informational control deals with both the internal & external environment. Key issue of information control: 1. Scan & monitor the external environment 2. Continuously monitor the internal environment Characteristic - Ongoing process of organizational learning - Focus is on constantly changing information – continuous monitoring, testing, review. - Data is interpreted and discussed face-to- face. A TRADITIONAL APPROACH TO STRATEGIC CONTROL • It is sequential : 1. Strategies are formulated & top management sets goals 2. Strategies are implemented 3. Performance is measured against the predetermined goal set • Control is based on feedback loop from performance measurement to strategy formulation • “Single-loop” - Simply compare actual performance to predetermined goal A CONTEMPORARY APPROACH TO STRATEGIC CONTROL • Informational control primarily concerned with whether or not the organization is doing the right things • Allow members to question whether there is a better path for the firm • Deals with internal environment as well as external strategic CONTROL SYSTEM: CORPORATE GOVERNANCE • the relationship among various participants in determining the direction and performance of corporations. • The primary participants are (1) the shareholders, (2) the management (led by the chief executive officer), and (3) the board of directors. • Assumes the separation of owners & management in a modern corporation AGENCY THEORY • Agency theory deals with the relationship between principals & agents. • Conflicts between principals (shareholders) and agents (managers) • Issues of risk preferences and information asymmetry • emphasis on two problems: 1. the conflicting goals of principals and agents, along with the difficulty of principals to monitor the agents 2. the different attitudes and preferences toward risk of principals and agents. EXTERNAL CORPORATE GOVERNANCE MECHANISMS • methods that ensure that managerial actions lead to shareholder value maximization and do not harm other stakeholder groups that are outside the control of the corporate governance system. The market for corporate control - if shareholders sell, stock value declines, increases possibility of takeover - Risk takeover constraint : the risk to management of the firm being acquired by a hostile raider. Influence the corporate behavior from outside organization through: • Role of regulatory bodies, auditors, bank and analyst • Media and public opinion • Market for corporate control • International standards International corporate governance o In countries other than the United States and the UK, there is another perspective o principal–principal conflicts : conflicts between two classes of principals—controlling shareholders and minority shareholders—within the context of a corporate governance system. o Three condition to met if PP conflict occurs 1. Dominant owner who have interest are distinct from minority shareholder 2. Motivation for the controlling shareholder to exercise their dominant positions to their advantages 3. Formal or informal constraint that would discourage controlling shareholder from exploiting their advantageous position o expropriation of minority shareholders : activities that enrich the controlling shareholders at the expense of the minority shareholders. o business group : a set of firms that, though legally independent, are bound together by a constellation of formal and informal ties and are accustomed to taking coordinated action. CORPORATE GOVERNANCE MECHANISMS • Corporate governance mechanisms: aligning the interests of owners and managers through 1. A committed and involved Board of Directors 2. Shareholder activism & active engagement 3. Managerial rewards and incentives ( Contract-based outcomes – reward & compensation agreements that align management & stockholder interests) 4. Making a decision about CEO duality Board of director effectiveness • Active, critical participants • Strategic plan scrutiny • Evaluation against high performance standards • Control of succession process • Independence and significant stock ownership Shareholder activism • Rights of individual shareholders (sell stock, vote, etc.) • Collective power of shareholders (direct course of corporation) • Institutional investor activism (review performance and pushing social initiative) Managerial rewards & incentives • CEOs as substantial stock owners • Performance-based rewards and penalties • Dismissal for poor performance CEO Duality • Unity of command ( duality) vs. agency theory perspective (separation) • Issues of focus, conflict of interest, and legitimacy CHAPTER 9 STRATEGIC CONTROL AND CORPORATE GOVERNANCE © NIRMALA (UITM SEGAMAT).

Scene 5 (4m 20s)

SIMPLE STRUCTURE FUNCTIONAL STRUCTURE DIVISIONAL STRUCTURE • Characteristic o Small organization & narrow product line o Owner-manager make most decision o Staff as an extension of top executive personality • Advantages o Highly informal o Coordination of tasks by direct supervision o Centralized decision making o Little specialization of tasks o Few rules & regulations; informal reward systems • Disadvantages o Responsibilities not understood o Self-interest, employees taking advantage of lack of regulations o Limited opportunities for upward mobility • Def : an organizational form in which the major functions of the firm, such as production, marketing, R&D, and accounting, are grouped internally. • Characteristic o The organization is small, with a single or closely related product or service, high production volume, perhaps some vertical integration. o The owner-manager needs specialists in various functional areas. o The chief executive has responsibility for coordination & integration of the functional areas. • Advantages o Enhanced coordination & control o Centralized decision making o Enhanced organizational-level perspective o More efficient use of managerial & technical talent o Facilitated career paths in specialized areas • Disadvantages o Impeded communication & coordination due differences in values & orientations – “silos” o May lead to short-term thinking o Difficult to establish uniform performance standards • Def : an organizational form in which products, projects, or product markets are grouped internally. • Characteristic o Divisions are relatively autonomous, consisting of products & services that are different from those of other divisions. o Although governed by a central corporate office, each division includes its own functional specialists. o Division executives help determine product-market & financial objectives; decision making is delegated to lower-level managers. • Advantages o Separation of strategic & operating control o Quicker respond on changes in market environment o Minimal problem sharing resources across functions o Good human resources (Development of general management) • Disadvantages o Very expensive o Dysfunctional competition among divisions o Differences in image & quality o More focus on short-term performances STRATEGIC BUSINESS UNIT STRUCTURE HOLDING COMPANY STRUCTURE MATRIX STRUCTURE • Def : an organizational form in which products, projects, or product-market divisions are grouped into homogeneous units. • Characteristic o Variation on the divisional structure o Similar divisions grouped into homogeneous units o Synergies achieved through related diversification – leveraging core competencies, sharing infrastructures, using market power o Each SBU operates as a profit center • Advantages o Planning & control by the corporate office o Decentralization of authority o Quicker response to changes in the market environment o Synergies through sharing core competencies, infrastructures, & market power • Disadvantages o Possible difficulty in achieving synergies o Increased personnel & overhead expenses o Corporate office further removed from the divisions o Corporate unaware of key changes in market conditions • Def : an organizational form that is a variation of the divisional organizational structure in which the divisions have a high degree of autonomy both from other divisions and from corporate headquarters. • Characteristic o Variation on the divisional structure o Similarities are few, synergies are limited o Autonomous operating divisions o Small corporate staffs, with limited involvement, relying on financial controls & incentive programs to obtain performance • Advantages o Cost savings due to fewer personnel and lower overhead o Divisional autonomy increases motivation level of divisional executives o Quicker response to changes in the market environment • Disadvantages o Potential for synergies is very limited o Corporate office has little control o Difficult to replace key divisional executives if they leave o Turnaround may be difficult due to limited corporate staff support • Def : an organizational form in which there are multiple lines of authority and some individuals report to at least two managers. • Characteristic o Functional departments, product groups & geographical units can be combined. o Individuals have two managers. o Project managers & functional managers share responsibility. o Product managers handle development, manufacturing & distribution of their own line. o Geographic managers are responsible for profitability of the business in their regions • Advantages o Increases market responsiveness, collaboration & synergies o Allows more efficient utilization of resources o Improves flexibility, coordination & communication o Increases professional development • Disadvantages o Dual reporting relationships lead to uncertainty regarding accountability o Can lead to power struggles & conflict o Relationships are complicated, need teamwork o Decision making takes longer ORGANIZATIONAL STRUCTURE • Organizational structure refers to formalized patterns of interactions linking = Tasks, Technologies & People Structure provides a balance between: a.The need for division of tasks into meaningful groupings b.The need to integrate these groupings for maximum efficiency and effectiveness CHAPTER 10 CREATING EFFECTIVE ORGANIZATIONAL DESIGNS © NIRMALA (UITM SEGAMAT).

Scene 6 (5m 25s)

INTERNATIONAL OPERATIONS • Def : an organizational form in which international operations are in a separate, autonomous division. Most domestic operations are kept in other parts of the organization. • Characteristic o Type of strategy driving the firm’s foreign operations o Degree of product diversity o The extent to which a firm is dependent on foreign sales • Multidomestic strategies use o International division structure o Geographic-area division structure o Worldwide matrix structure • Global strategies use o Worldwide functional structure o Worldwide product division structure o Worldwide holding company structure • Global startup : a business organization that, from inception, seeks to derive significant advantage from the use of resources and the sale of outputs in multiple countries. o Uses inputs from around the world o Sells its products & services to customers around the world o Has communication & coordination challenges o Has fewer resources than well-established corporations o Must use less costly administrative mechanisms o Frequently chooses a boundaryless organizational design AMBIDEXTROUS DESIGN • Def : organizational designs that attempt to simultaneously pursue modest, incremental innovations as well as more dramatic, breakthrough innovations. • Characteristic o Aligned and efficient while they pursue modest, incremental innovations o Flexible enough to adapt to changes in the external environment and create dramatic, breakthrough innovations • Advantages/effectiveness o Effectively integrate and coordinate existing operations o Establish project teams that are structurally independent units o Pay attention to each unit’s processes, structures & cultures o Effectively integrate each unit into the existing management hierarchy BOUNDARYLESS DESIGN 1. BARRIER-FREE ORGANIZATION • Def : organizations in which the boundaries, including vertical, horizontal, external, and geographic boundaries, are permeable. • Characteristic o Vertical boundaries between organizational levels o Horizontal boundaries between functional areas o External boundaries between the firm and its customers, suppliers, & regulators o Geographic boundaries between locations, cultures, & market o Include barrier-free, modular, & virtual organizations • Benefits o Agency costs are reduced through the use of relational systems. o Transaction costs between the firm and its suppliers are reduced. o Individual participants are less likely to perceive a conflict of interest. • Cost o Relationships between individuals become more important than profits. o Conflicts are resolved through ad hoc negotiations & processes. o Relationships are driven more by social connections than by needed competencies. • Def : A barrier-free organization has permeable internal & external boundaries • Characteristic o Higher level of trust and shared interests o Shift in philosophy from executive development to organizational development o Greater use of teams o Flexible, porous organizational boundaries o Communication flows & mutually beneficial relationships with both internal and external constituencies • Advantages o Leverages the talents of all employees o Enhances cooperation, coordination, and information sharing among functions, divisions, SBUs, and external constituencies o Enables a quicker response to market changes through single-goal focus. o Can lead to coordinated win-win initiatives with key suppliers. • Disadvantages o Difficult to overcome political and authority boundaries inside and outside the organization o Lacks strong leadership and common vision, which can lead to coordination problems o Time-consuming and difficult-to-manager democratic processes. o Lacks high levels of trust, which can impede performance. 2. MODULAR ORGANIZATION 3. VIRTUAL ORGANIZATION • Def : A modular organization requires seamless relationships with external organizations. • Characteristic o Outsources nonvital functions or non-core activities to outsiders o Activates knowledge & expertise of “best in class” suppliers but retains strategic control o Focuses scarce resources on key areas o Accelerates organizational learning o Decreases overall costs, leverages capital • Advantages o Directs a firm’s managerial and technical talent to the most critical activities. o Maintains full strategic control over most critical activities − core competencies. o Achieves “best in class” performance at each link in the value chain. o Leverages core competencies by outsourcing with smaller capital commitment. o Encourages information sharing and accelerates organizational learning. • Disadvantages o Inhibits common vision through reliance on outsiders. o Diminishes future competitive advantages if critical technologies or other competencies are outsourced. o Increased the difficulty of bringing back into the firm activities that now add value due to market skills. o Leads to an erosion of cross-functional skills. o Decreases operational control and potential loss of control over a supplier. • Def : A virtual organization requires forming alliances with multiple external partners. • Characteristic o Continually evolving network of independent companies o Linked together to share skills, costs, & access to one another’s markets o Coping with uncertainty through cooperative efforts o Each gains from resulting individual & organizational learning o May not be permanent • Advantages o Enables the sharing of costs and skills. o Enhances access to global markets. o Increases market responsiveness. o Creates a “best of everything” organization since each partner brings core competencies to the alliance o Encourages both individual and organizational knowledge sharing and accelerates organizational learning. • Disadvantages o Harder to determine where one company ends and another begins, due to close interdependencies among players. o Leads to potential loss of operational control among partners. o Results in loss of strategic control over emerging technology. o Requires new and difficult-to-acquire managerial skills. CHAPTER 10 CREATING EFFECTIVE ORGANIZATIONAL DESIGNS © NIRMALA (UITM SEGAMAT).

Scene 7 (6m 30s)

STRATEGIC LEADERSHIP • Leadership is the process of transforming organizations from what they are to what the leader would have them become. Successful leaders are: • Proactive – dissatisfied with the status quo • Goal oriented – visualizing successful futures • Focused on the creation & implementation of a creative vision – understanding the process STRATEGIC LEADERSHIP MODEL 1. Setting the direction • Setting a direction requires the ability to scan the environment for knowledge of all of the company’s stakeholder and other salient environmental trends & events. • Managers must integrate this knowledge into a vision of what the organization could become. • Benefit: • A clear future direction • A framework for the firm’s mission & goals • Leading to enhanced employee communication, participation, & commitment. 3. Nurturing a culture • Nurturing an excellent and ethical organizational culture is a key leadership activity, requiring that managers & leaders to accept personal responsibility for developing & strengthening ethical behavior and consistently demonstrate that such behavior is central to the mission & vision of the firm • Leaders play a key role in changing, developing, and sustaining an organization’s culture. • Develop & reinforce ethical behavior via: • Role models • Corporate credos & codes of conduct • Reward & evaluation systems, policies & procedures 2. Designing the organization • Designing the organization requires building mechanisms to implement the leader’s vision and strategies through structures & teams and systems & processes. • Without appropriately structuring organizational activities, a firm would generally be unable to attain an overall low-cost advantage by closely monitoring its costs through detailed and formalized cost and financial control procedure. • Lack of appropriate design could cause problems: • Managers who don’t understand their responsibilities • Reward systems that are not motivating • Inappropriate financial control systems • Insufficient integrating mechanisms ELEMENTS OF EFFECTIVE LEADERSHIP 1. Overcoming Barriers to Change • Leaders must overcome barriers to change. • Organizations are prone to inertia, slow to learn, adapt, & change because of: • Vested interests in the status quo. People tend to be risk-averse and resistance to change. • Systemic barriers. The design of the organization’s structure, information processing, reporting relationship, and so forth impedes the proper flow and evaluation of information. • Behavioral barriers. Manager to look at issues from a biased or limited perspective due to their education, training, work experiences and so forth. • Political barriers. Conflict arising from power relationship which can make outcome of vested interest, refusal to share information and conflict of resources. • Personal time constraints. Not having enough time for strategic thinking and reflection. • Leader must draw on a range of personal skills as well as organizational mechanism to move their organizations forward to face barrier. • Two factor earlier – building a learning organization and building ethical organization provide the kind of climate within leader to make progress towards its goals. • Tools to overcome barrier: - Their personal and organizational power - Must be on guard not to abuse power - Measure exercise of power. 2. Effective Use of Power • Leaders must make effective use of power to influence other people’s behavior and persuade them to do things they otherwise would not do and overcome resistance & opposition Sources of power: 1. Organizational bases of power: Legitimate, reward, coercive, information - Refer to the power that a person wields because of her formal management position. - Legitimate power: organizationally conferred decision-making authority and is exercised by virtue of manager’s position in organization. - Reward power: ability of leader to confer rewards for positive behaviour or outcome. - Coercive power: power of manager exercise over employee using fear of punishment for error. - Information power: manager’s access, control and distribution of information that is not freely available to everyone in the organization. 2. Personal bases of power: Referent, expert - A leader might also be able to influence subordinate because of his/her personality characteristic and behavior. - Referent power: a leader personal attributes or charisma might influence subordinates and make them devoted to that leader. - Expert power: the leader is the expert on whom subordinates depend for information that they need to do their jobs successfully. CREATING AN ETHICAL ORGANIZATION • Ethics deals with right and wrong. Ethical beliefs come from religion, ethnic heritage, family practices, community standards, educational experiences, friends & neighbors. • Organizational ethics promote an operating culture & determine acceptable behavior. • Ethical beliefs come from the values, attitudes, & behavioral patterns of leadership. • Unethical business practices involve the tacit, if not explicit, cooperation of others. ETHICAL ORIENTATION • The ethical orientation of the leader is a key factor in promoting ethical behavior. • Leaders who exhibit high ethical standard become role models for others and raise an organization’s overall level of ethical behavior. • Ethical organization is characterized by conception of ethical value and integrity: o Shape behaviors o Provide a common frame of reference o Act as a unifying force o Have a positive effect on employee commitment & motivation to excel o Can create value & a competitive advantage ETHICAL FRAMEWORK 1. Compliance-based ethics program • Design by corporate counsel • Goal: preventing, detecting & punishing legal violation • Externally motivated 2. Integrity-based ethics program • Focus on managerial responsibility for ethical behaviour • More broad, deeper & demanding • Driven by the individual & organisational APPROCHES TO ETHICS MANAGEMENT Compliance-based ─ Ethos: Conformity with externally imposed standards ─ Objective: Prevent criminal misconduct ─ Leadership: Driven by legal office ─ Methods: Reduced discretion, training, controls, audits, and penalties ─ Behavioral assumption: Individualistic, self-interested actors Integrity-based ─ Ethos: Self-governance according to chosen standards ─ Objective: Enable responsible conduct ─ Leadership: Driving by management, with input from functional staff ─ Methods: Education, leadership, accountability, decision processes, auditing, and penalties ─ Behavioral assumption: Social actors, guided by a combination of self-interest, ideals, values, and social expectations KEY ELEMENT 1. Ethical role models • Must be consistent in their words & deeds • Values & character must become transparent to an organization’s employees • Responsibility for ethical lapses within the organization. Courageous behavior by leaders helps to strengthen an organization’s ethical environment. 2. Corporate credos & codes of conduct • Provide a statement & guidelines for norms, beliefs & decision making • Provide employees with clear understanding of the organization’s position regarding behavior • Provide the basis for employees to refuse to commit unethical acts • Contents of credos & codes of conduct must be known to employees 3. Ethically-based reward & evaluation systems • Reward & evaluation systems can either support or undermine an ethical orientation. • Support by creating an evaluation system that rewards ethical thinking • Actions consistent with words; follows through on commitments; readily admits mistakes • Undermine by rewarding results regardless of how they were achieved • Intense competition encourages falsification of data. 4. Consistently enforced ethical policies & Procedures • Carefully developed policies & procedures can help guide ethical behavior. • By specifying proper relationships with customers & suppliers through global sourcing guidelines to identify conflicts of interest • By encouraging employees to behave ethically through effective communication, enforcement, & monitoring and sound corporate governance practices A LEARNING ORGANIZATION To enhance the firm’s long-term viability, leaders also need to build a learning organization. Organization need to: • Capable of adapting to change • Able to foster creativity • Willing to question basic assumptions, refresh strategies, reengineer work Key element: 1. Inspiring and motivating people with a mission or purpose • Successful learning organizations create a proactive, creative approach to the unknown actively solicit the involvement of employees at all levels enable all employees to use their intelligence and apply their imagination. • Learning environment involves organization-wide commitment to change and an action orientation, applicable tools and methods 2. Empower employees at all levels • A manager’s role becomes one of creating an environment where employees can achieve their potential as they help move the organization towards its goal. • Instead of viewing themselves as flexible resources controller and power broker, leader mist envision themselves as flexible resources willing to assume numerous roles as coaches, information provided and decision maker. 3. Accumulating and sharing internal knowledge • encourages employees to offer ideas, ask questions and express concerns • encourages widespread sharing of information from various sources • identifies opportunities and makes it safe to experiment • encourages collaborative decision making and the sharing best practices • uses technology to facilitate both the gathering and sharing of information 4. Gathering and integrating external information • Firm must recognize opportunities & threats both general and industry-specific • company employees at all levels can use a variety of sources to acquire external information • benchmarking can be a useful means of employing external information • focus directly on customers for information. 5. Challenging the status quo and enabling creativity • Leader trying to bring about change in an organization to create a sense of urgency. • establish ‘culture of dissent’ where dissenters can openly question a superior’s perspective without fear of punishment • Fostering of culture that encourages risk taking o formulize forum for failure o move the goalposts o bring in outsiders o prove yourself wrong, not right EMOTIONAL INTELLIGENCE • Def: the ability to understand emotion of oneself and others. Component of Emotional Intelligent: 1. Self-awareness = It involves people with a deep understanding of their emotions, strengths, weaknesses, and drives. 2. Self-regulation = It is an ability to understand and manage your behaviour and reactions to feelings and things happening around you. 3. Motivation = Our drive to improve and achieve, commitment to our goals, initiative, or readiness to act on opportunities, as well as optimism, and resilience 4. Empathy = The ability to understand and share the feelings of another when making decisions. 5. Social = skillsThe skills needed to handle and influence other people's emotions effectively. Advantages: • Have empathy for others • Be astute judges of people • Be passionate, persistent about pursuing objectives • Create personal connections with people, take time to engage employees individually & in groups • Be altruistic, focused on the firm’s general welfare, highly principled Disadvantages: • Over-identify, confuse empathy with sympathy • Become overly critical • Allow passion to close their minds to other possibilities • Make too many announced visits, creating a culture of fear & micromanagement • Be manipulative, selfish, dishonest, use leadership solely to gain power CHAPTER 11 STRATEGIC LEADERSHIP © NIRMALA (UITM SEGAMAT).

Scene 8 (7m 35s)

MANAGING INNOVATION • Def: Using new knowledge to transform organizational processes to create commercially viable product and services. Innovation requires new knowledge from latest technology, results of experiments, creative insights and competitive information. TYPES OF INNOVATION 1.Product Innovation: new product designs, applies technologies 2.Process Innovation: improve efficiency, materials utilization, shortens cycle time, increases quality 3.Radical Innovation: major departure, result technological change 4.Incremental Innovation: enhance existing practices, small improvements in products & processes 5.Sustaining Innovation: extend sales, enable new products/services sold at higher margins 6.Disruptive Innovation: technologically simpler, less sophisticated, less demanding customer CHALLENGES • Seeds vs Weeds : Company must decide which innovation project bear the most benefit. • Experience vs Initiative : Company decide who will lead the innovation project. Senior manager with experiences but risk averse or midlevel employee who is an innovator but not detailed. • Internal vs External staffing : Innovation project need competent staffs to succeed. • Building capabilities vs Collaborating : Innovation project often require new sets of skills. • Incremental vs Preemptive launch : incremental is less risky, fewer resources, serves as market test. IMPROVING THE PROCESS 1. Scope of innovation - By defining the strategic envelope (scope of firm effort) ensure that their innovation efforts are not wasted on projects that are outside the firm’s domain of interest. - Evaluating results: • How much will the innovation initiative cost? • How likely is it to actually become commercially viable? • How much value will it add; what will it be worth if it works? • What will be learned if it does not pan out? 2. Managing the pace of innovation - How long will it take for an innovation initiative to realistically come to realise? - Incremental innovations: May take six months or two years. May use a milestone approach, goals & deadlines - Radical innovations: May take 10 years or more. May involve open ended experimentation & time consuming mistakes 3. Staffing to capture value from innovation - They need broad sets of skills as well as experience working with team and experience working on successful innovation project - Effective human resource management practices for innovation projects include: • Use experienced players from diverse areas. • Require employees to serve in the new venture group as part of career development. • Transfer experienced people to mainstream management, revitalizing core businesses. • Separate individual performance from innovation performance so failure is not a stigma. 4. Collaborating with innovation partners - Innovation partner provide skills and insight that are needed to make innovation project succeed. - Research universities & the government provide new skills & insights. • Capabilities include market & technology expertise, social capital contacts. • Issues include how to share rewards & intellectual property. - The value of unsuccessful innovation • Even unsuccessful innovation efforts bear fruit. • Value is in learning & experience gained from failure. • Don’t overcommit or despair; pivot quickly & transfer knowledge; rethink the details; engage in continuous incremental innovation. CORPORATE ENTREPRENEURSHIP • Def: Using the fruits of innovation process to help firm build new sources of competitive advantages and renew value proposition. How to pursue entrepreneurial projects? a.Consider corporate culture & leadership. b.Consider supportive structures & systems. c.Consider using teams. d.Consider whether the company is product or service oriented; high-tech or low-tech. e.Is innovation aimed at product or process improvements? Step in effective leverage technology 1.Redefine the technology or competency in general terms 2.Identify new applications of the technology 3.Select the most promising application 4.Choose the best entry mode FOCUSED APPROACH - Create an autonomous corporate venturing workgroup separated from the rest of the firm. - Free up entrepreneurial team members from constraints imposed by existing norms & routines; facilitate open-minded creativity. - Group from the corporate mainstream: • New Venture Groups : semi-autonomous units with informal structure, gather resources, launch venture • Business Incubators : operate independently, provide fund, space, business services, monitoring, networking DISPERSED APPROACH - Entrepreneurship is spread throughout the firm. - Ability to change is a core capability. Stakeholders can bring new opportunities to anyone in the organization. - Related aspect: • Entrepreneurial Culture : corporate culture in which change and renew are constant focus • Resource Allotments : involve firm’s investment in generation & execution of innovative ideas. Time investment and monetary investment • Product Champions : bring entrepreneurial ideas forward, identify what kind market exists. - Must pass two critical stages; - Project definition (justify opportunity) - Project impectus (support development) MEASURING THE SUCCESS 1.Comparing strategic and financial goal 2.Exit champion – an individual working in a organization who is willing to question the viability of a venture project by demanding hard evidence of venture success and challenging the belief system that carry forward the venture. • Exit champions help avoid costly defeats by: o Questioning the viability of a venture project o Reducing ambiguity by gathering hard data o Developing a strong case for why a project should be killed o Reasserting decision-making criteria to guide venture decisions o Risking loss of status while opposing popular projects o Saving a corporation’s finances & reputation ENTREPRENEURIAL ORIENTATION • Def: Strategy making practices used to identify & launch new ventures Dimension Of Entrepreneurial Orientation 1.Autonomy - willingness to act independently in order to carry forward an entrepreneurial vision or opportunity. PROBLEM RELATED: duplication of effort and wasting or resources. 2.Innovativeness - firm’s effort to find new opportunities & solutions. PROBLEM RELATED: Competitors may copy it more profitably and The investment may not pay off. 3.Proactiveness - firm’s efforts to seize new opportunities. PROBLEM RELATED: First movers are not always successful AND Customers may be reluctant to commit to a new way of doing things. 4.Competitive Aggressiveness - firm’s efforts to outperform its industry rivals. PROBLEM RELATED: Being overly aggressive & damaging a firm’s reputation and Trying to decimate rather than just defeat the competition 5.Risk Taking - firm’s willingness to act boldly without knowing the consequences. PROBLEM RELATED: Lack of forethought, research, & planning and Failure to evaluate uncertainty. TOOLS: REAL OPTION ANALYSIS • Real options analysis is an investment tool. • It helps manage the uncertainty associated with launching new ventures. • ROA helps the firm make decisions: • Invest additional funds to accelerate the activity? • Delay further investment in order to learn more? • Shrink the scale of the activity? • Abandon the activity? • Requires a series of decisions. • Idea must prove itself at each stage of development. LIMITATION • Agency theory and the back-solver dilemma – Managers scheme to have a project meet investment approval criteria • Managerial conceit: overconfidence and the illusion of control – Blind spots leading to poor managerial decisions • Managers’ irrational escalation of commitment – Managers continue existing project even if it should be ended CHAPTER 12 MANAGING INNOVATION AND FOSTERING CORPORATE ENTREPRENEURSHIP © NIRMALA (UITM SEGAMAT).