Scene 1 (0s)

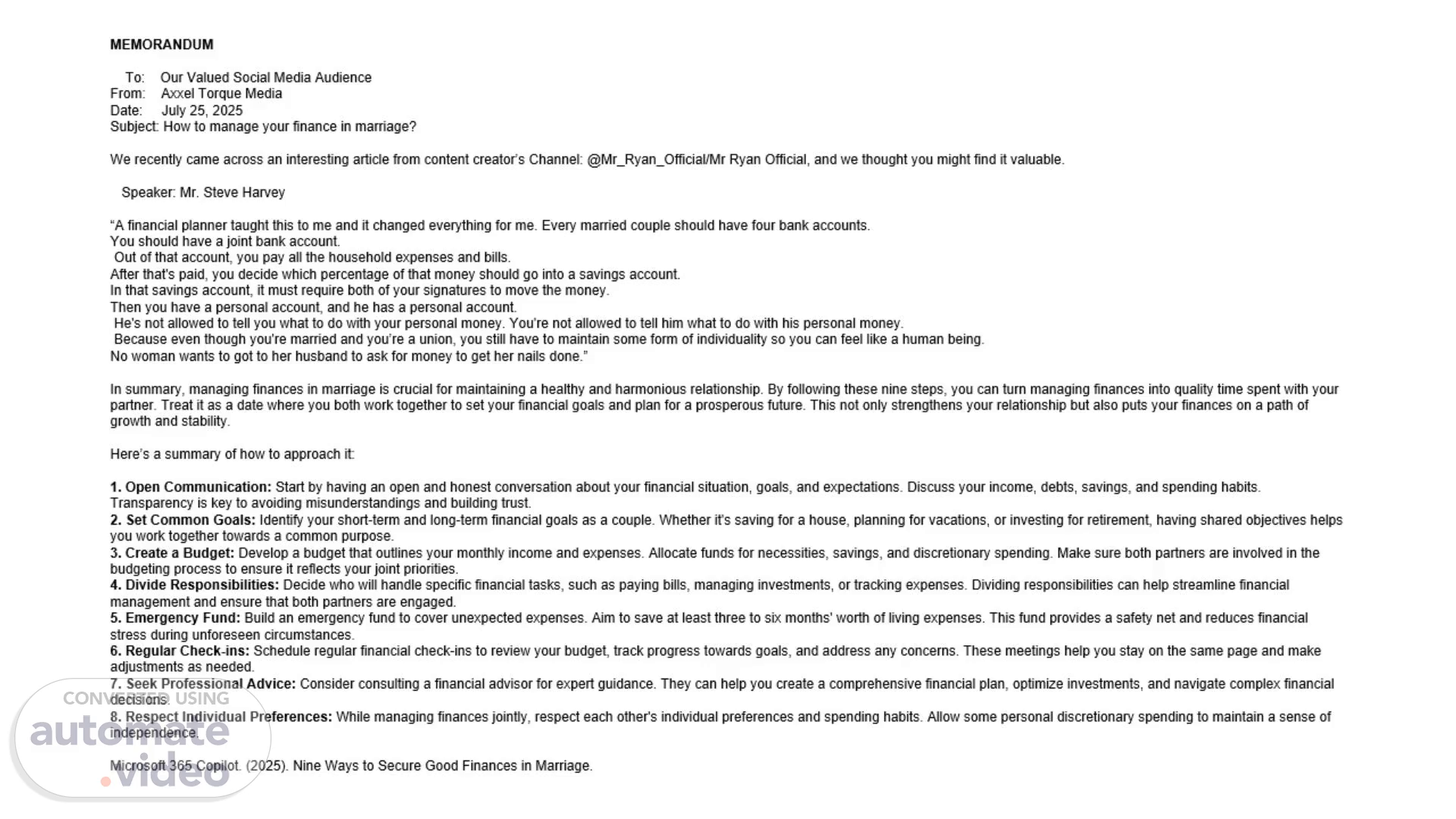

[Audio] MEMORANDUM To: Our Valued Social Media Audience From: Axxel Torque Media Date: July 25, 2025 Subject: How to manage your finance in marriage? We recently came across an interesting article from content creator's Channel: @Mr_Ryan_Official/Mr Ryan Official, and we thought you might find it valuable. Speaker: Mr. Steve Harvey "A financial planner taught this to me and it changed everything for me. Every married couple should have four bank accounts. You should have a joint bank account. Out of that account, you pay all the household expenses and bills. After that's paid, you decide which percentage of that money should go into a savings account. In that savings account, it must require both of your signatures to move the money. Then you have a personal account, and he has a personal account. He's not allowed to tell you what to do with your personal money. You're not allowed to tell him what to do with his personal money. Because even though you're married and you're a union, you still have to maintain some form of individuality so you can feel like a human being. No woman wants to got to her husband to ask for money to get her nails done." In summary, managing finances in marriage is crucial for maintaining a healthy and harmonious relationship. By following these nine steps, you can turn managing finances into quality time spent with your partner. Treat it as a date where you both work together to set your financial goals and plan for a prosperous future. This not only strengthens your relationship but also puts your finances on a path of growth and stability. Here's a summary of how to approach it: 1. Open Communication: Start by having an open and honest conversation about your financial situation, goals, and expectations. Discuss your income, debts, savings, and spending habits. Transparency is key to avoiding misunderstandings and building trust. 2. Set Common Goals: Identify your short-term and long-term financial goals as a couple. Whether it's saving for a house, planning for vacations, or investing for retirement, having shared objectives helps you work together towards a common purpose. 3. Create a Budget: Develop a budget that outlines your monthly income and expenses. Allocate funds for necessities, savings, and discretionary spending. Make sure both partners are involved in the budgeting process to ensure it reflects your joint priorities. 4. Divide Responsibilities: Decide who will handle specific financial tasks, such as paying bills, managing investments, or tracking expenses. Dividing responsibilities can help streamline financial management and ensure that both partners are engaged. 5. Emergency Fund: Build an emergency fund to cover unexpected expenses. Aim to save at least three to six months' worth of living expenses. This fund provides a safety net and reduces financial stress during unforeseen circumstances. 6. Regular Check-ins: Schedule regular financial check-ins to review your budget, track progress towards goals, and address any concerns. These meetings help you stay on the same page and make adjustments as needed. 7. Seek Professional Advice: Consider consulting a financial advisor for expert guidance. They can help you create a comprehensive financial plan, optimize investments, and navigate complex financial decisions. 8. Respect Individual Preferences: While managing finances jointly, respect each other's individual preferences and spending habits. Allow some personal discretionary spending to maintain a sense of independence. Microsoft 365 Copilot. (2025). Nine Ways to Secure Good Finances in Marriage..