Scene 1 (0s)

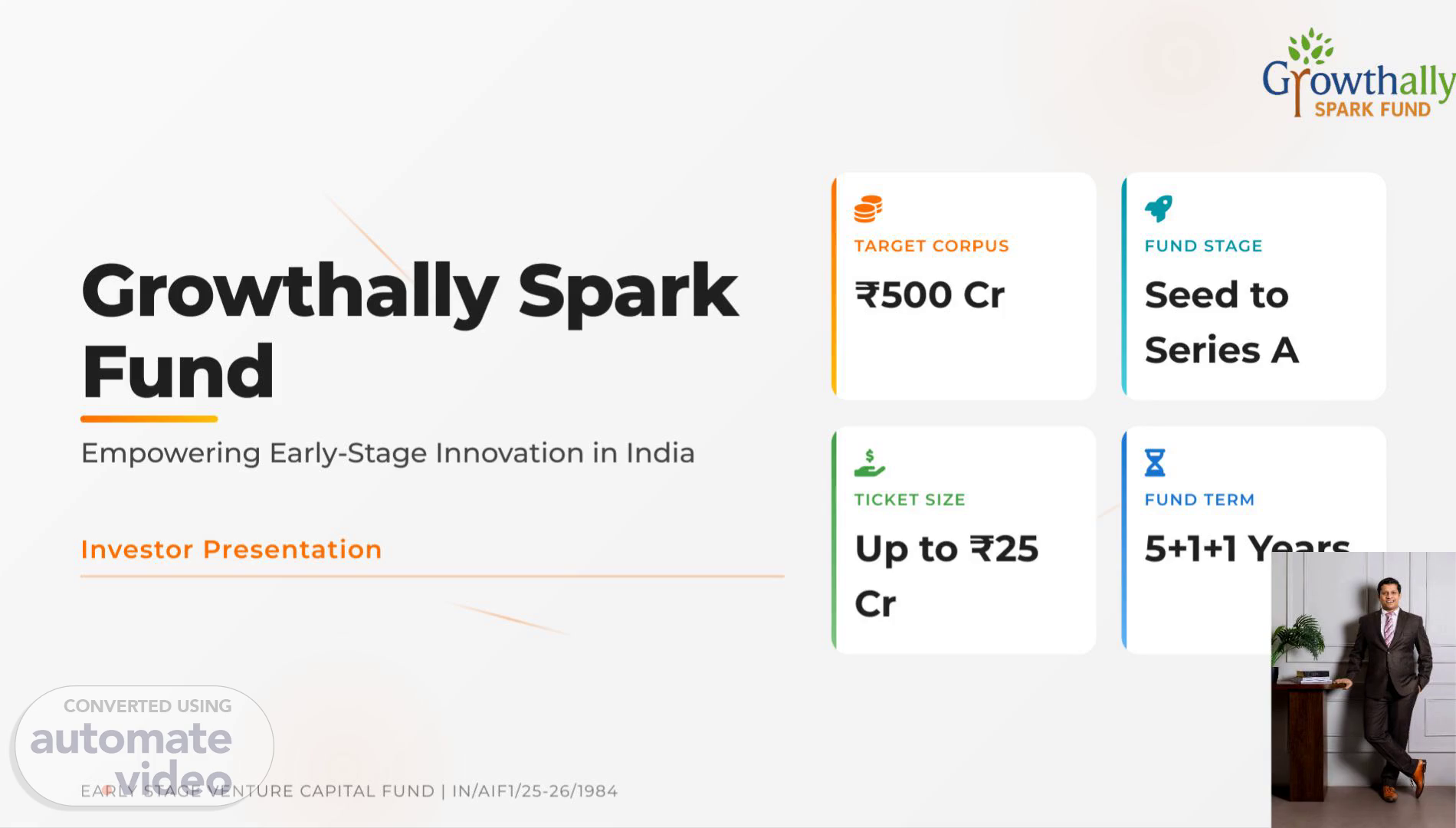

EARLY STAGE VENTURE CAPITAL FUND | IN/AIF1/25-26/1984 Empowering Early-Stage Innovation in India Growthally Spark Fund Investor Presentation TARGET CORPUS ₹500 Cr FUND STAGE Seed to Series A TICKET SIZE Up to ₹25 Cr FUND TERM 5+1+1 Years.

Scene 2 (1m 4s)

[Audio] The current ecosystem faces several key challenges. An imbalanced risk-return approach and capital without capability are significant issues. Many angel funds lack a clear investment strategy, which leads to inflated valuations and a skewed risk-return balance. This results in poor performance for these funds. Furthermore, many early-stage funds fail to provide strategic or operational support, leading to high mortality rates among startups. The ecosystem also tends to prioritize short-term gains over long-term sustainability. As a result, it fails to recognize and support underrepresented sectors..

Scene 3 (1m 14s)

[Audio] The Spark Fund invests in early-stage companies that have shown significant growth potential. The fund focuses on businesses with a clear vision and a proven track record of success. The investment process involves thorough analysis of the company's financials, market trends, and competitive landscape. The fund also provides guidance on strategic planning, governance, and operational scaling. Additionally, the fund offers support to entrepreneurs through its extensive network of experienced professionals. The network includes over 1000 experts from various industries, providing valuable insights and advice. The fund's investment approach is disciplined and thesis-driven, combining valuation rigor with diversification across high-potential sectors. The fund assesses investments based on strong fundamentals rather than hype. The fund's goal is to create impact and drive sustainable growth..

Scene 4 (1m 28s)

[Audio] Our competitive edge lies in our 15 years of credibility in the investment banking space, allowing us to tap into a vast network of industry connections and deal flow. We offer full lifecycle support, partnering with entrepreneurs throughout their journey from early-stage fundraising to strategic planning for growth and successful exits. This comprehensive support is complemented by our network advantage, providing ready access to curated ecosystems, domain experts, corporates, as well as limited partners. Our disciplined approach ensures a steady stream of high-quality opportunities, giving us a strong pipeline of pre-vetted deals..

Scene 5 (1m 38s)

[Audio] We are focused on investing in high-potential sectors with transformative potential, where we can leverage our expertise and resources to drive growth and innovation. Our sector focus areas include AI, healthtech, medtech, and sustainability, where we identify opportunities to support entrepreneurs and businesses that are shaping the future of these industries. These sectors have significant growth potential, driven by technological advancements, changing consumer needs, and shifting regulatory environments. By targeting these sectors, we aim to capitalize on emerging trends and create value for our investors through long-term investments..

Scene 6 (1m 49s)

[Audio] The company provides a range of services including management consulting, strategy development, and operational improvement. The company has a strong focus on governance, risk management, and compliance. The company also offers hands-on guidance across various operations, ensuring that all aspects of the business are compliant with regulatory requirements. Through its strategic scaling efforts, the company partners with other businesses to create sustainable growth opportunities. The company's long-term vision is focused on creating value for its stakeholders, while maintaining a patient capital approach to investing in new ventures. This approach allows the company to provide access to funding for early-stage companies, enabling them to scale their operations and achieve long-term success..

Scene 7 (2m 1s)

[Audio] The fund's primary objective is to generate high-quality returns for investors by investing in early-stage startups that have the potential to scale quickly. The fund focuses on companies that are developing innovative products or services that can disrupt traditional industries. The fund invests in companies across various sectors, including technology, healthcare, and finance. The fund also provides strategic guidance and support to its portfolio companies to help them achieve their growth goals. The fund's investment strategy is based on a thorough analysis of each company's business model, market opportunity, and competitive landscape. The fund's investment team works closely with the portfolio companies to provide ongoing support and guidance throughout the investment period. The fund's investment horizon is typically 5-7 years, during which time it seeks to identify and invest in companies that have the potential to become industry leaders. The fund's investment process involves a rigorous evaluation of each company's financial performance, market position, and growth prospects. The fund's investment decisions are made based on a combination of quantitative and qualitative factors, including financial metrics, market trends, and competitive intelligence. The fund's investment approach is designed to maximize returns while minimizing risk. The fund's investment team uses a variety of tools and techniques to analyze data and make informed investment decisions. The fund's investment strategy is aligned with the interests of its investors, who are seeking high-quality returns on their investments..

Scene 8 (2m 25s)

[Audio] Our portfolio companies have experienced significant growth and valuation increases due to our investments. These examples highlight the impact of our investments on the businesses we support, demonstrating the potential for substantial returns on investment. We have successfully implemented various projects across multiple industries, including healthcare, where we have achieved strong product-market fit and adoption. Our investments in cutting-edge technologies, such as AI-powered customer support and automation platforms, have driven innovation and improved operational efficiency. The diverse range of projects showcases our ability to adapt to different industries and sectors, enabling us to provide valuable insights into the potential of our investments and the benefits they can bring to our portfolio companies..

Scene 9 (2m 37s)

[Audio] The management team consists of experienced professionals with a strong background in finance, investment banking, and strategic advisory. The team has over 30 years of combined experience in these areas. They have worked extensively in various sectors including finance, technology, media, and healthcare. Their expertise spans multiple industries, including private equity, venture capital, and real estate..

Scene 10 (2m 44s)

[Audio] The company has a strong partnership with several key players in the industry. These partnerships are built on mutual respect and trust, and are essential for the company's success. The partnerships are based on a shared understanding of the market and a commitment to excellence. The company works closely with its partners to identify opportunities for growth and development, and to develop strategies that align with their goals and objectives. The partnerships are also critical in providing access to new markets and customers, as well as facilitating the exchange of knowledge and best practices. The company believes that these partnerships are vital to its long-term success and will continue to nurture them over time..

Scene 11 (2m 54s)

[Audio] The advisory board consists of six members who are highly respected in their respective industries. The members include Takshay Sheth, Nandan Kulkarni, Ratheen Shroff, Hitesh Mehta, Rajeev Wadhwa, and Raveendra Sahni. Each member brings unique experiences and skills that contribute to the board's overall effectiveness. The board provides expert advice on matters related to market expansion, manufacturing, and risk management. The members also drive growth and innovation in specific sectors through their collective efforts. The diversity of the board's membership enables it to offer a wide range of perspectives and insights..

Scene 12 (3m 4s)

[Audio] The Growthally Spark Fund is positioned at the forefront of India's start-up revolution. This position allows it to offer investors a unique opportunity to participate in the country's high-growth entrepreneurial ecosystem. The fund identifies and supports promising early-stage ventures through strategic planning. Its primary goal is to generate superior long-term returns for its investors. Furthermore, the fund drives innovation and creates economic value by investing in these ventures. The growth of these ventures contributes to the overall growth of the economy..

Scene 13 (3m 13s)

[Audio] The organization has been working on a project that aims to promote sustainable development through innovative technologies. The project focuses on developing new products and services that can help reduce carbon emissions and mitigate climate change. The organization has partnered with several leading companies to bring about this vision, and they are committed to making it a reality. They believe that by working together, they can create a better future for all Indians. The organization is seeking funding to support its projects and initiatives. They are looking for investors who share their vision and values, and who are willing to contribute to the growth and development of India's innovation ecosystem. In return, they offer a range of benefits, including access to cutting-edge technology, expertise, and networking opportunities. The organization is committed to transparency and accountability in all its dealings. They have established a robust system of governance and oversight, which ensures that funds are used efficiently and effectively. They also provide regular updates and progress reports to stakeholders, ensuring that everyone is informed and engaged throughout the process. The organization is dedicated to creating a positive impact on the environment and society as a whole. They believe that by promoting sustainable development and reducing carbon emissions, they can make a significant difference in addressing global challenges such as climate change. They are passionate about using innovative technologies to drive positive change and to create a better future for all Indians..