Scene 1 (0s)

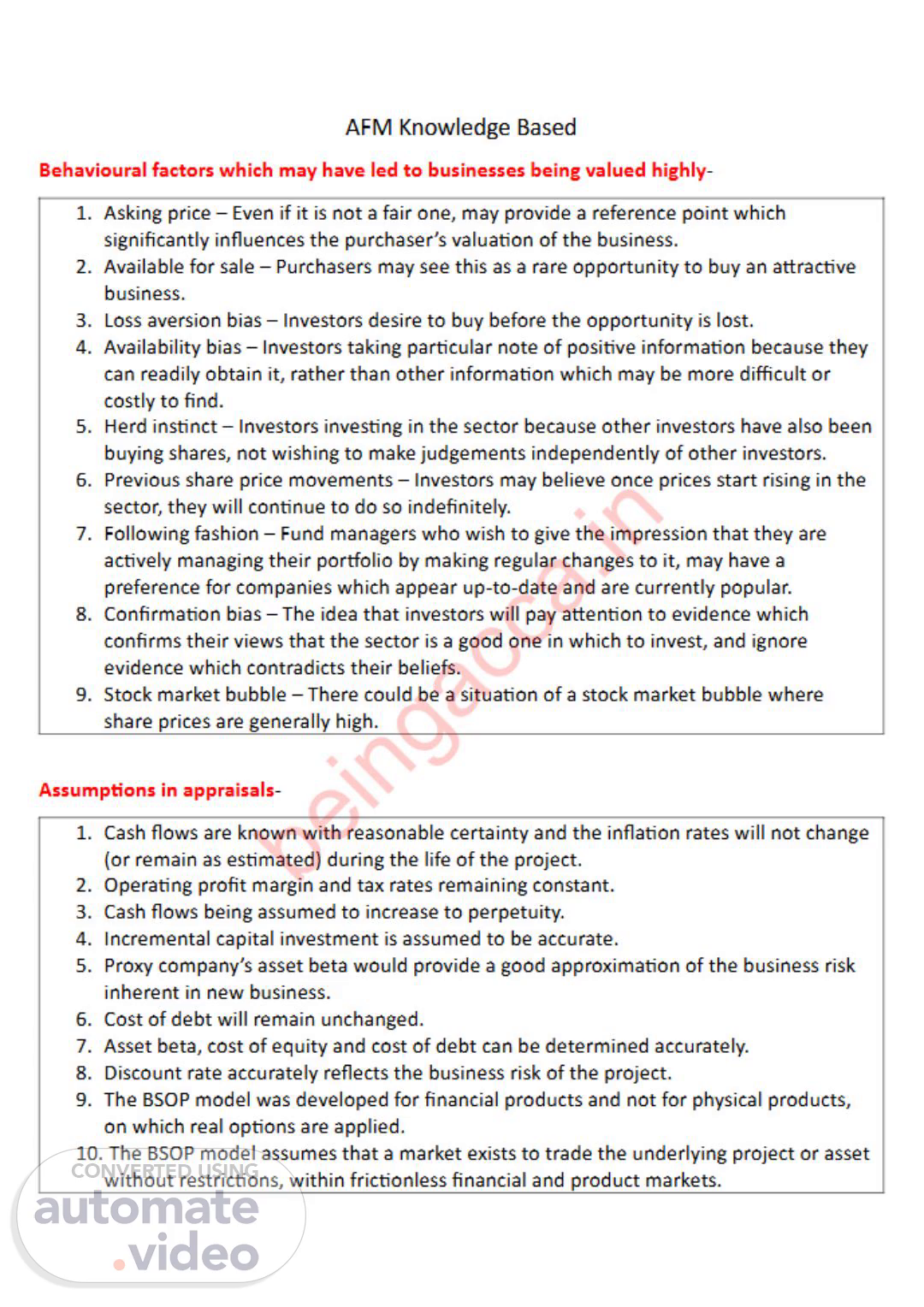

AFM Knowledge Based Behavioural factors which may have led to businesses being valued highly- 1. Asking price —Even if it is not a fair one, may provide a reference point which significantly influences the purchaser's valuation Of the business. 2. Available for sale — Purchasers may see this as a rare opportunity to buy an attractive business. 3. Loss aversion bias — Investors desire to buy before the opportunity is lost. 4. Availability bias — Investors taking particular note Of positive information because they can readily obtain it, rather than other information which may be more difficult or costly to find. 5. Herd instinct — Investors investing in the sector because other investors have also been buying shares, not wishing to make judgements independently Of other investors. 6. Previous share price movements — Investors may believe once prices start rising in the sector, they will continue to do so indefinitely. 7. Following fashion — Fund managers who wish to give the impression that they are actively managing their portfolio by making regular changes to it, may have a preference for companies which appear up-to-date and are currently popular. 8. Confirmation bias —The idea that investors will pay attention to evidence which confirms their views that the sector is a good one in which to invest, and ignore evidence which contradicts their beliefs. 9. Stock market bubble — There could be a situation of a stock market bubble where share prices are generally high. Assumptions in appraisals- Cash flows are known with reasonable certainty and the inflation rates will not change I. (or remain as estimated) during the life of the project. Operating profit margin and tax rates remaining constant. 2. Cash flows being assumed to increase to perpetuity. 3. Incremental capital investment is assumed to be accurate. 4. Proxy company's asset beta would provide a good approximation Of the business risk 5. inherent in new business. Cost Of debt will remain unchanged. 6. Asset beta, cost of equity and cost of debt can be determined accurately. 7. Discount rate accu rately reflects the business risk of the project. 8. The BSOP model was developed for financial products and not for physical products, 9. on which real options are applied. 10. The BSOP model assumes that a market exists to trade the underlying project or asset without restrictions, within frictionless financial and product markets..

Scene 2 (1m 5s)

11. The BSOP model assumes that the real option is a European-style option which can only be exercised on the date when the option expires. In some cases, it may make more strategic sense to exercise an opton earlier. The real option is more representative of an American-style option which can be exercised before expiry. Therefore, the BSOP model may underestimate the true value of an option. 12. Real options models assume that any contractual obligations involving future commitments made between parties will be binding, and will be fulfilled. 13. The BSOP model assumes that once determined the variables will not change but in reality they may do. 14. The BSOP model does not take account of behavioural anomalies which may be displayed by managers when making decisions. 15. The company should assess the accuracy or reasonableness of the assumptions and carry out sensitivity analysis using different assumptions and obtaining a range of values to observe how much the pro•ects' values chan e if input variables are altered. Factors affecting mode of financing- 1. 2. 3. 4. 5. 6. Directors' preference — Pecking order theory states that equity issue is seen as the last resort for financing, so if the purchase is financed by an equity issue, it may be seen as a sign of a lack of confidence by directors that company can sustain its current share price. Costs and cash flows Availability Industry average gearing levels Control of the company Mix of finance Rationale for the policy of hedging foreign exchange risk and the potential benefits to shareholder value if that policy is effectively communicated to the company's key stakeholders- Within the framework of Modigliani and Miller, a company's hedging policy is irrelevant. In a world without transaction or agency costs, and where markets are effcient and informaton symmetrical, hedging creates no value if shareholders are well diversified. Shareholder value may even be destroyed if the costs associated with hedging exceed the benefits. However, in the real world where market imperfections exist, including the transaction costs of bankruptcy and other types of financial distress, hedging protects shareholder value by avoiding the distress costs associated with potentially devastatng foreign exchange fluctuatons..

Scene 3 (2m 10s)

Active hedging may also benefit debt-holders by reducing the agency costs of debt. A clearly defined hedging policy acts as a signalling tool between shareholders and debt-holders. In this sense, hedging allows for higher leverage and a lower cost of debt and reduces the need for restrictive covenants. Benefits of communicating the policy- 1. 2. 3. 4. 5. 6. 7. 8. Stakeholders will benefit from knowing that the company is creating value for them in a stable and sustained manner. It will help to ensure that they are more engaged with the company. It will reduce agency costs and costs related to asymmetric information. Informed decision — A well communicated hedging strategy allows debt providers to make informed decisions about the company's ability to service its debt. Reduces risks faced by employees — Agency costs and the risk of financial distress also impact the expected wealth of employees who, unlike shareholders, may not enjoy the risk reduction benefits of a diversified portfolio. A consistent hedging policy reduces the risks faced by employees which may serve to benefit the company in the form of moävational and productivity improvements. Customers and suppliers — Customers and suppliers have claims on a company which create shareholder value but are conditonal upon company's survival. Suppliers may invest in production systems which create value in the form of lower costs. For customers, these claims reflect promises of quality and after-sales service levels which enable the company to charge higher prices. In both cases, shareholder value is created as long as the customers and suppliers believe these claims will be honoured. It will also ensure that the company is able to attract appropriate shareholder clientele to invest, which will result in more stable share price and cash flows. It is also important to keep proprietary information confidential while providing sufficient information to stakeholders. In conclusion, management should attempt to communicate the principles underlying its hedging strategy and the benefits to shareholder value in the form of reduced agency and distress costs. In this way, stakeholders can make informed decisions about the potental risks and impact on their expected wealth. Recommendations for hedging- 1. 2. 3. 4. The futures contract is exposed to basis risk. The futures contract may be marked-to-market daily. In such a case, the initial margin and variation margins need to be funded and would impact cash flow in the short term. There may be a default risk associated with a forward contract. There may be counterparty risk for the forward rate a reement and swap..

Scene 4 (3m 15s)

5. Swaps face the market risk of an unexpected fall in interest rates. Discuss the benefits and drawbacks in using forward contracts compared with using over- the-counter currency options, and explain why exchange-traded derivatives may be preferred rather than over-the-counter derivatives to hedge foreign currency risk- Benefits of a forward contract 1. No large premium upfront 2. Gives a certain receipt 3. Simple arrangement to understand Drawbacks of a forward contract 1. Bound to fulfil 2. Does not allow to take advantage of favourable movements 3. May only be available for a short time period 4. Rate will be determined by a predicton based on expected interest rates. The rate offered on an OTC option may be more flexible. Reasons why exchange-traded derivatives are used One of the main reasons why the treasury function uses exchange-traded derivatives is that the contracts can be bought and sold as required. Also, because the markets are regulated by an exchange, counterparty risk (the risk of the other party to the transaction defaulting) should be minimised, Rationale for implementing capital investment monitoring systems and post-completion audits and ways in which company may benefit if these procedures are applied- Capital investment monitoring It involves reviewing the implementation of an investment project to ensure it progresses according to the original investment plan, tmescale and budget. This involves assessing the risks associated with the implementation phase and identifying deviations from the investment plan so that remedial action can be taken where necessary. Controls should be established to ensure effective delivery of the project. Effective investment monitoring may avoid the cost overruns and time delays. The appointment of a project manager would ensure ownership of the project and provided accountability for time delays and cost increases. The original investment plan, including cost estimates, provides a benchmark against which actual performance can be assessed. An effective monitoring system would ensure that any changes to the cost estimates would be •ustified and authorised. Where si nificant deviations are encountered, it may be necessary.

Scene 5 (4m 20s)

to terminate the project. A project steering committee would ensure greater scrutny and accountability and oversee the implementation phase. Post-completon audit A post-completion audit is an objective, after the fact, appraisal of all phases of the capital investment process regarding a specific project. Each project is examined from conception until as much as a few years after it has become operational. It examines the ratonale behind the initial investment decision, including the strategic fit, and the efficiency and effectiveness of the outcome. The key objective is to improve the appraisal and implementaton of future capital investment projects by learning from past mistakes and successes. An effective post-completion audit may help identify the reasons behind the failure to achieve its forecast revenues. By comparing the actual project outcome with the original projections, an audit will examine whether the benefits claimed prior to approval ever materialise. The audit is not an academic exercise; an effective audit would identify failings and help the company learn from past mistakes as well replicate its successes. An audit would establish the reasons behind failures and identify ways in which this can be addressed. It can also help management learn how to appraise investment proposals more accurately and implement them more efficiently than before: J Discuss why a company may prefer to use the adjusted present value (APV) method, rather than the net present value (NPV) method- Adjusted present values (APVs) separate out a project's cash flows and allocate a specific discount rate to each type of cash flow, dependent on the risk attributable to that paräcular type of cash flow. Net present value (NPV) discounts all cash flows by the average discount rate attributable to the average risk of a project. 1. By separating out different types of cash flows, the company's managers will be able to see which part of the project generates what proportion of the project's value. 2. Allocatng a specific discount rate to a cash flow part helps determine the value added or destroyed. Companies will be able to determine how much value is being created by the investment and how much by the debt financing. 3. For complex projects, investment related cash flows could be further distinguished by their consttuent risk factors, where applicable. 4. Net present value captures just the intrinsic value of an investment opportunity, whereas real options capture both the intrinsic value and the time value, to give an overall value for an opportunity. When a company still has time available to it before a decision needs to be made, it may have opportunities to increase the intrinsic value of the investment through the strategic decisions it makes..

Scene 6 (5m 25s)

Discuss why a company may be exposed to economic risk (economic exposure) and how it may be managed- Companies face economic exposure when their competitive position is affected due to macroeconomic factors such as changes in currency rates, political stability, or changes in the regulatory environment. Long-term economic exposure or economic shocks can cause a permanent shift in the purchasing power and other parity conditons. Normally, companies face economic exposure when they trade intemationally. However, even companies which do not trade internationally nor rely on inputs sourced internationally may stll face economic exposure. Managing economic exposure is diffcult due to its long-lasting nature and because it can be diffcult to identify. Financial instruments, such as derivatives, and money markets cannot normally be used to manage such risks. Companies can try tactics such as borrowing in intemational markets, sourcing input products from overseas suppliers and ultimately shifting production facilities overseas. None of these are easy or cheap, and can expose the company to new types of risks. Companies would also need to assess that any action it takes to manage economic risk fits into its overall risk management strategy. Discuss how each category of risk, in terms of severity and frequency, may be managed- Severe and frequent These need immediate attention, as they could threaten the company's survival or derail its long- term strategy, The aim here would be to reduce the severity of the risks and the frequency with which they occur quickly. It may mean avoiding certain actions or abandoning certain , even if they pro- Low impact, high frequency Action needs to be taken so that such risks do not become severe in the future. For example, the company could put systems into place to detect these risks early and plans to deal with them if they do occur. Where the same kind of risks occur often, the company may decide to have set processes for dealin with them, Severe, less frequent The company should try to insure against these. Contingency plans could also be put into place to mitigate the severity. For example, if the consequences of IT failure are high when a business decides to move to a new system, it could put appropriate connngencies into place. These may include secondary backup IT systems or Neither severe, nor frequent These should be monitored and kept under review, but no significant action should be taken. It is possible that any significant action would incur costs which would likely be higher than the benefits derived from eliminatng such risks. Monitoring such risks will ensure that should they move.

Scene 7 (6m 30s)

could be profitable in the long term. Where a company has a real option, and does not need to take action which will result in high frequency and high severity of risk, it may prefer to wait and see what happens. For example, where there is a loss of relatively unskilled staff, the company may decide to replace staff quickly with casual workers, but also have appropriate training facilities in place. initially trialling the new system on a few business units before undertaking a complete role out. out of this category into the more severe/frequent categories, the company can start to take appropriate action. Discuss possible sources of financial synergy arising from acquisitions- Many acquisitions are justified on the basis that the combined organisation will be more profitable or grow at a faster rate than the companies operating independently. The expectation is that the acquisition will generate higher expected cash flows or a lower cost of capital, creating value for shareholders. The additional value created is known as synergy, the sources of which can be categorised into three types: revenue, cost and financial synergies. Sources of financial synergy- 1. Utilisation cash resources to increase expected cash flows 2. Increase in debt capacity, and therefore the present value of the tax shield, increases the value of the combined company in the form of a lower cost of capital 3. Utilisation of unrelieved tax losses 4. Potental diversification Overestimation of synergies- There is evidence that bidding companies often overestimate the value of synergy arising from a potential acquisition with the result that companies pay too much for their target. When this happens, there is destruction in wealth for the bidding company's shareholders. There are a number of possible explanatons for this problem. 1. Merger and acquisition activity tends to be driven by the availability of cheap credit. At the peak of a wave of activity, there may be competition for targets, thereby increasing acquisition premiums. 2. Conflicts of interest may lead to a biased evaluation process. Deal advisers such as investment banks earn a lar e proportion of their fees from me ers and acquisitons..

Scene 8 (7m 35s)

Their advice on whether an acquisition makes sense is potentially biased if they do not look after their clients' interests. 3. Management overconfidence may explain why this occurs. Acquiring companies may overestimate the acquisition synergy and/or underestimate the time it will take to deliver. Management may then be reluctant to admit mistakes when the facts change, even when there is still time to back out of a deal, Agency costs may be also a factor if managers are more interested in pursuing personal goals than maximising shareholder wealth. 4. There may be difficulties integrating the companies due to different work cultures and conflicts of interest. 5. A change in management style may also create diffculties in integratng the companies. Steps to address overestimation of synergies- 1. 2. 3. 4. 5. 6. 7. 8. 9. Thorough investigation of possible synergies should be done. Company should strive to obtain cheaper financing. Tax losses should be utilised as efficiently as possible. Companies which allocate this responsibility and monitor and review performance tend to be more successful in creating value. In order to avoid any bias, the deal advisers who stand to profit from an acquisiäon need to be separate from the evaluation process. Effective due diligence ensures the financial documents which form the basis of a valuaton are scrutinised and inspected, It should include which staff to retain and also cover staff remuneraton and redundancy costs. Communication with staff is important to minimise staff turnover, they may require motivation and reassurance. A flexible plan will be needed for the acquisition and inte ration process. Cash and share for share offer- Cash offer 1. Certain and immediate return 2. Realised gain may lead to tax liability 3. No dilution of shareholding Share for share offer 1. Dilution of shareholding 2. Right to participate in future growth of the large company 3. Reduction of possible a ency costs due to ali nment of interests.

Scene 9 (8m 40s)

Discuss how incorporating real options into net present value decisions may help a company with its investment appraisal decisions- When making decisions, following investment appraisals of projects, net present value assumes that a decision must be made immediately or not at all, and once made, it cannot be changed. Real optons, on the other hand, recognise that many investment appraisal decisions have some flexibility. For example, decisions may not have to be made immediately and can be delayed to assess the impact of any uncertainties or risks attached to the projects. Alternatively, once a decision on a project has been made, to change it, if circumstances surrounding the project change. Finally, to recognise the potential future opportuniäes, if the initial project is undertaken. Real options consider- I. Estmate the value of this flexibility or choice. 2. Time available before a decision, on a project has to be made, 3. Risks and uncertainties attached to the project. It uses these factors to estimate an additional value which can be attributable to the project. Real options view risks and uncertainties as opportunities, where upside outcomes can be exploited, and a company has the option to disregard any downside impact. By incorporating the value of any real options available into an investment appraisal decision, a company will be able to assess the full value of a project. Discuss the advantages and disadvantages of using swaps as a means of hedging interest rate risk- Advantages of swaps I. Low transaction costs 2. Guaranteed fixed rate of interest so finance costs on the loan can be forecast with certainty. 3. Over-the-counter arrangements — Can be arranged in any size and for whatever time period is required. 4. The period available for the swap may be longer than is offered for other interest rate derivatives. 5. Swaps make use of the principle of comparative advantage. Disadvantages of swaps.