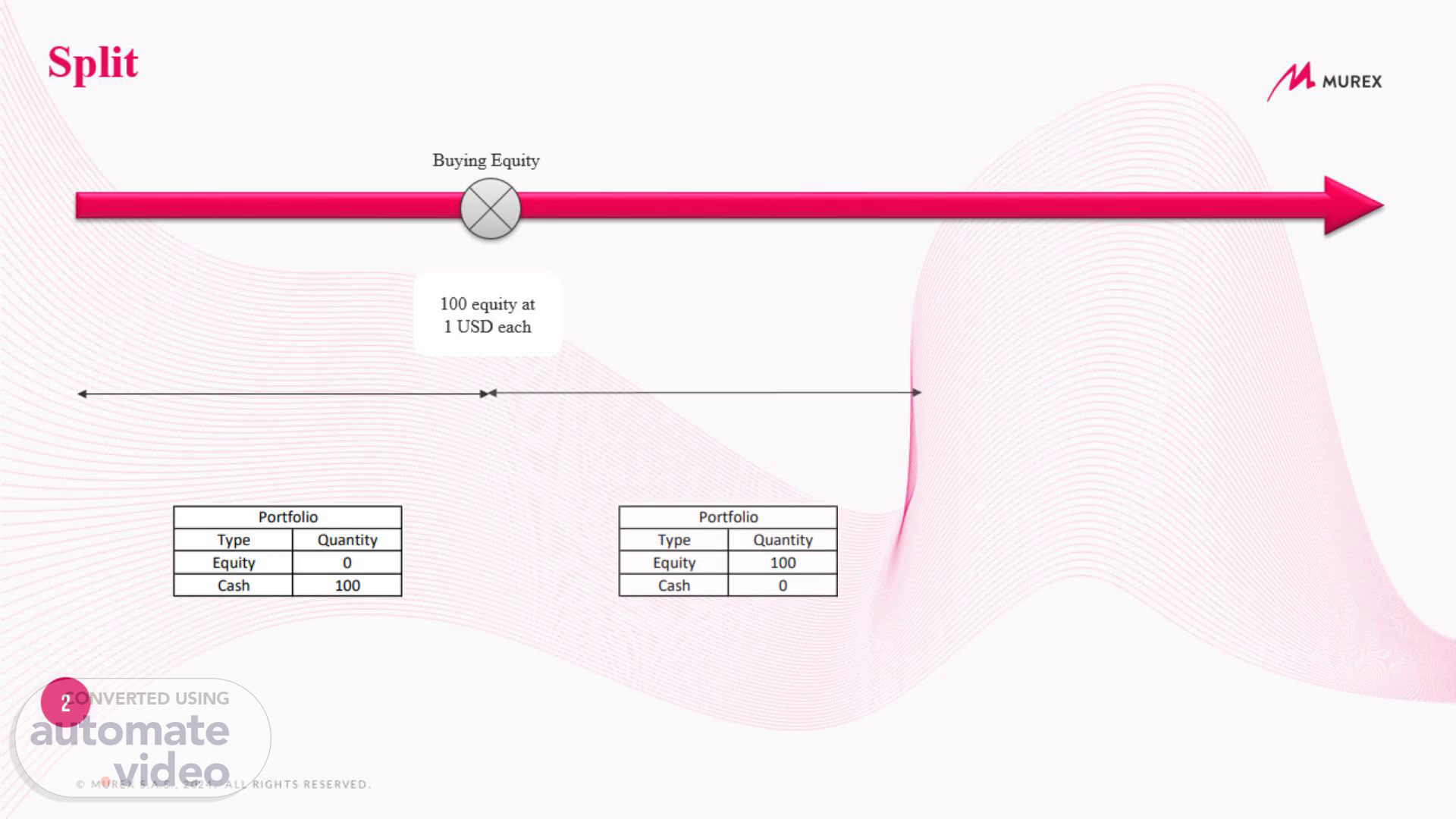

Page 1 (0s)

[Audio] Let's walk through an example of how a portfolio is affected by a split corporate action. Imagine a portfolio initially holds 100 USD in cash. The investor then purchases 100 equities at 1 USD each, so now the portfolio holds 100 equities and 0 USD in cash. Next, the issuer announces a split as a mandatory corporate action. This means that for every share held, the shareholder will now own 2 shares The portfolio now holds 200 equities..

Page 2 (38s)

[Audio] Again, with the same example. The investor purchases 100 equities at 1 USD each, And now the portfolio holds 100 equities and 0 USD in cash. The issuer announces a reverse split as a mandatory corporate action. This means that for every 2 shares held, the shareholder will now own 1 share The portfolio now holds 50 equities..

Page 3 (1m 6s)

[Audio] In the case of the cash dividend corporate action The investor purchases 100 equities at 1 USD each, And now the portfolio holds 100 equities and 0 USD in cash. The issuer announces a cash dividend as a mandatory corporate action. This means that for every share held, the shareholder will receive 0.2 USD The portfolio now holds 100 equities and 20 USD..

Page 4 (1m 36s)

[Audio] For the stock dividend corporate action The investor purchases 100 equities at 1 USD each, The portfolio now holds 100 equities and 0 USD in cash. The issuer announces a stock dividend as a mandatory corporate action. This means that for every share held, the shareholder will receive 0.1 additional share The portfolio now holds 110 equities..

Page 5 (2m 5s)

[Audio] Considering the option dividend corporate action The investor purchases 100 equities at 1 USD each, The portfolio now holds 100 equities and 0 USD in cash. The issuer announces an option dividend as a mandatory with choice corporate action. This means that for every share held, the shareholder will receive 0.1 additional share or 0.2 USD The shareholder chooses to split his holdings, 60% of the dividend is received in equity and 40% is received in cash. The portfolio now holds 106 equities and 8 USD..

Page 6 (2m 46s)

[Audio] The dividend reinvestment plan is an agreement between the issuer and the shareholder, it's a voluntary corporate action. After the investor buys 100 share at 1 USD each The portfolio holds 100 share and 0 USD If the investor agreed to a DRIP stating that every dividend received is to be reinvested by acquiring equity at 90% of its listed market price and the issuer distributes a cash dividend of 0.2 USD/share The shareholders does not receive the dividend, instead he receives an additional 20.2 shares. It is equivalent to receiving the cash dividend and then using it to buy back additional shares, but without paying broker fees and buying the additional shares at a discount price. Afterwards, the issuer distributes a stock dividend of 0.1 share/share Instead of receiving 12 shares, the shareholder receives 13.3 shares. It is equivalent to selling the received shares at their market price and then buying them back at a discounted price and without additional fees..

Page 7 (3m 55s)

[Audio] Taking the same example, The investor buys 100 shares at 1 USD each The portfolio now holds 100 equities and 0 USD Next, the issuer announces a scrip distribution, every two shares held, the shareholder will receive 1 scrip warrant—a financial instrument. The portfolio now owns 100 equities and 50 scrip warrants. After some time, the issuer executes a scrip dividend, for every scrip warrant held, the shareholder can choose either 2 USD in cash or 1 additional equity. In this case, the investor decides to split the reward: The investor takes half in cash: 25 warrants x 2 USD = 50 USD. The other half is taken in additional equities: 25 warrants x 1 equity = 25 more equities. After the scrip dividend is processed, the portfolio now owns 125 equities and 50 USD in cash. It's also important to note that warrants can be bought or sold between the scrip distribution and the scrip dividend. However, only the holder of the scrip warrants on the scrip dividend date is eligible to receive the payout, whether in cash or additional equities..