Dokument dotyczący opłat - Konto24 walutowe 1.07.2022_eng

Scene 1 (0s)

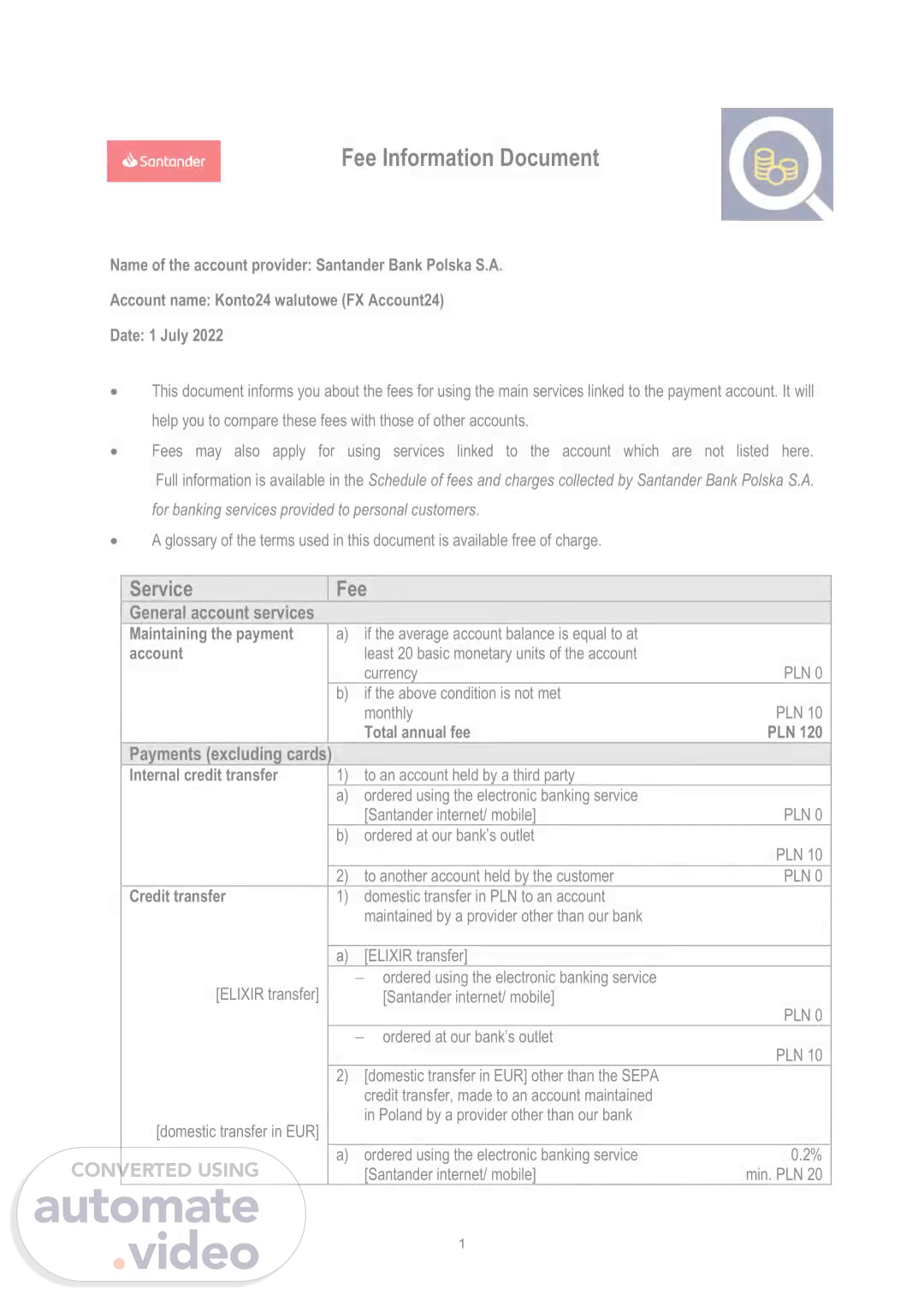

[Audio] 1 Fee Information Document Name of the account provider: Santander Bank Polska S.A. Account name: Konto24 walutowe (FX Account24) Date: 1 July 2022 This document informs you about the fees for using the main services linked to the payment account. It will help you to compare these fees with those of other accounts. Fees may also apply for using services linked to the account which are not listed here. Full information is available in the Schedule of fees and charges collected by Santander Bank Polska S.A. for banking services provided to personal customers. A glossary of the terms used in this document is available free of charge. Service Fee General account services Maintaining the payment account a) if the average account balance is equal to at least 20 basic monetary units of the account currency PLN 0 b) if the above condition is not met monthly Total annual fee PLN 10 PLN 120 Payments (excluding cards) Internal credit transfer 1) to an account held by a third party a) ordered using the electronic banking service [Santander internet/ mobile] PLN 0 b) ordered at our bank's outlet PLN 10 2) to another account held by the customer PLN 0 Credit transfer [ELIXIR transfer] [domestic transfer in EUR] 1) domestic transfer in PLN to an account maintained by a provider other than our bank a) [ELIXIR transfer] ordered using the electronic banking service [Santander internet/ mobile] PLN 0 ordered at our bank's outlet PLN 10 2) [domestic transfer in EUR] other than the SEPA credit transfer, made to an account maintained in Poland by a provider other than our bank a) ordered using the electronic banking service [Santander internet/ mobile] 0.2% min. PLN 20.

Scene 2 (2m 52s)

[Audio] 2 max. PLN 200 b) ordered at our bank's branch 0.25% min. PLN 28.50 max. PLN 200 c) additional fees for a payment order for express transfer (available for transfers in EUR, USD, GBP and PLN) i. ordered using the electronic banking service [Santander internet/ mobile] 0.2% min. PLN 9.50 max. PLN 180 ii. ordered at our bank's branch 0.3% min. PLN 20 max. PLN 180 OUR cost option PLN 40 [international transfer] 3) [international transfer] other than the SEPA credit transfer, made to an account maintained outside of Poland (excluding EUR payment orders sent to European Economic Area member states other than Poland) a) ordered using the electronic banking service [Santander internet/ mobile] 0.2% min. PLN 20 max. PLN 200 b) ordered at our bank's branch 0.25% min. PLN 28.50 max. PLN 200 c) additional fees for a payment order for fast-track transfer (available for transfers in EUR to accounts maintained outside of the European Economic Area and for transfers in USD, GBP and PLN) ordered at our bank's branch or using the electronic banking service [Santander internet/ mobile] 0.1% min. PLN 4.75 max. PLN 90 for express transfer (available for transfers in EUR, USD, GBP and PLN) i. ordered using the electronic banking service [Santander internet] 0.2% min. PLN 9.50 max. PLN 180 ii. ordered at our bank's branch 0.3% min. PLN 20 max. PLN 180 OUR cost option PLN 40 4) [international transfer] other than the SEPA credit transfer, made as a standard or express transfer to European Economic Area member states other than Poland a) ordered using the electronic banking service [Santander internet/ mobile] PLN 0 b) ordered at our bank's outlet PLN 10.

Scene 3 (6m 19s)

[Audio] 3 SEPA credit transfer 1) SEPA credit transfer (except for EUR payment orders sent to European Economic Area member states other than Poland) a) ordered using the electronic banking service [Santander internet/ mobile] PLN 8 b) ordered at our bank's branch 0.25% min. PLN 28.50 max. PLN 200 2) SEPA credit transfer sent to a European Economic Area member state other than Poland a) ordered using the electronic banking service [Santander internet/ mobile] PLN 0 b) ordered at our bank's outlet PLN 10 FX credit transfer 1) ordered using the electronic banking service [Santander internet/ mobile] 0.2% min. PLN 20 max. PLN 200 2) ordered at our bank's branch 0.25% min. PLN 28.50 max. PLN 200 3) additional fees for a payment order a) for fast-track transfer (available for transfers in EUR to accounts maintained outside of the European Economic Area and for transfers in USD, GBP and PLN) ordered using the electronic banking service [Santander internet/ mobile] or at our bank's branch 0.1% min. PLN 4.75 max. PLN 90 b) for express transfer (available for transfers in EUR, USD, GBP and PLN) ordered using the electronic banking service [Santander internet/ mobile] 0.2% min. PLN 9.50 max. PLN 180 ordered at our bank's branch 0.3% min. PLN 20 max. PLN 180 c) OUR cost option PLN 40 Direct debit PLN 0 Standing order to an account in our bank PLN 0 Cards and cash Cash withdrawal 1) made using the FX MasterCard card in EUR/ GBP/ USD a) from our bank's ATMs EUR/ GBP/ USD 0.25 b) from any other ATMs and terminals in and outside of Poland (except for cross-border payment transactions made with a debit card used for cash payments) EUR/ GBP/ USD 2.50 2) made at our bank's outlet PLN 0 Cash deposit made at our bank's outlet PLN 0 Issuing a payment card renewing the FX MasterCard card in EUR/ GBP/ USD every two years Total annual fee EUR/ GBP/ USD 3 −.

Scene 4 (10m 22s)

[Audio] 4 Handling a debit card FX MasterCard card in EUR/ GBP/ USD a) card fee monthly Total annual fee EUR/ GBP/ USD 0.8 EUR/ GBP/ USD 9.6 b) generating a new PIN provided on paper at our bank's outlet (at the cardholder's request) EUR/ GBP/ USD 2 c) converting a transaction made in a currency other than the account currency (the fee is based on the amount of the transaction after its conversion into the account currency) 2.8% Cross-border payment transaction made with a debit card used for noncash payments 1) all transactions other than quasi-cash transactions PLN 0 2) quasi-cash transactions 4% min. EUR/ GBP/ USD 2.50 Cross-border payment transaction made with a debit card used for cash payments made using the FX MasterCard card in EUR/ GBP/ USD EUR/ GBP/ USD 2.50 Handling a credit card the service is not available Overdrafts and related services Overdraft the service is not available Other services Issuing a payment account certificate PLN 50 Preparing a list of payment transactions [account history] 1) for transactions made with the FX MasterCard card in EUR/ GBP/ USD monthly Total annual fee EUR/ GBP/ USD 2 EUR/ GBP/ USD 24 2) [account history] a) for customers with access to the electronic banking service [Santander internet/ mobile] PLN 10 b) for customers who do not use the electronic banking service [Santander internet/ mobile], if the history covers only the previous calendar month PLN 0 c) for customers without access to the electronic banking service [Santander internet/ mobile], if the history covers any month other than the previous calendar month PLN 10 Text message notification [Alerty24] [Alerty24] a) sending a text message notification with an alert within the MINI package PLN 0.30 b) use of the MAXI package (monthly fee) PLN 9 Phone banking service PLN 0 Electronic banking service PLN 0.