Scene 1 (0s)

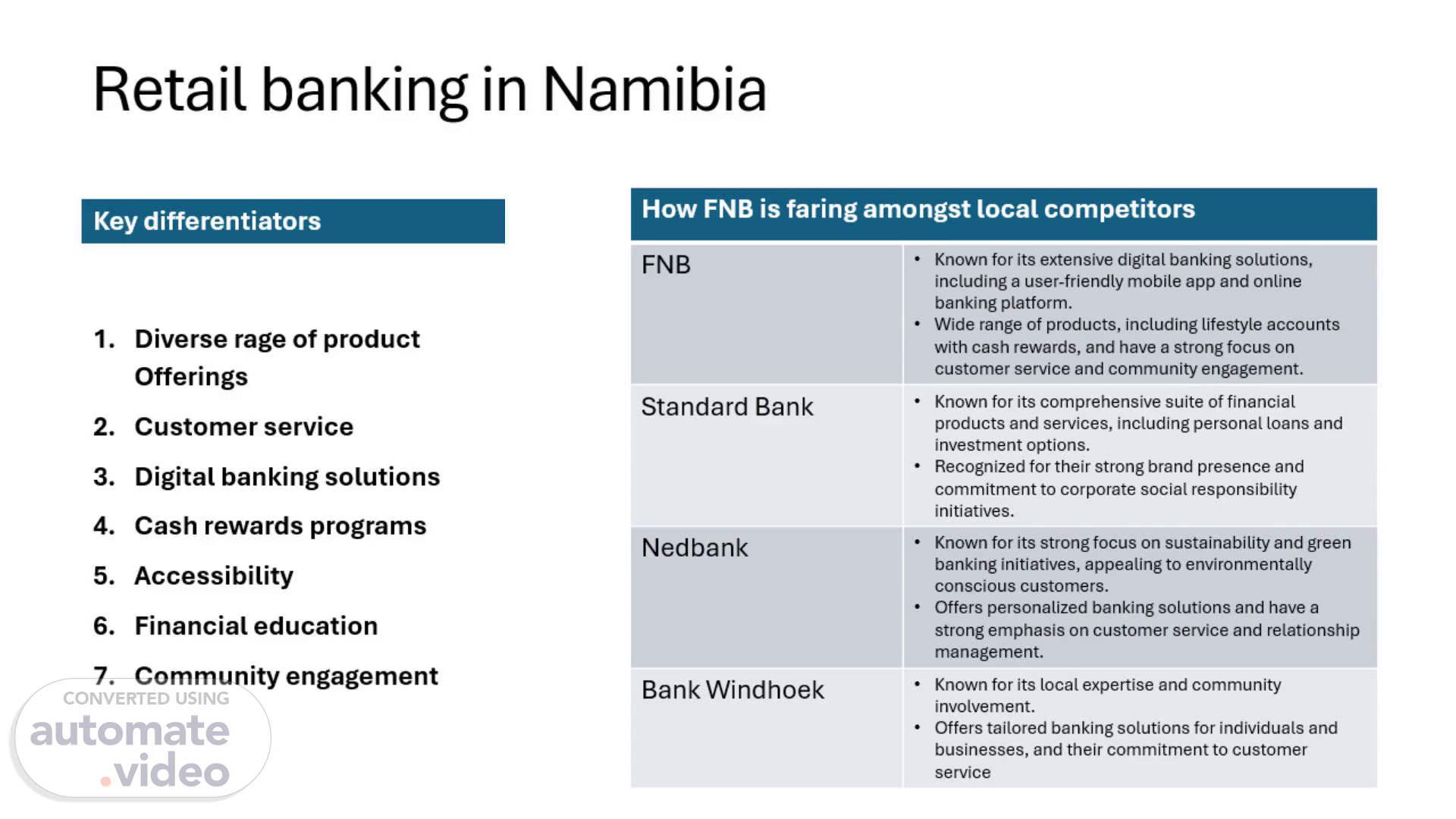

[Audio] "Good morning students, today our topic of discussion will be retail banking in Namibia. As shown on this slide, each bank in Namibia offers a variety of products, with unique strengths to offer. However, FNB is the standout among its local competitors for several reasons. Firstly, FNB is renowned for its advanced digital banking solutions, including a user-friendly mobile app and online platform. This enables our customers to bank conveniently and effortlessly, making it the preferred choice in this digital era. Additionally, FNB provides a wide range of products, including lifestyle accounts with cash rewards. This serves as a great incentive for our customers and reflects our dedication to providing a complete banking experience. Moreover, our strong emphasis on exceptional customer service ensures that every client feels valued and well taken care of. In addition, we actively engage with the community through various initiatives, as we believe in giving back and making a positive impact in the lives of those around us. This sets us apart from our competitors and highlights our genuine commitment to the well-being of society. Moving on, let us now examine how FNB stands against our local competitors in the table. As mentioned earlier, our digital banking solutions, diverse product offerings, strong focus on customer service and community engagement have positioned us as the leading bank in the industry. However, our competitors also have their own strengths. Standard Bank is recognized for its comprehensive range of financial products and services, while Nedbank is known for its strong brand presence and dedication to corporate social responsibility initiatives. On the other hand, Bank Windhoek stands out with its local expertise and active community involvement. Ultimately, what truly sets us apart from our competitors are our key differentiators. Our advanced digital banking solutions, diverse range of products, strong emphasis on customer service, and community engagement make FNB the top choice for retail banking in Namibia. Thank you for your attention, and let us now move on to the next slide to further explore our other key differentiators and how they make us stand out from the competition..

Scene 2 (2m 29s)

[Audio] FNB is a leading player in the business banking sector in Namibia, offering a robust digital banking platform and a variety of financing options for businesses. They also provide dedicated relationship managers for personalized support. When compared to other local competitors, FNB stands out for its digital solutions, wide range of products, and strong focus on customer service and community engagement. However, it is important to note that each bank has its own strengths in different areas, such as financial offerings, sustainability, and community involvement. This information has hopefully provided a better understanding of the business banking landscape in Namibia..

Scene 3 (3m 13s)

[Audio] As we continue to explore the landscape of banking in Namibia, it is important to note that FNB stands out among its local competitors for a variety of reasons. FNB offers an extensive range of digital banking solutions, making it easy and convenient for clients to manage their finances. This includes a wide range of products, ensuring that FNB can meet the diverse needs of its customers. In addition to this, FNB places a strong focus on customer service and community engagement. This sets them apart from other banks and shows their commitment to making a positive impact on the communities they serve. Moving on to the other banks in the market, each one brings its own unique strengths. Standard Bank is known for its wide range of corporate and investment banking services, providing valuable insights and support to clients through their extensive network and deep understanding of various sectors. Nedbank is recognized for its strong focus on sustainable finance and corporate responsibility, which is particularly appealing to clients who prioritize environmental, social, and governance considerations. They also offer personalized service and industry-specific expertise. Bank Windhoek is known for their strong emphasis on local knowledge and community involvement, allowing them to provide tailored services to corporate clients and further showcasing their commitment to the Namibian market. FNB is faring well amongst local competitors, with their sector expertise, comprehensive financial solutions, strong relationships, local market knowledge, access to capital markets, and innovative financing and risk management services. Let's take a look at this table for a quick comparison of how FNB stands out among its competitors: Bank | Known for --- | --- FNB/RMB | Strong origination franchise, comprehensive product offerings, focus on innovation and tailored solutions Standard Bank | Wide range of corporate and investment banking services, extensive network and expertise in various sectors Nedbank | Strong focus on sustainable finance and corporate responsibility, personalized service and industry-specific expertise Bank Windhoek | Strong emphasis on local knowledge and community involvement, providing tailored services to corporate clients and showcasing commitment to the Namibian market..

Scene 4 (5m 50s)

[Audio] In this class, we will be discussing the competitive landscape of insurance in Namibia. Our focus will be on the insurance industry, as we have already learned about the strengths and unique offerings of local banks in our previous discussions. We all know that FNB stands out among its local competitors for its extensive digital banking solutions, wide range of products, strong focus on customer service, and community engagement. However, other banks also have their own strengths in areas such as financial offerings, sustainability, and community involvement. So what sets FNB apart in the insurance sector? Let's take a closer look. Firstly, FNB offers a wide variety of insurance products tailored to fit the specific needs of their customers. They also prioritize customer service and support, and have efficient digital platforms for easy access and management of insurance policies. As a local bank, FNB also has the advantage of local expertise and a deep understanding of the community's needs. Now, let's take a look at how FNB is faring among its local competitors in Namibia. As shown in the table, FNB may be fairly new to the insurance industry but is known for its efficiency in claim processing. On the other hand, Sanlam and Santam Namibia are well-known for their wide array of insurance products, including life, health, and property insurance. They are also recognized for their innovative solutions and strong focus on providing customer-centric services. Moving on, we have Trusted Brands in Namibia, Hollard Namibia (Short Term and Life). They are known for their flexible insurance products and customer-focused approach, offering a diverse range of short-term insurance solutions. They are also a well-known brand in Namibia and their life business is consistently growing. Old Mutual Namibia (Short Term and Life) is another well-known insurance provider in the country, offering a comprehensive range of insurance products, including life, health, and general insurance. They have a strong brand reputation, an extensive distribution network, and are committed to providing financial education and exceptional customer service, particularly for their life business. Lastly, KingPrice has a strong brand presence throughout Namibia and a strong focus on marketing. They offer a wide range of short-term insurance products. And finally, we have Capricorn Group, known for its integrated approach to insurance..