Scene 1 (0s)

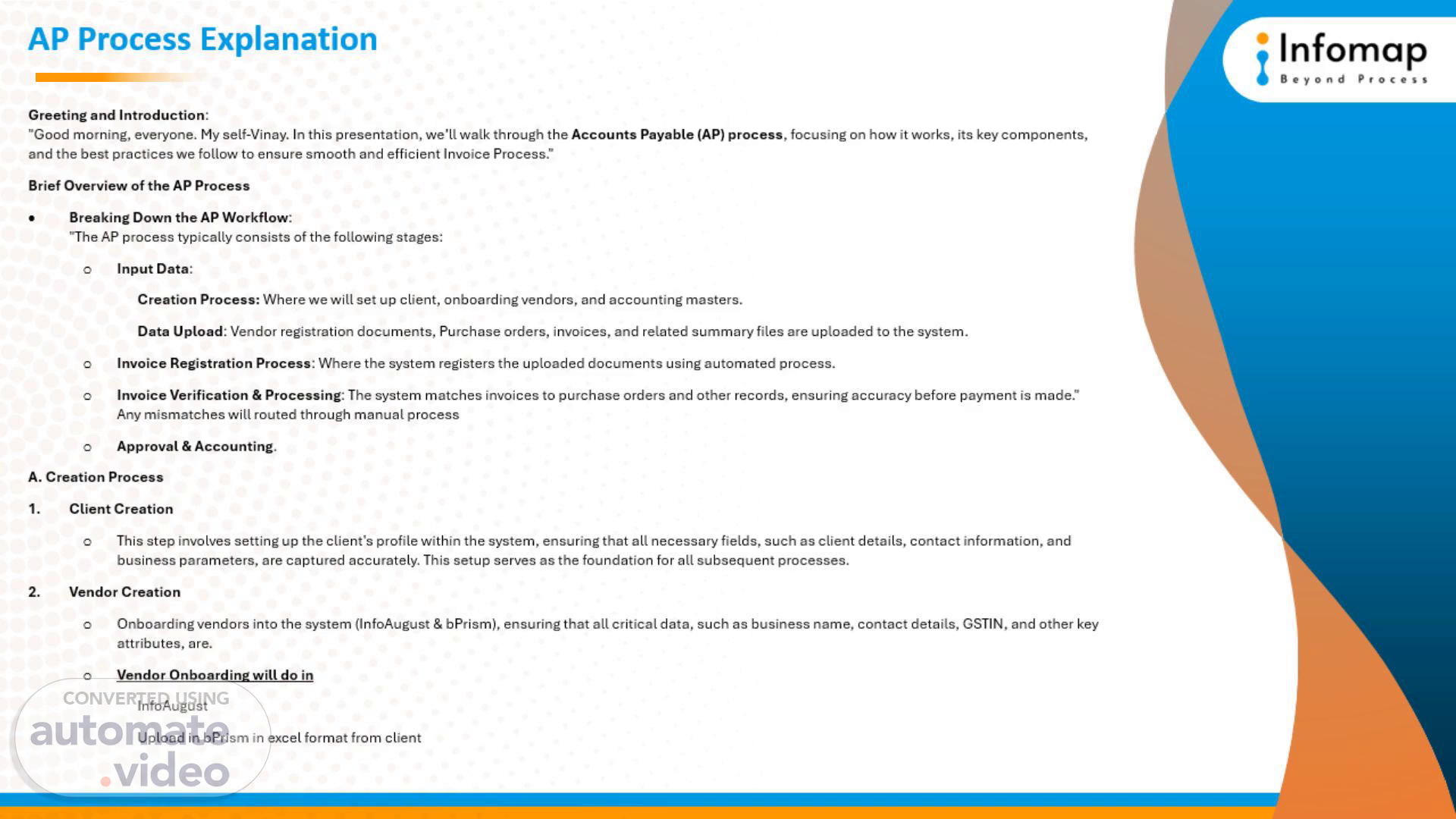

[Audio] The Accounts Payable process commences with the establishment of client profiles, wherein we configure the client's particulars, encompassing client information, contact details, and commercial parameters. This foundational setup is vital for all ensuing procedures. Subsequently, we onboard vendors into the system, capturing pivotal data such as business name, contact details, Goods and Services Tax Identification Number (GSTIN), and other salient attributes. This data serves to guarantee precise accounting, tax reporting, and financial processing..

Scene 2 (58s)

[Audio] Internal users from within the Infomap will create user profiles to manage and oversee the processes. These internal users will have specific roles and responsibilities. External users, including client stakeholders, will also have access to certain features for data submission or verification. Secure access control is ensured through user creation, allowing relevant personnel to perform specific tasks according to their role. Master data setup, including chart of accounts, cost centers, and tax codes, is critical for accurate accounting, tax reporting, and financial processing. Purchase orders are uploaded via PDF and Excel files, with automated readability extracting information from these files. Individual documents can be uploaded separately, while bulk uploads allow for the simultaneous upload of multiple documents. Clients can also upload documents directly through their login on infoAugust, or share files via a dedicated email address and store them in a shared folder for easy retrieval..

Scene 3 (2m 2s)

[Audio] Invoices are uploaded to the system through various channels. Vendors with infoAugust access can directly upload invoices through their login, while those without access can submit them to clients or generic email IDs or hard copies. All invoices are uploaded to bPrism. Clients can also upload invoices through share folders or email. Furthermore, GSTR 2A summaries are uploaded to bPrism for further processing and reconciliation. During processing, GR/SR summaries are matched against invoices..

Scene 4 (2m 58s)

[Audio] The system generates a unique document number (UDN) for each uploaded invoice during the invoice registration process, serving as a reference throughout the process to ensure traceability and prevent duplication. After uploading necessary documents, the system initiates an automated BOT process that uses a predefined checklist to extract data consistently and accurately. The checklist verifies document readability, client GSTIN, vendor GSTIN, GSTR 2A summary, and PO. If all checks pass, the invoice is automatically registered; otherwise, it is routed for manual review. In case of failed documents, manual correction may be required, involving manual entry, checking SAP for vendor information, or confirmation with clients before registering or discarding the documents. The outcome is the automatic registration of invoices in the system, ensuring efficient processing..